Market Moves Up Into Resistance

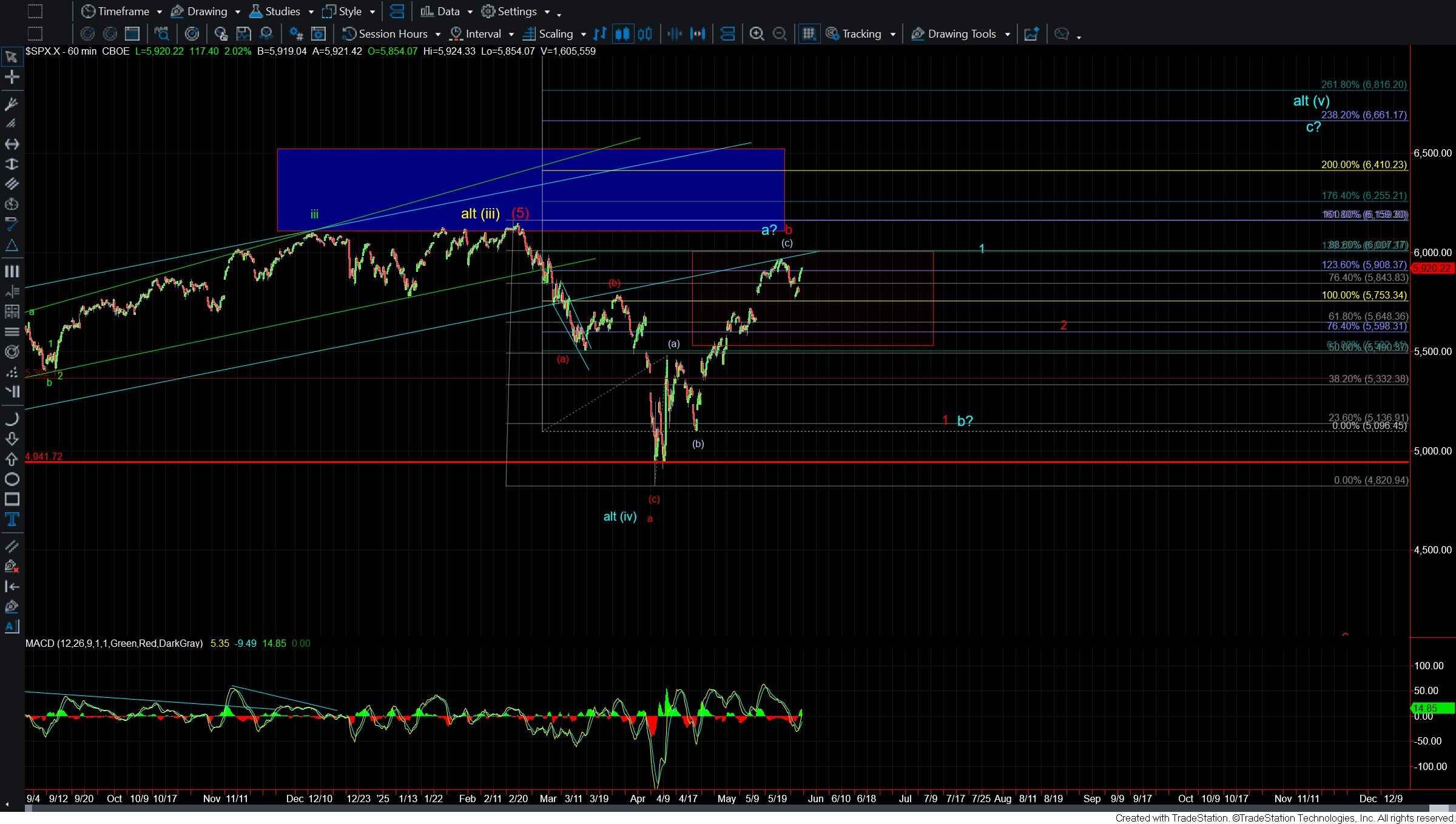

We saw the market continue to push higher today, moving into the key retrace resistance zone for the potential initiation move down that began last week. As long as price holds beneath this zone, my primary expectation remains for a downside resolution in the coming days. A sustained move through resistance, however, would open the door to one more push to a higher high before any significant top is in place.

