Market Is Still Holding Support, But the Small Caps Stil May Be Telling a Different Story

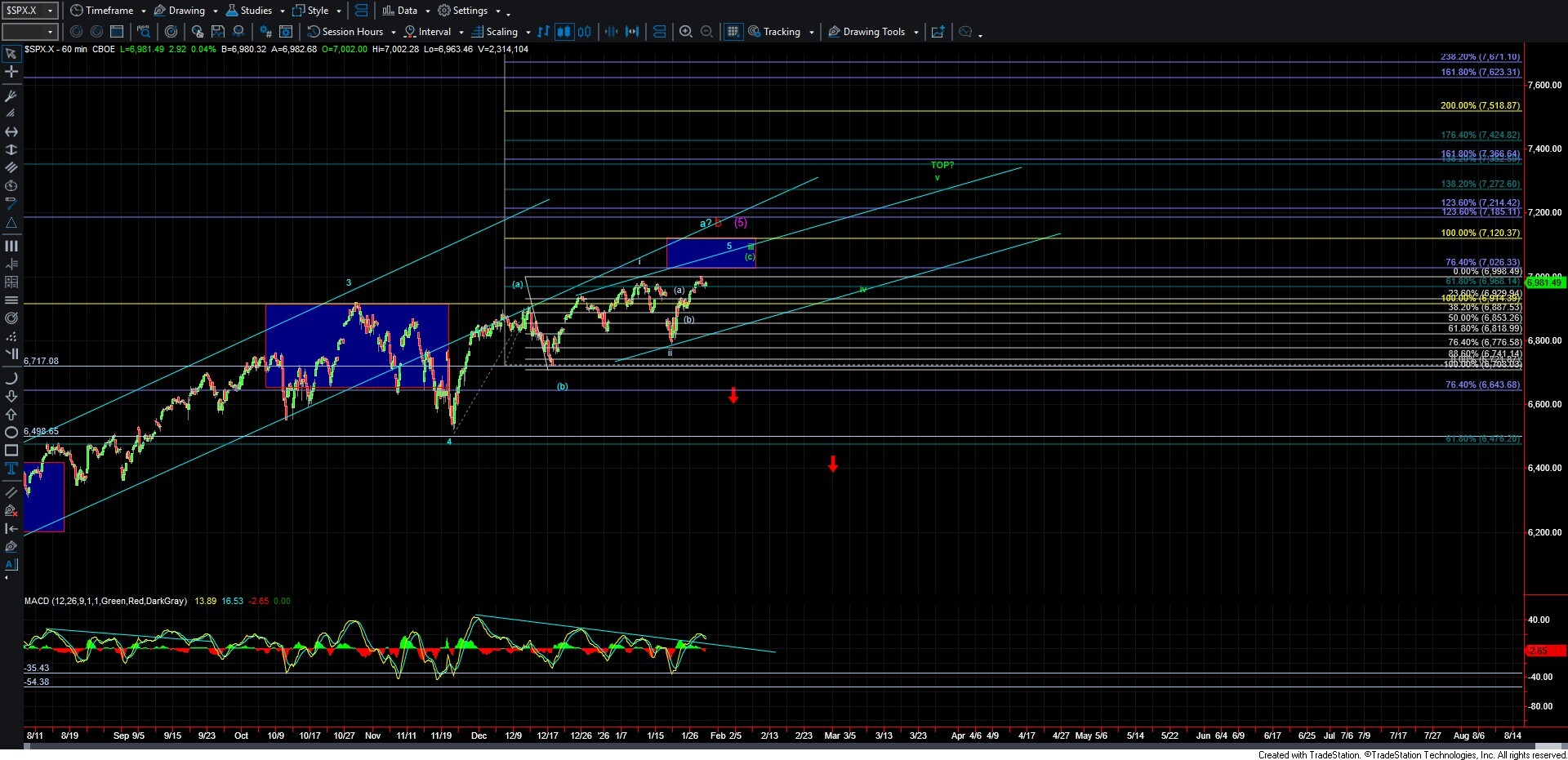

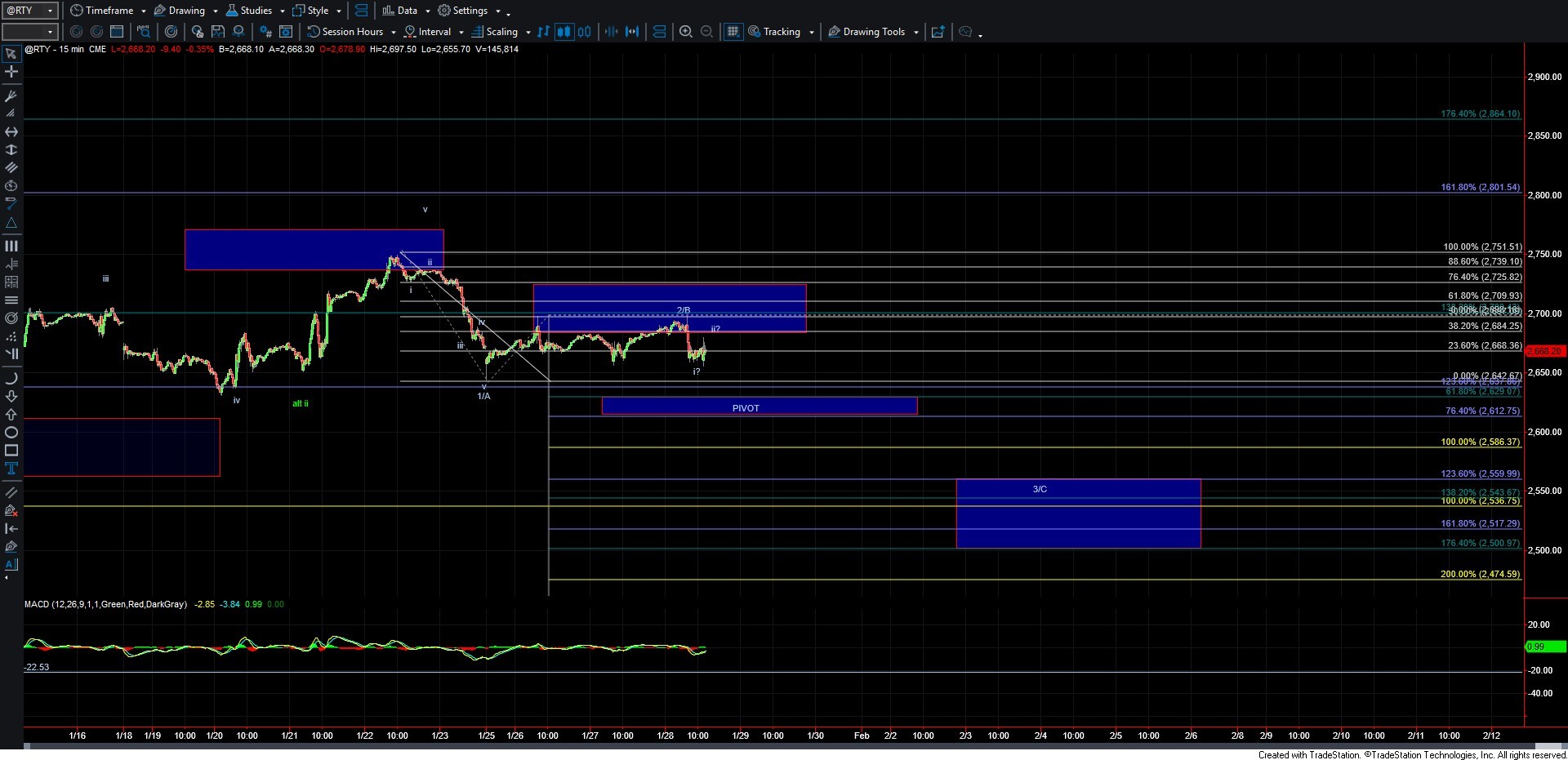

Today, we saw the market open higher, only to pull back into the key micro support zone that I laid out yesterday. While the bullish count I have been tracking on both the SPX and Nasdaq remains intact for the time being, the Russell 2000 chart still shows a potentially bearish resolution, at least in the short term. In fact, the bearish count on the Russell 2000 is actually a bit cleaner than the potentially bullish count I am watching on the SPX and Nasdaq. While I will continue to give the SPX the benefit of the doubt in resolving higher, the count on the Russell 2000 has me becoming even more cautious in this region.

