Market Likely Entering Fourth Wave Chop

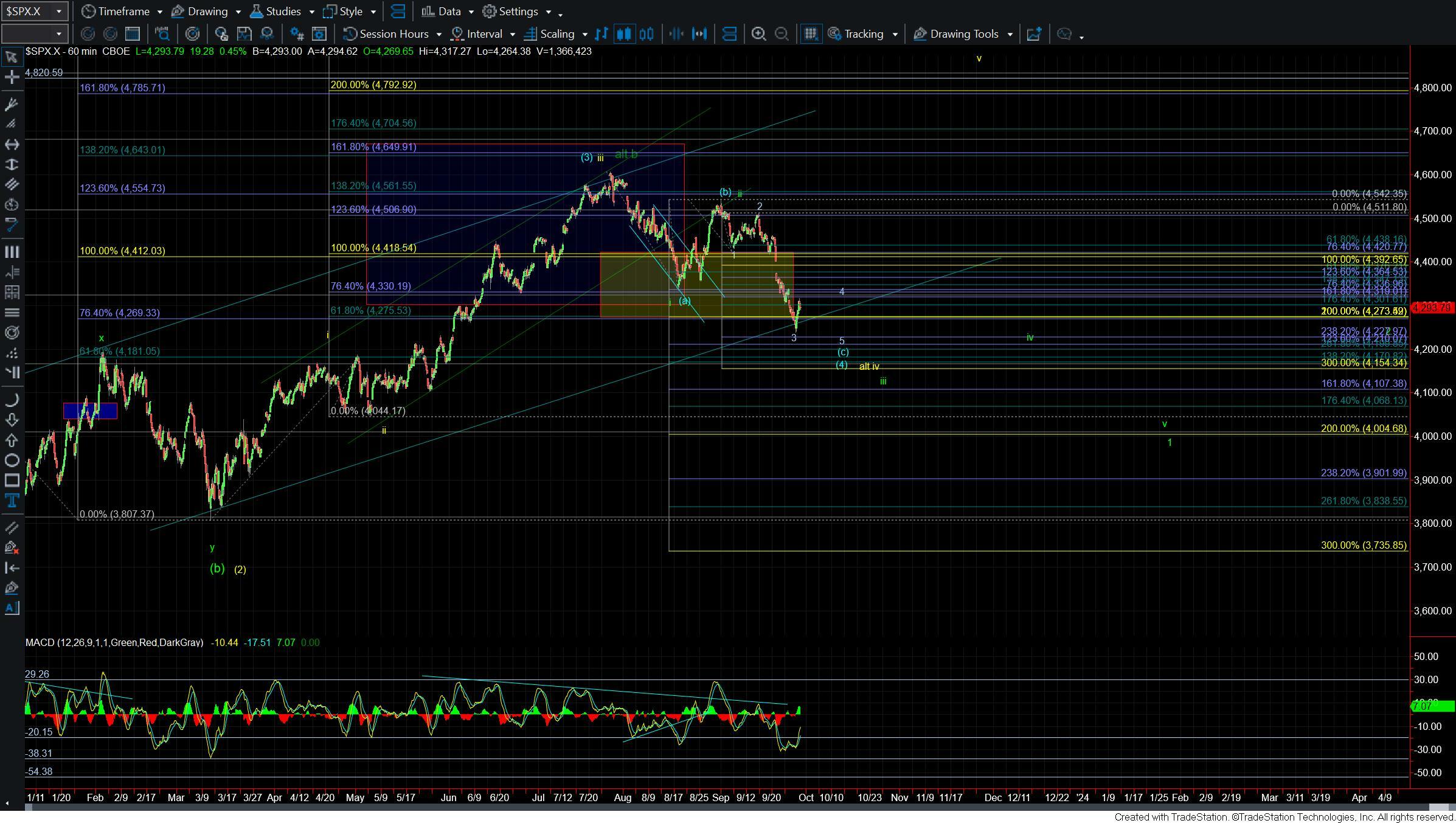

After finding a bottom yesterday we saw the market follow-through to the upside today moving up sharply in the morning session. We hit a fairly hard wall at the 100ext of the initial move up off of the lows at the 4318 level and so far that level has contained this upside move. Hitting and turning down at the 100ext almost on the nose is typically a good indication that we are tracing out a corrective wave structure. This of course fits within our current and primary count that is suggestive that we are in the midst of a fourth wave corrective wave structure to the upside. Fourth waves are notoriously challenging and difficult to trade. So, while we did see a fairly clean smaller degree setup to the upside this morning we are getting into the region in which we likely will see more choppy wave action and some more twists and turns. The wave 4 is however still a bit small to be considered completed so as long as we remain over support this wave 4 likely has a bit of unfinished business to the upside before it is all said and done.