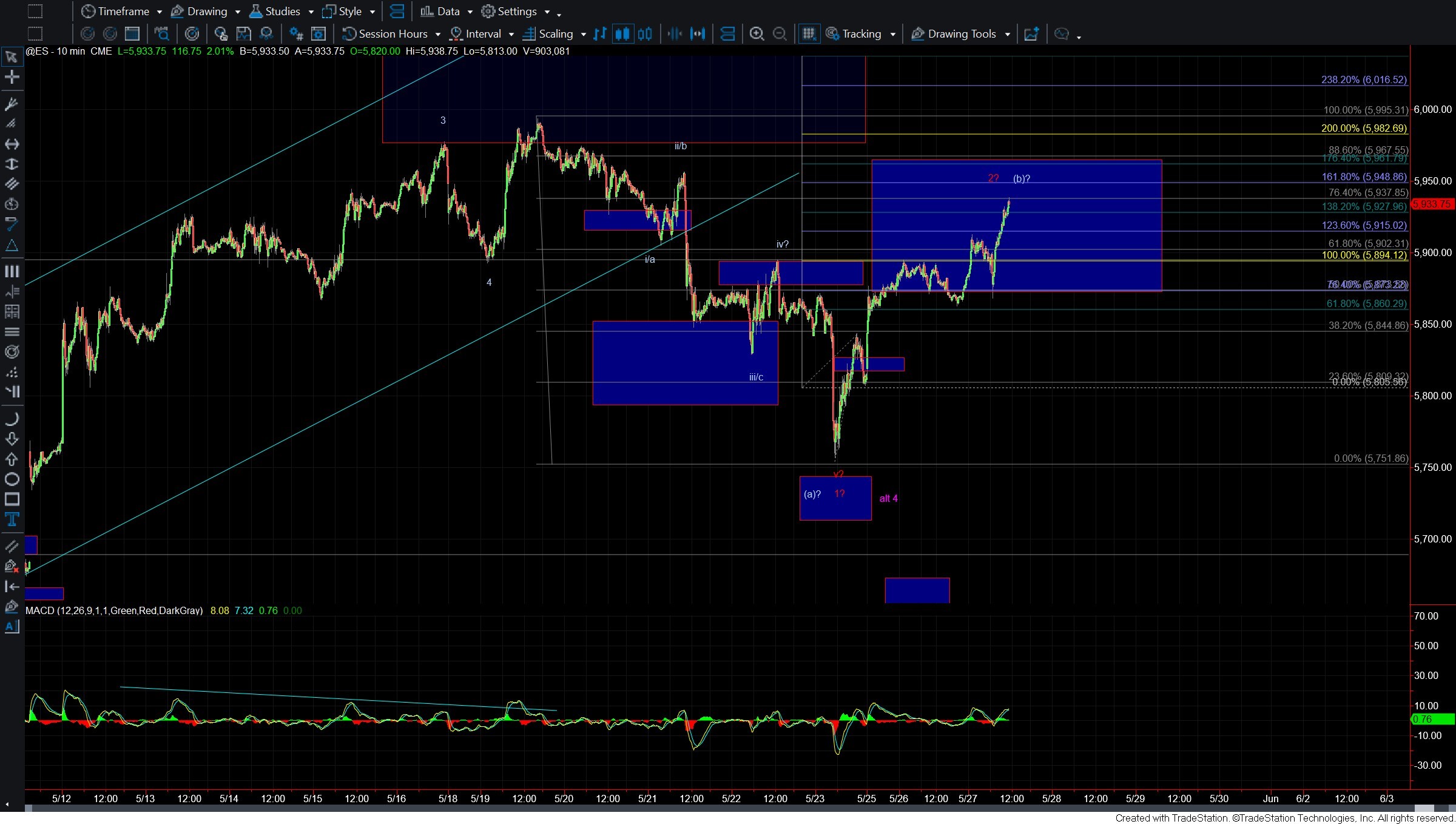

Zooming in on the ES chart, I continue to favor counting five waves down into last week's low. The bounce off that low has thus far only developed as a three-wave structure, and we remain below the 5937–5967 resistance zone. As long as we continue to hold beneath that region, I maintain a near-term bearish bias, with a move at least below last week’s low at 5751 as the next level of confirmation.

To start confirming a top in place, whether for a wave 2/(b), we’ll need to see an initial five-wave decline followed by a break under the 5680 level. That would provide a stronger signal that downside continuation is underway.

If we do break beneath last week’s low, the structure of the follow-through will be key in guiding us between the red and blue counts on the 60-minute chart. A clean five-wave structure lower of one larger degree would favor the red count, while a more corrective three-wave move would lean toward the blue as shown on the 60min chart.

Alternatively, if price pushes above the 5967 level, that opens the door to the purple count playing out, suggesting we still have one more higher high to come before a more meaningful top is found.

While last week's move down was a solid initial step in building a bearish setup, we still need additional confirmation before a high-probability short setup presents itself. That said, given the potential completion of a larger Ending Diagonal structure off the April lows, any reversal lower, once confirmed, could be quite sharp. So, while I remain cautious on the long side here, the pattern is still potentially full, and risk is elevated as the upside continues to be quite extended.