Market Moves Lower After Stalling at Key Resistance

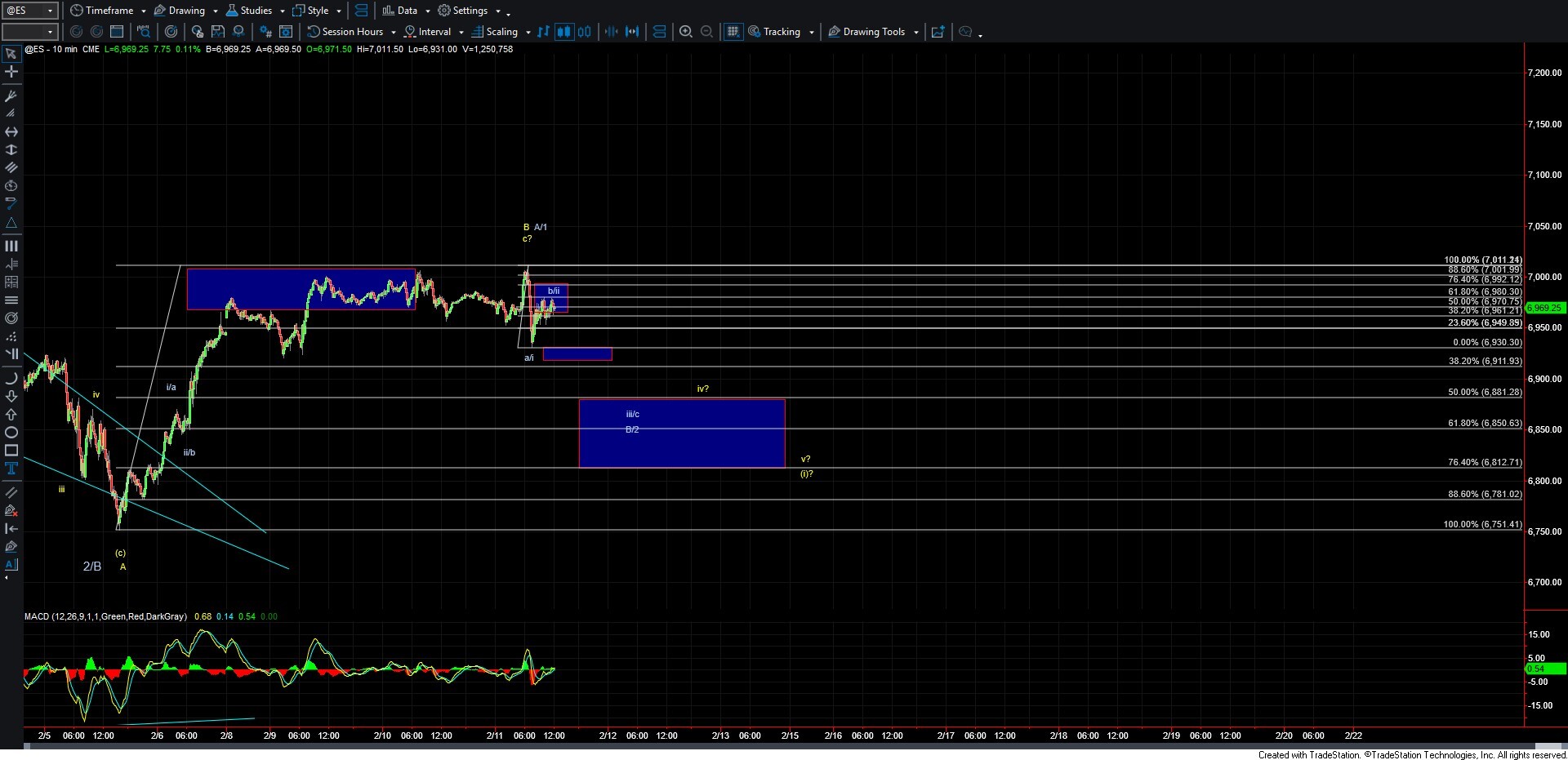

Today the market opened higher and reached the upper end of the key retracement zone from the decline off the February 2nd high. However, that level was quickly rejected, and we saw a sharp move lower that can be counted as a five-wave impulsive decline.

Since today's low of the day was struck earlier this morning, the price has bounced higher, but that move so far counts best as being corrective in nature. That suggests the market likely has more work to do to the downside before we can begin looking for even a local bottom. Assuming we break today’s low of the day, the structure of the downside follow-through will be critical in determining whether the market still intends to push to another higher high per the white count, or if we are beginning a more significant move lower as outlined in the yellow count.

As noted above, the market held the 88.6% retrace of the move down from the February 2nd high before rolling over in what counts best as a five-wave move to the downside. That keeps the door open for a top in the yellow wave B on the ES chart. That said, we would still need to see a larger-degree five-wave move lower before we could consider that scenario confirmed. If the decline only unfolds in three waves, it would suggest this is still part of a larger wave B/2 per the white count, which would continue to point toward new highs in the weeks ahead.

Near-term micro resistance now comes in at the 6980–6992 zone. As long as we remain below that area, I am looking for a break back under today’s low at 6930. From there, the structure of the decline will provide further clarity.

If the market develops a full five-wave move lower toward the 6812–6760 region, it would suggest that the yellow wave B top is in place. If instead we see only a three-wave move lower that holds above the 6882–6811 zone, followed by a five-wave move back to the upside, it would favor the white count and another push to new highs.

For now, while I do expect additional downside into the end of this week, there remains significant support below that would need to break before we could confirm that a larger-degree top has been struck. As the larger degree pattern remains quite sloppy, I will let the structure unfold over the next several trading sessions, which should provide greater clarity as we move into the second half of the month.