Market Moving Toward Yellow?

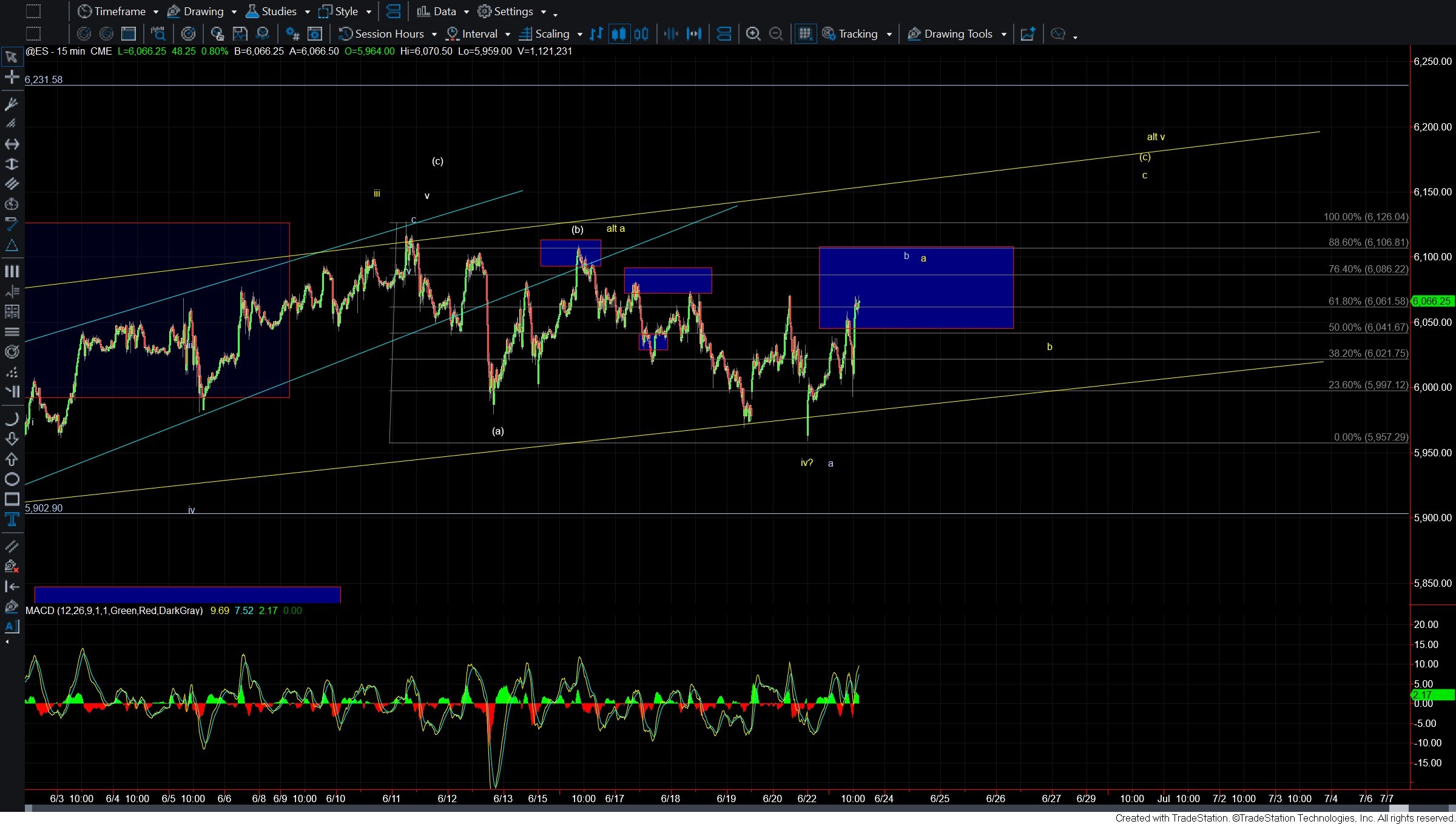

After moving lower overnight, we saw a strong rebound during the morning session, with the market now trading firmly in the green as we head into the close. This recovery, and more importantly, the lack of a sharp breakdown, has increased the odds that we may indeed be tracking the yellow count I’ve been outlining over the past several sessions.

While we still don’t have full confirmation, and won’t until we see the structure of the next move lower, the fact that the market failed to produce the kind of sharp reversal typically associated with an Ending Diagonal (ED) top is noteworthy. Generally, when an ED completes, we expect to see a swift and decisive reversal back to the origin of that pattern. Instead, the move lower was slow, overlapping, and corrective in nature, raising a red flag that a larger ED off the May 23 low at 5806 may still be in progress, requiring one more push to a higher high to complete.

If we continue to see shallow, corrective pullbacks in the coming sessions, that will further support the yellow count and the potential for a marginal new high. However, I would caution that any new high is likely to be short-lived. The entire move off the May 23 low has been very overlapping, which typically points to an ending structure. Should we top, I’d expect a strong reversal back toward that 5806 region.

On the other hand, if the market fails to make a higher high and instead stalls at micro resistance in the coming days, followed by a clear five-wave decline, that would keep the door open to the white count. Under that scenario, this recent push higher would count as a b-wave retracement, with a larger c-wave decline still on deck.

At this point, I can't say with high confidence which path is active just yet, but I’m watching two key things very closely: the 6066–6106 resistance zone overhead, and the structure of the next move lower. These should provide clearer guidance on which count is taking hold in the near term.