Market Moves Lower But Still Holding Support

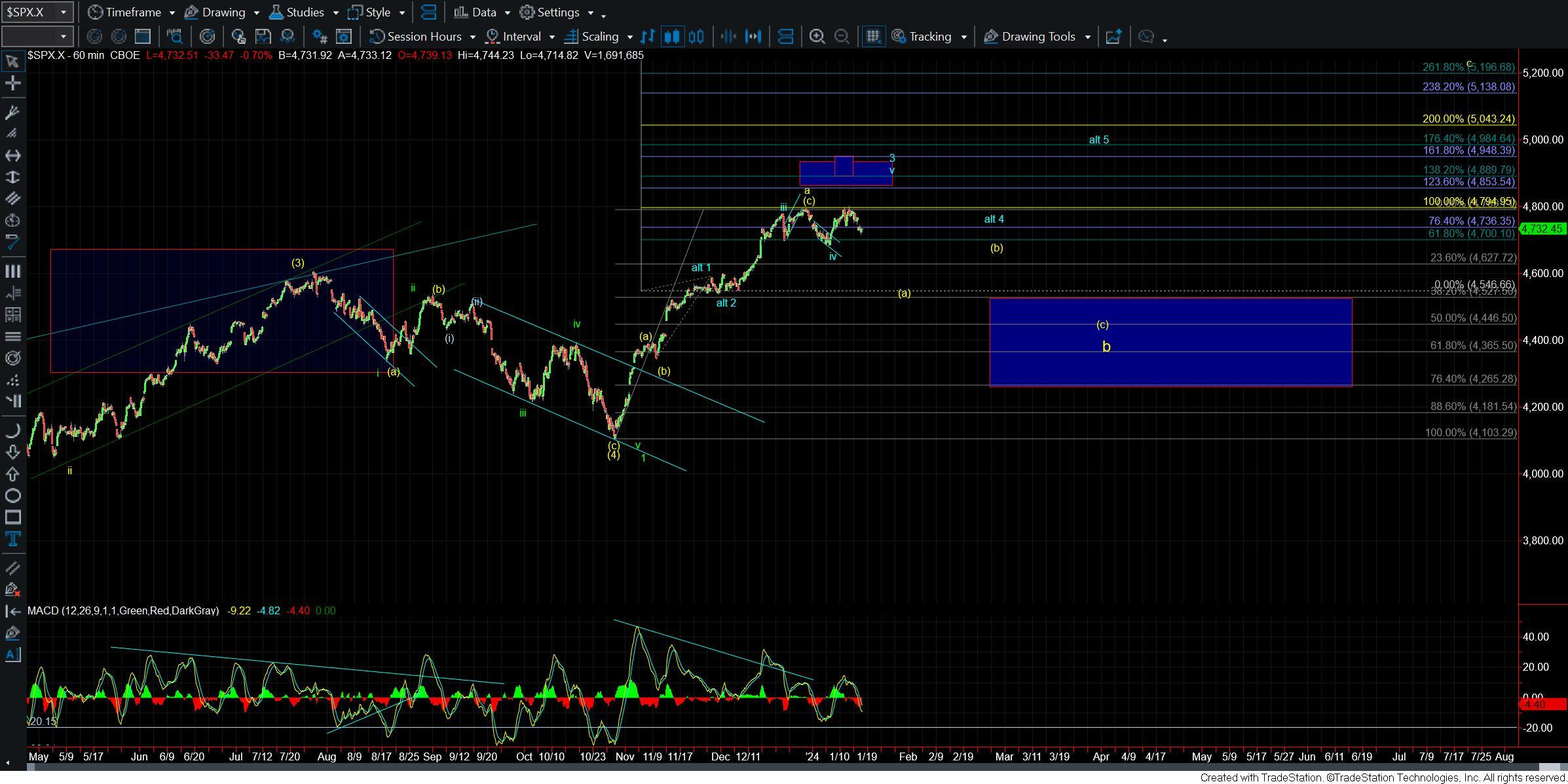

Today the market opened lower and continued to move lower into the afternoon session. We did see the market find support near the end of the day and as of the time of this writing is slightly up off of the lows. Furthermore, we are still holding over both the 76.4 retrace level of the move up off of the 4681 low. Furthermore, the action down off of the highs counts better as three waves rather than five waves.

So as long as we can hold over support this pattern is more supportive of seeing a local bottom per the blue count rather than a more immediate drop per the yellow count. If however we continue to move lower and break support then the yellow count will increase in odds at which point I would likely to have to count the initial move down off of the highs as part of a more sloppy leading diagonal to start the wave (c) down.

Drilling down to the five-minute chart we have the 76.4 retrace of the move up off of the lows coming in at the 4709 level. As long as we do not see a sustained break of this level the partner off of the 4681 low as well as the structure of the move down into current levels is more supportive of seeing a break back over the 1/12 high before breaking back under the 4681 low. We would still need further follow-through to confirm the blue count but moving back up over the 1/12 high would be a good initial start.

If we break under the 4709 level followed by a break of the 4681 low then we likely are already in the yellow wave (c) down however the initial move down off of the highs is not overly supportive of this path as it counts much better as a corrective wave structure rather a five wave move.

So while we are yet to have confirmation of a bottom we do have fairly clear parameters so from here it really is simply a matter of watching the price levels. I think we will likely have an answer as to which path this is taking as we move into the final days of this week and the early part of next week.