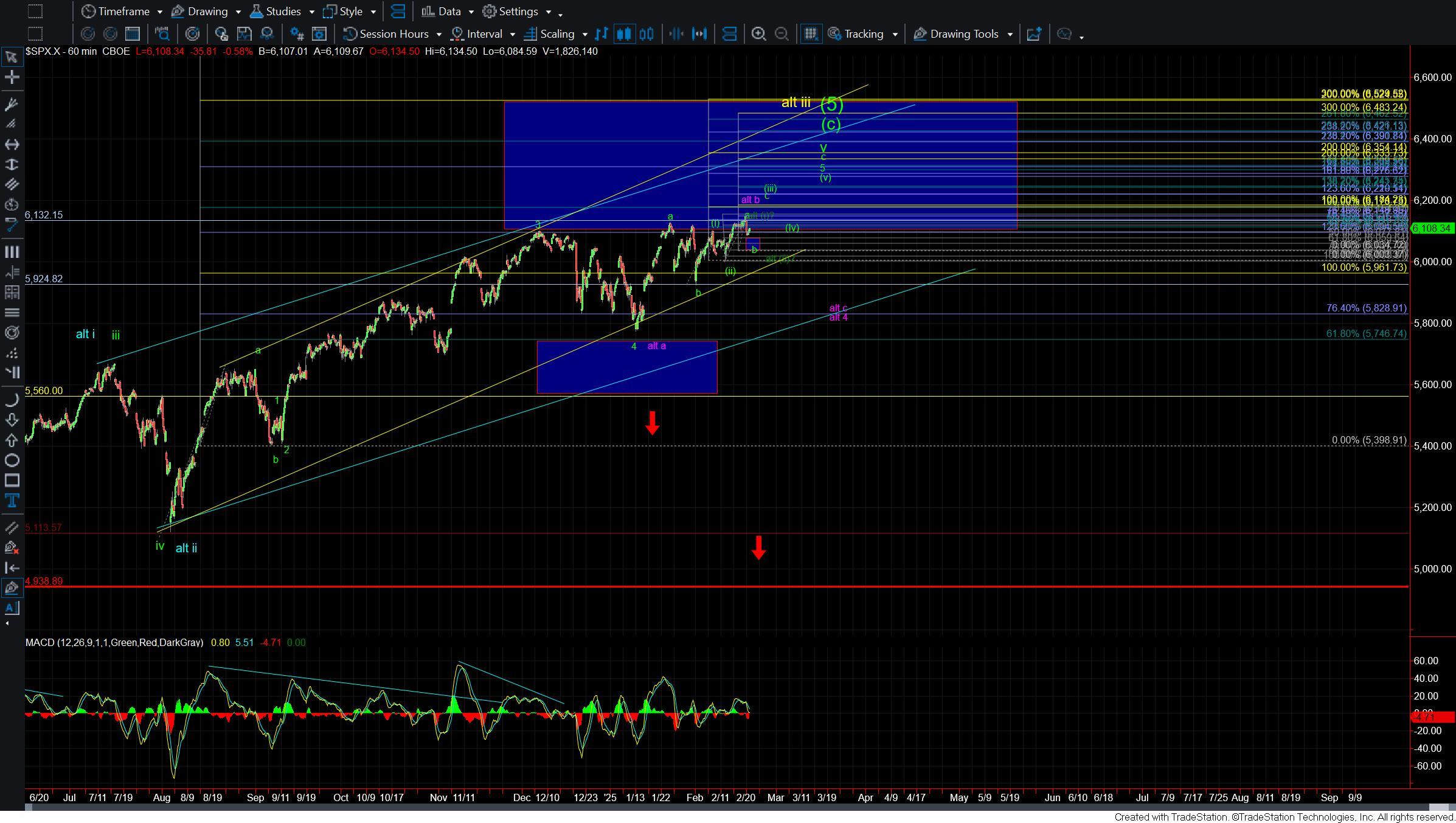

Market Likely Moving Higher In A Diagonal

After moving to new highs yesterday we saw the market pullback stalling at key resistance. This makes it more likely that we are going to finish this move in ending diagonal form. So while we still are likely heading higher to finish off the pattern the path to those highs is likely going to be messy as we look to complete an Ending Diagonal to the upside. Once that ED completes it should result in a sharp reversal lower but for the time being and as long as we continue to hold over support the near term pressure will remain up.

Drilling down to the five-minute chart there are two paths within this diagonal that I am watching. The first would suggest that yesterday's high was a wave a as part of the wave (iii) of that diagonal to the upside. Under this pattern, we should hold over the 6003 low and ideally the 6077-6034 zone. This should then be followed up with a five wave move to the uspide to begin the wave c of (iii) up.

If we break under the 6003 level then we are likely going to see a deeper retrace for a wave (ii). Under this case, we should hold over the 5924 low and then head higher in a corrective fashion to finish off the wave (iii) of the Ending Diagonal.

Should we see a break under that 5924 level it would open the door for this to still be forming an expanded b wave as shown in purple, however, I am still not viewing this as a highly probable outcome but it will remain on the charts until we see a sustained break over the 6150 high.

So while the pressure does remain up the path to new highs is likely going to take a few twists and turns so trading in this environment is likely going to be difficult as the pattern within Ending Diagonals is not terribly reliable. So until we fill out this pattern being patient is going to be key.