Market Provides Further Confirmation That A Bottom Is In Place

Today the market opened higher giving us another push over the high that was struck yesterday giving us what can be counted as a fairly clean five wave move up off of the lows on both the ES and SPX charts. This continued push higher is giving us further confirmation that we have indeed put in at least a local bottom and should see a push up at least into the overhead resistance labeled on the charts as the "Danger Zone". I do want to caution that although it does appear that we have a five-wave move up off of the lows suggesting that we should still see further upside follow-through because the entire structure up off of the February lows is likely a diagonal the path higher is still likely to be fairly sloppy in the coming weeks and months. That being said the five up off of the 4-18 low may provide us with at least a short-term setup to the long side if we can see a corrective retrace develop over the next day or two. Of course, there still is some work to be done before that setup is fully formed and due to the overall sloppy structure caution is still somewhat warranted in the near term.

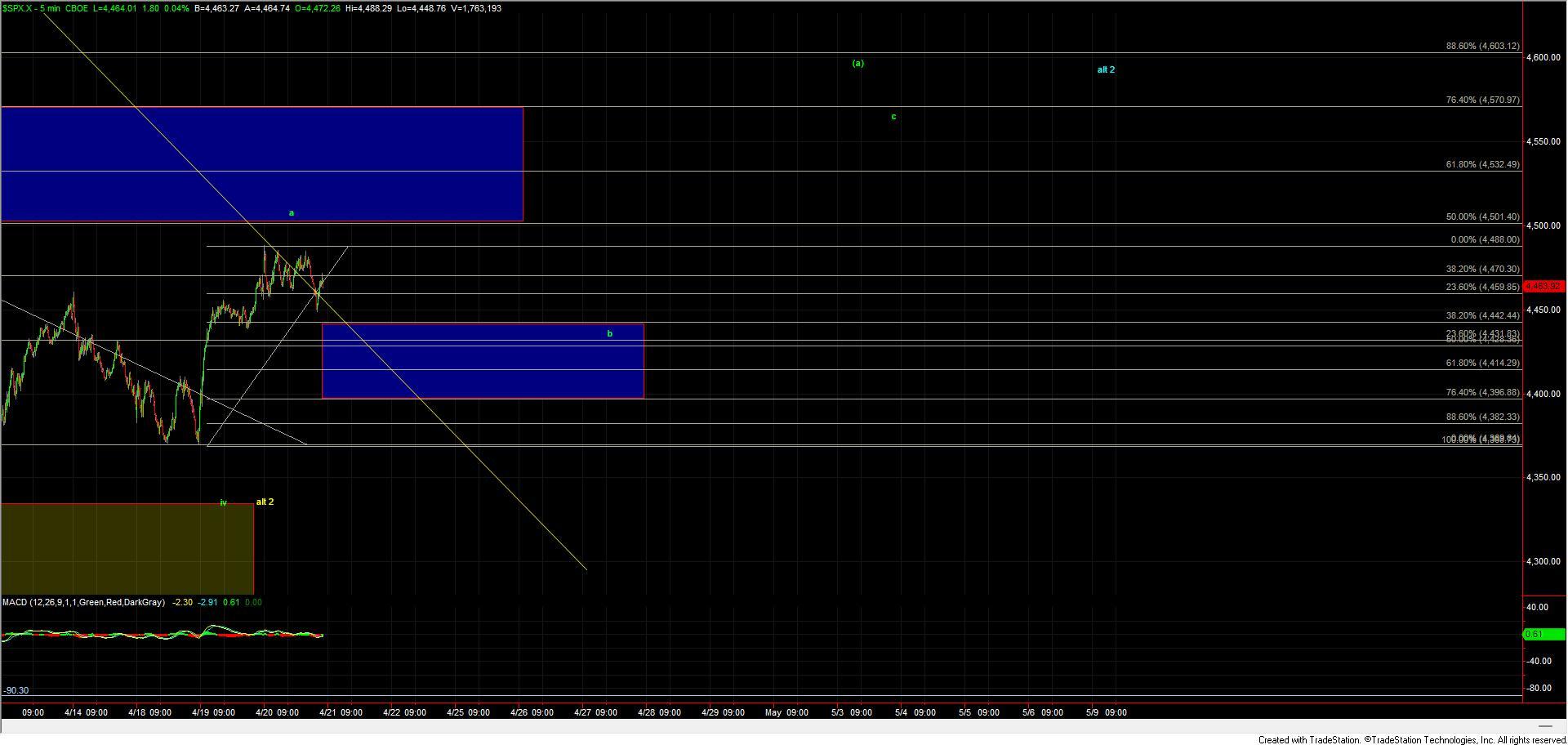

From here we still should see a pullback for the wave b that should be followed by a wave c up into the "Danger zone". With that potential five up off of the lows however that pullback certainly may be less deep than had we saw only a three-wave move to begin the push up off of the 4/18 low. So with that the retrace zone for the wave b currently sits in the 4442-4396 zone on the SPX and as long as we hold that zone then we should still see at least a wave c up into the larger overhead resistance or "Danger Zone". That overhead resistance zone still remains in the 4501-4570 zone and this is still the level that needs to clear to reduce the probability that we are filling out the alternate wave 2 per the blue count. How this wave action subdivides on the way up still is going to be a bit sloppy which is why we are still very focused on this larger degree resistance zone but we do have some fairly well laid out parameters to work with here as we move into the final trading days of the week.

Today's action has not changed the overall larger degree structure all that much but the potential five-wave move up off of the lows certainly is a positive development in regards to the primary count. This also can give near-term traders a possible setup over the coming days with clearly defined entry, stop and target levels. We do however still need to remain cautious and diligent if we do indeed push higher and keep a very close eye on the overhead resistance zone as this still needs to break to give the market a bit more breathing room to the upside.