Market Is Testing The Trap Door

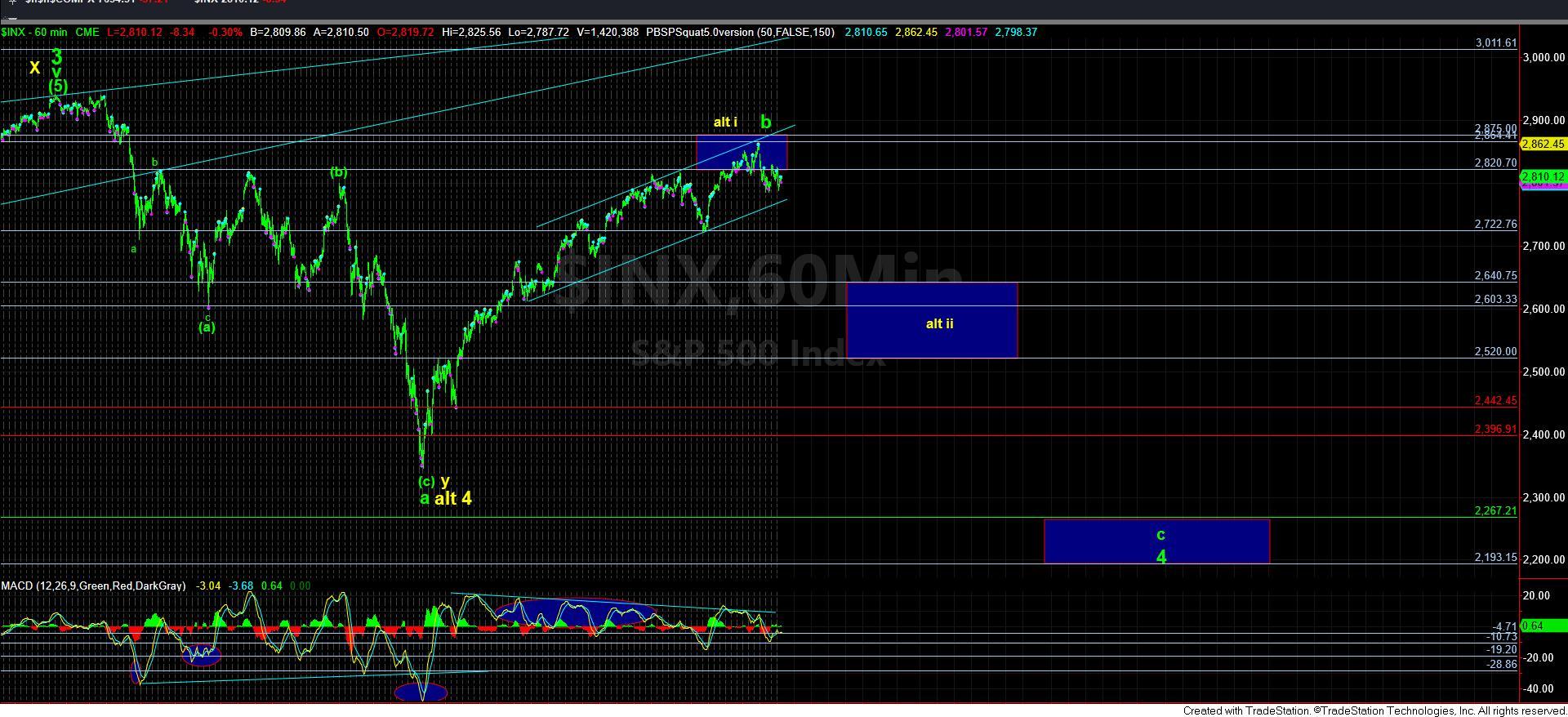

With the market completing what seemed to be a i-ii, [i][ii] downside structure this morning, it dropped quite strongly down to towards our market pivot. And, as we began to drop, I noted in our trading room that we will need to strongly follow through below the 2790-2800SPX region in order to suggest that wave [iii] is potentially upon us.

However, the market only broke slightly below that support, and then turned up into our resistance region noted at the lows.

When I review the pattern we have on the chart right now, I would say that it has not been following an ideal Fibonacci Pinball structure to the downside with the size of today’s rally. While it certainly can continue lower into tomorrow, the rally today makes me question the ability of the market to follow through to the downside in a big way right now.

As you can see from the 5-minute chart, we still need to break down below the market pivot to then make that pivot our resistance for a drop down towards the 2700SPX region. So, unless tomorrow sees follow through below 2770SPX, I am starting to consider that the market may levitate a bit longer in the blue count, to provide us a bigger wave ii consolidation.

I want to be clear that it still seems as though the market is setting up a break down. And, we need to see follow through below the market pivot to suggest that break down is likely in progress. That is the trap door I keep mentioning in my updates. But, based upon today’s rally, I am not as certain that this break down will occur before we complete more of a corrective rally back up.

Moreover, as I mentioned last night and today, the IWM also seems to need more of a retracement to the upside before it is likely ready to resume its next decline phase. In fact, more of a retracement in the IWM would align it with the SPX in a i-ii to the downside, with the wave i down in the IWM being a leading diagonal.

So, at this time, I am leaning towards more of a retracement being seen in the market before the bigger downside takes hold. But, please do not mistake that for a desire to be aggressively trading the long side. The larger risk I see is clearly to the downside, so caution is still very much suggested. So, I am leaving the blue count as the “alternative” due to the inherent risk I still see in the market.