Market Moves Lower But Still Over Support

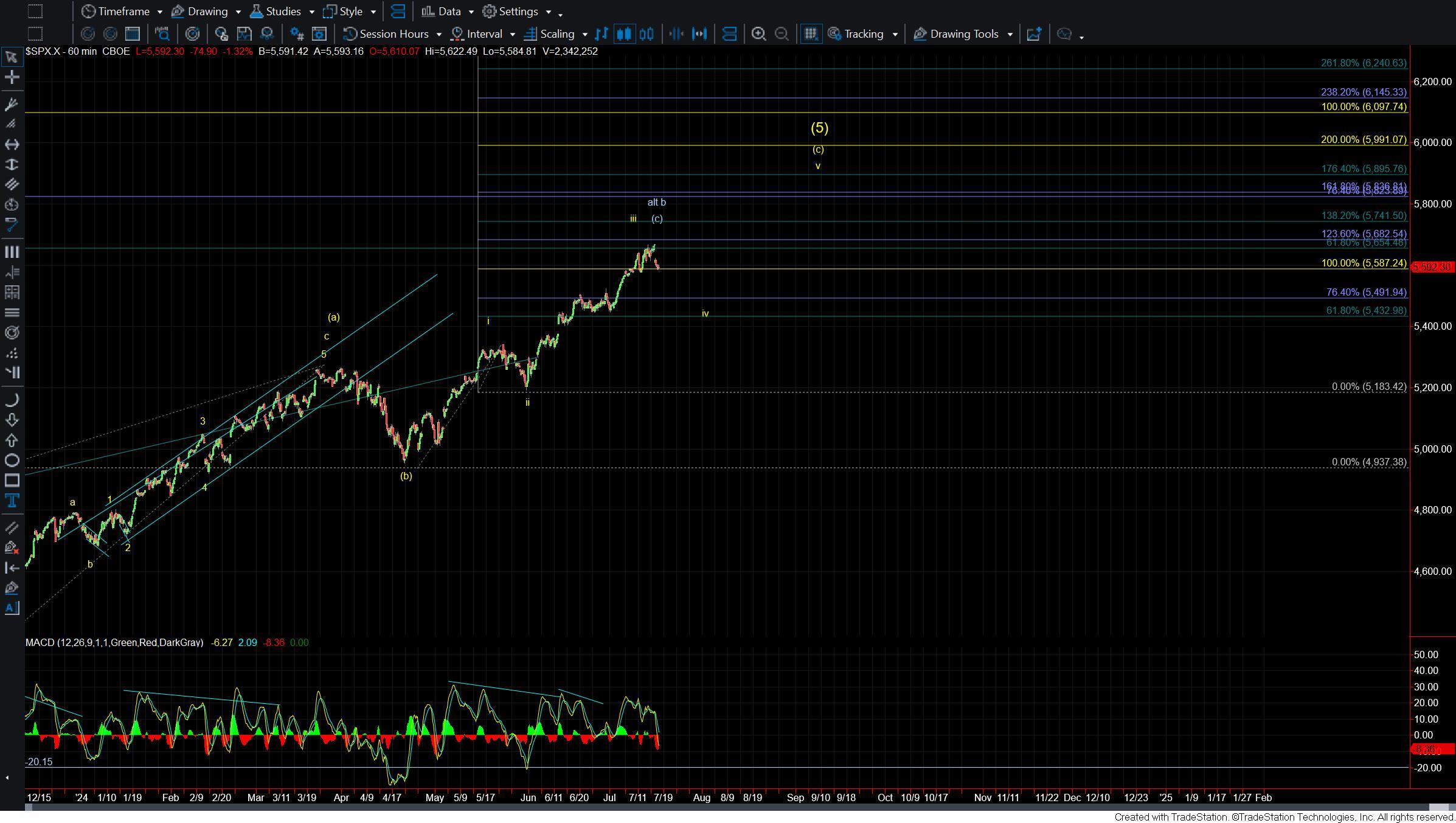

Today we saw the market move sharply lower with the largest pullback since May. While the action today is certainly quite different than the relentless grind higher that we had seen over the past several months we are still sitting well over upper and lower support. So with that being the case and with what remains an incomplete pattern to the upside unless we are able to see the market give us a sustained break under some key support levels it is still likely that we have a bit more work to do to the upside before a larger degree top is seen. Now I will caution that from a larger degree perspective this market remains quite stretched and should this begin to break under these key support levels we could begin to see a strong move lower to begin the much larger degree corrective move that is likely on the horizon in the not too distant future.