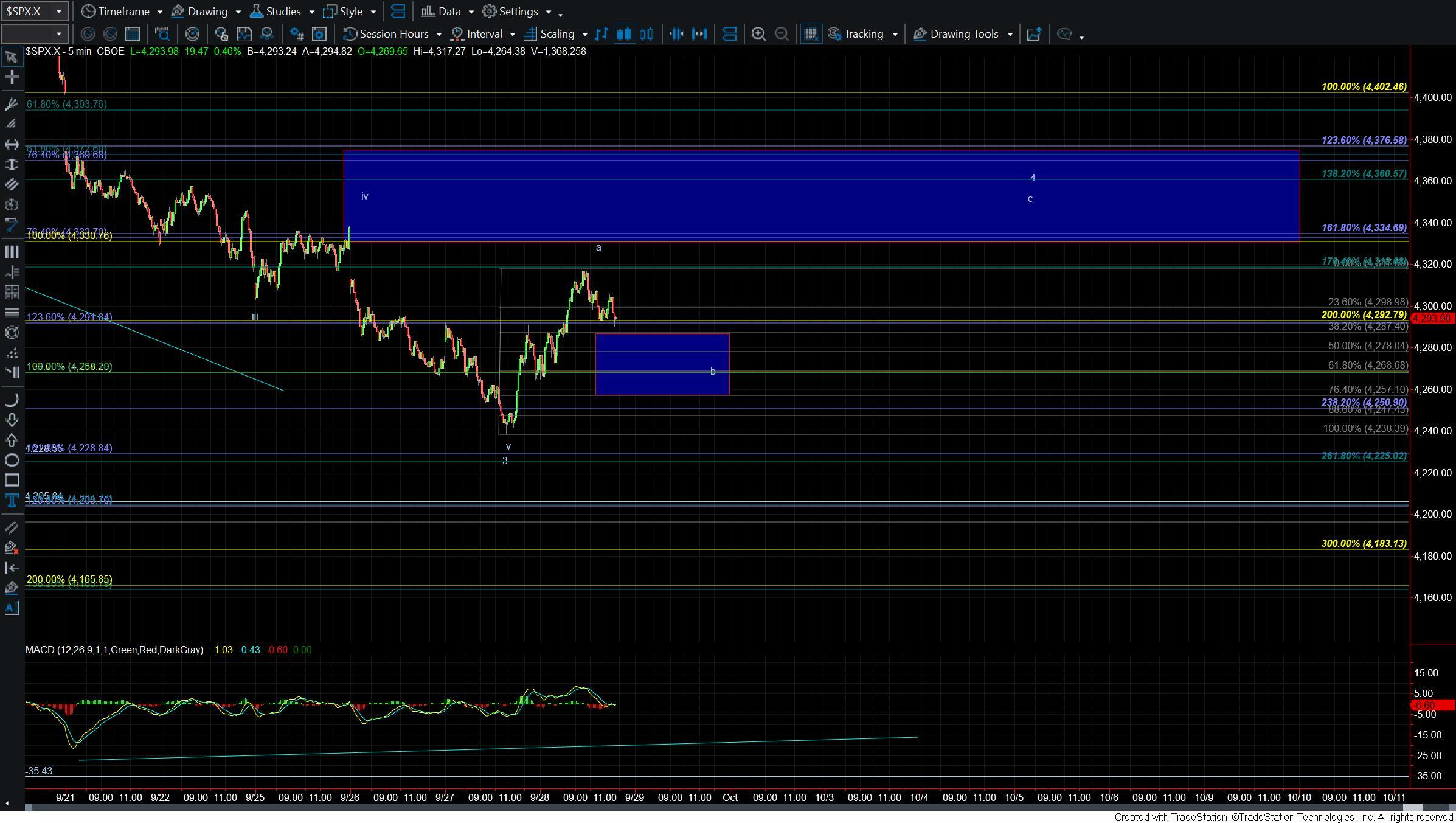

Zooming into the micro charts as shown on the five-minute chart as long as the market is able to hold over the 4287-4257 zone then we still should see this push higher as part of that wave 4. This zone represents the standard retrace zone for the wave b of what is likely part of the larger wave 4. From there we would then be looking for the wave c of 4 to move into the 4330-4376 zone to give us a better-proportioned wave 4 of the larger wave c of (4) down. Assuming we can hold that retrace zone then we would be looking for a five wave move back to the downside signaling that we have indeed begun the final wave 5 of c of (4) down into the 4222-4165 zone below. With all of that said please note that this is the ideal path as I mentioned above fourth waves are notoriously sloppy and I would expect this to take some twists and turns along the way but this is the general path that we would be looking for this wave 4 to complete.

From a bigger picture perspective, there is really very little change to what Avi laid out in yesterday’s update. As he noted at that time the move down off of the highs is quite stretched but the move up yesterday and today has given us some relief into that starched structure. So while the count would still look better with another lower low to finish off this wave 5 of (c) of larger wave (4) per the blue count on the 60min chart we do seem to be beginning the early stages of a bottom. Assuming that we do see the expected lower low after completing this retrace higher as long as the market is able to hold over the 4165 level the bullish count remains intact and we should still see higher levels in the months ahead.