Market May Be Vulnerable

There are times the market is very clear, and there are times the market is unclear. But, one of the best opportunities the market provides is when both the primary and the alternative counts are pointing in the same direction for a period of time. Yesterday presented us with such an opportunity.

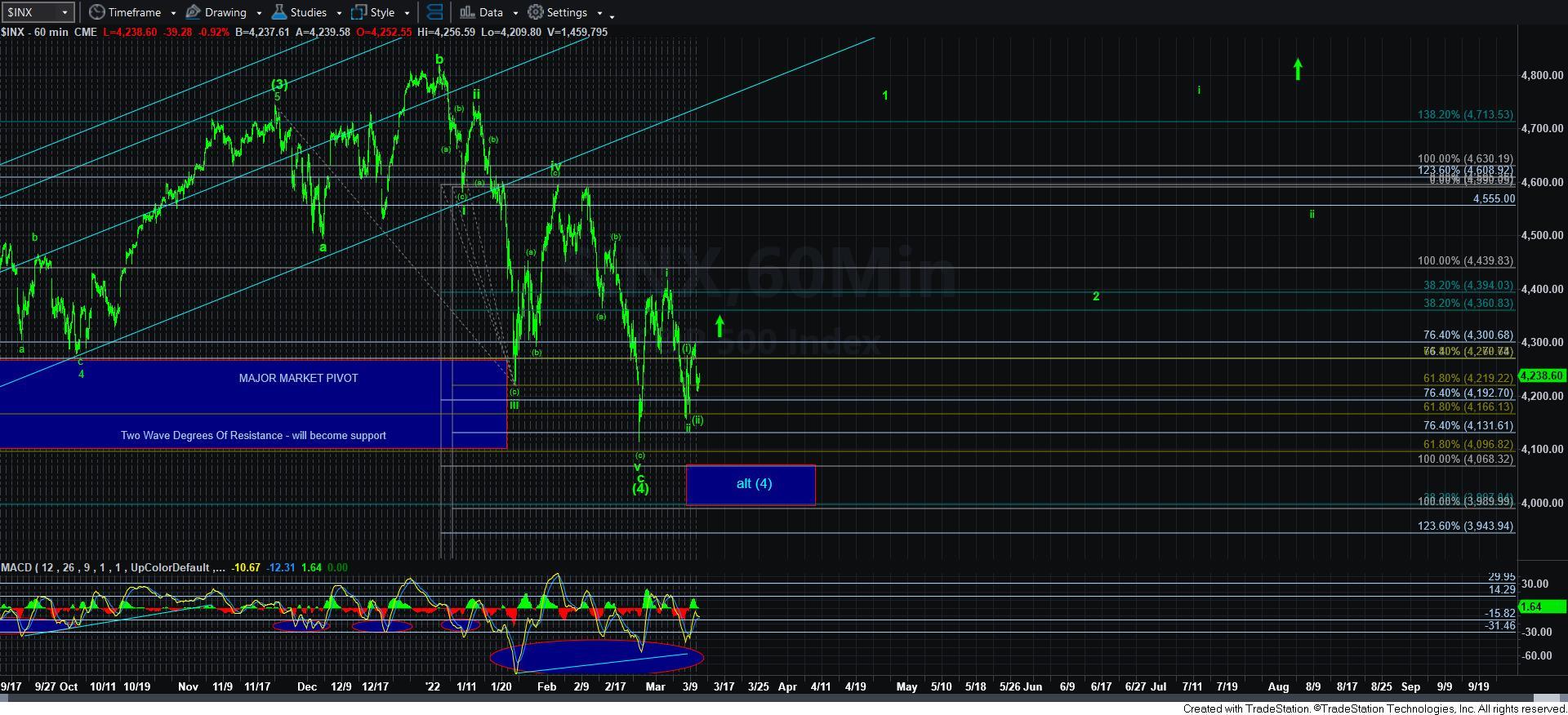

I sent the update out early in the day so that you can prepare for the potential downside that was setting up into today, is you so wished. As we were heading up to resistance in the 4285-4300SPX region, I highlighted that the next likely move in the market would be to the downside, as long as the market respected the 4300SPX resistance. With the market topping at 4299.40, we were either going to see a corrective wave [2] pullback in green, or we were going to head lower to complete the alternative [4] in blue.

While I was still not sure which count would prevail, it was certainly an easy point in time in which we were able to protect our positions, as I noted in the chat room that I was hedging my long positions. And, as it stands right now, I remain hedged, but I did take some off just to cash in the money I initially laid out.

As it stands now, I would not want to see the market break down below today’s low. While I cannot say that either the SPX or the ES have provided a CLEAR 5-wave move down off the low to strongly indicate that the blue [c] wave down has begun, I can say that it is unclear enough for me to remain hedged until we see the market being able to break back over the 4300SPX.

In fact, I may be so bold as to claim that the next time we break over the 4300SPX region, we will likely have strong indications that wave [5] has begun towards 5500SPX.

So, for now, the market still remains vulnerable for a break down to lower lows in the alternative blue count for wave [4]. And, until we are able to rally back over 4300, I think it may be prudent to remain somewhat protective, at least until the bulls can really prove themselves.