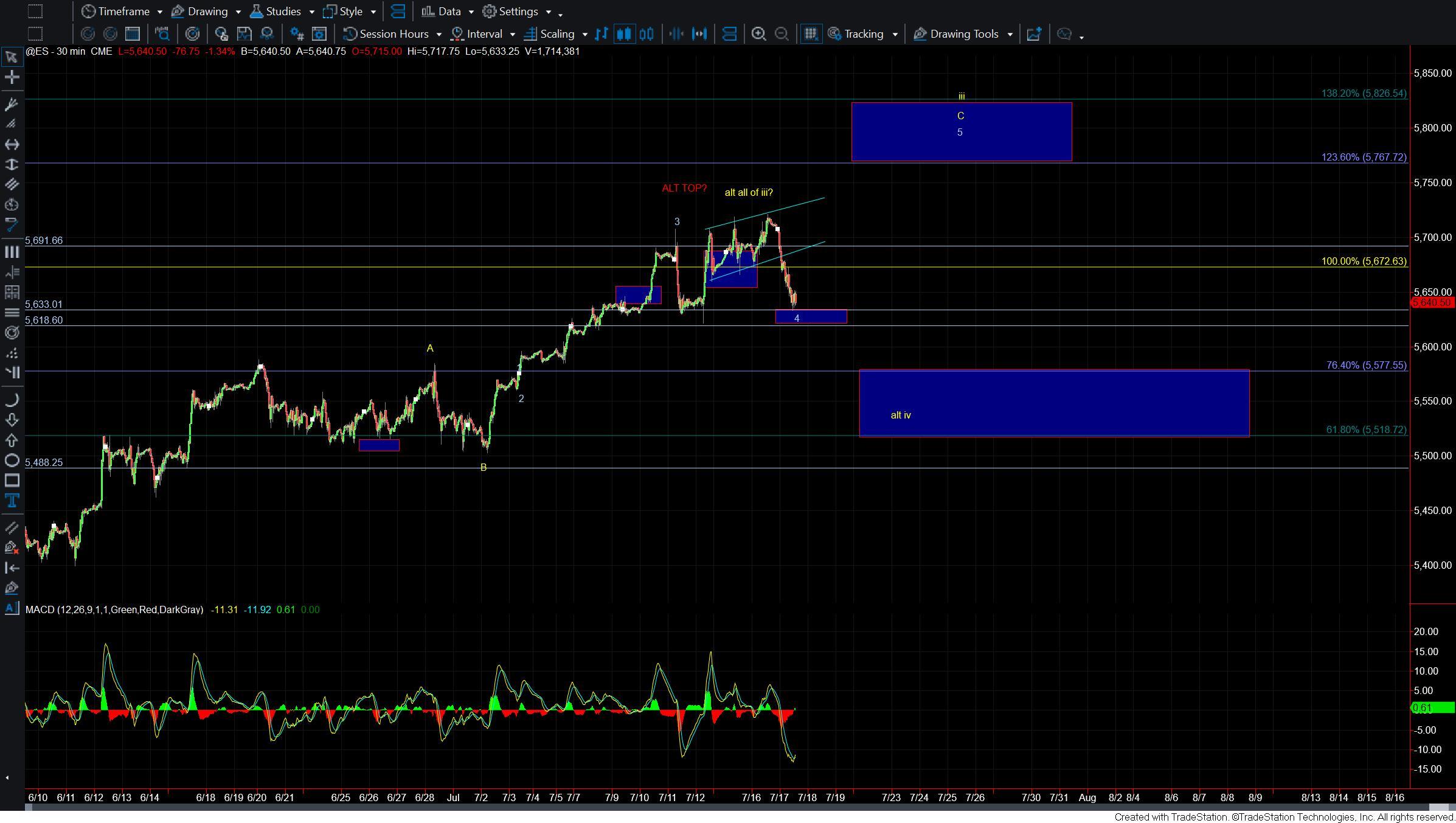

Zooming into the 30min ES chart I have upper support for the micro wave 4 coming in at the 5633-5618 zone. As long as we can hold over that zone we still can see this find a local bottom and give us another push higher as part of the wave 5 of C of iii.

Should we begin to break under that zone followed by a move into the 5577 level then it would open the door for this to have topped in all of the wave iii per the yellow count. At that point, I would watch the 5577-5518 zone as ideal support for the wave iv with the potential for that wave iv to move as low as the 5400 zone.

If we are unable to hold 5400 and then break below the 5300 level it would open the door for a larger degree top to be in place but as of right now and as long as we hold those support levels the pattern still would look better with a deeper wave iv pullback followed by a wave v to finish off the larger degree pattern.

Bigger picture nothing has really changed since the weekend update but with this pullback we do have some fairly clear parameters to watch for to help give us guidance as to whether we have indeed put in a local top or whether we are going to find a more immediate bottom before topping in that yellow wave iii. Again from a macro perspective, the market remains quite stretched here and I still remain quite cautious to the long side on the larger degree charts.