Market Keeps Grinding Along

With the market continuing to grind higher, it continues to present itself as being within a 3rd wave higher.

As we noted last night:

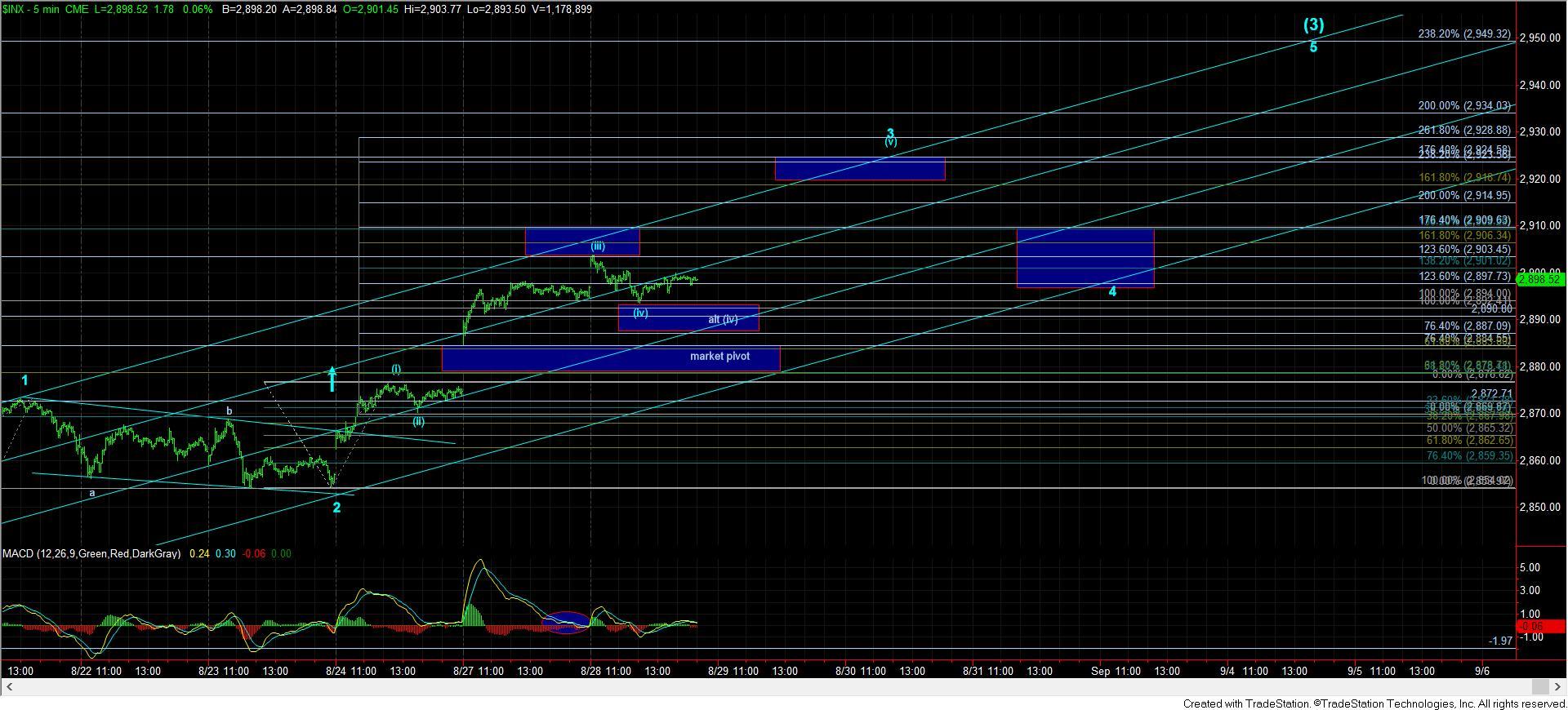

“that means that, as early as tomorrow, we should see continuation up to the 2903-2910SPX region to complete wave (iii) of 3 of (3), as shown on the 5-minute chart.”

Today’s top for wave (iii) of 3 of (3) was just above the 2903SPX level, and today we came down to test the top part of the support box for wave (iv). While wave (iv) can certainly give us one more dip a bit deeper into the support box, we have enough waves in place to consider wave (iv) to have completed.

Ultimately, as long as we remain over 2887SPX, pressure will continue to remain to the upside. Our next target is the 2920-2925SPX region, which can still be hit this week, especially if we have already completed wave (iv) today. So, as long as we remain over 2887SPX, that is my next target region before we see a bigger pullback in wave 4, which should easily maintain over the 2890SPX region, as you can see from the 5-minute chart. Ultimately, this structure should be targeting the 2950/55SPX region by next week to complete wave (3).

There is one more point I want to address. I know many of you are watching that trend line that we are hitting our head upon and expecting a top of some sort to be struck here. Should we break below 2887SPX then I would consider that perspective. However, as I have mentioned before, when the market moves into the heart of a 3rd wave, we often see an acceleration take us from the lower channel into the upper channel, where the conclusion of the 3rd wave completes near the top of that accelerated trend channel. This is why I said the action into the end of August and early part of September will likely tell the story for us. And, we are now on the cusp of that potential.

At the end of the day, I will continue to look higher as long as we hold 2887SPX this week on this pullback.