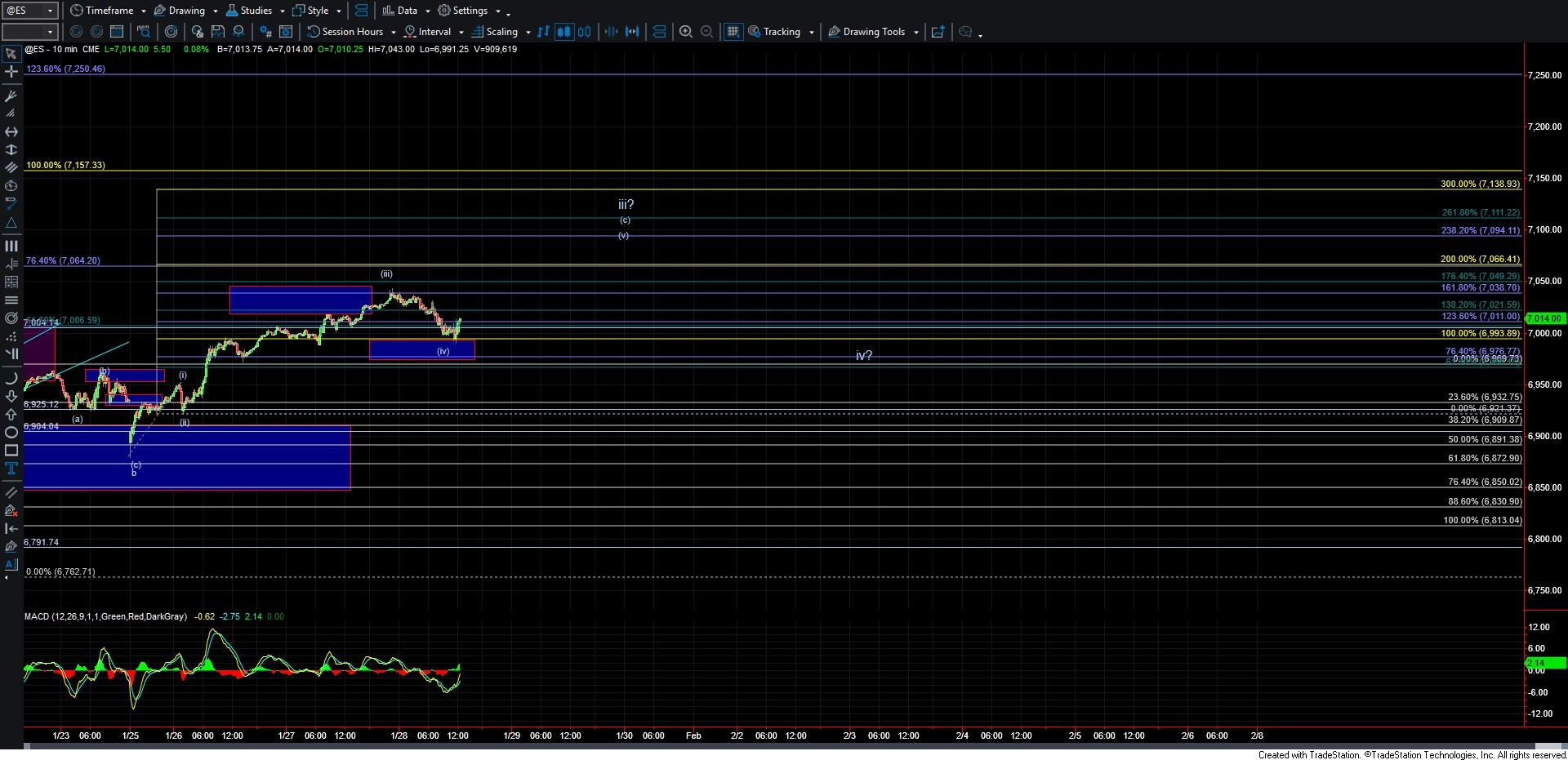

As shown on the ES chart, I currently have micro support sitting at the 6993–6976 zone. As long as we can hold over this zone, the move still counts best as a wave (iv) retrace that would require at least one more higher high to finish off the larger wave iii, as shown on the chart. If we can indeed hold support, then we should be targeting the 7066–7111 region overhead for the wave (v) target.

If we are unable to hold over that micro support zone, it would suggest that we have put in at least a local top with today’s high. Should that occur, we will then need to watch the 6900–6850 region below as larger support. If we begin to break down under that region, followed by a break under the 6813 level, it would start to give us an early indication that a larger-degree top may have been struck.

The RTY chart is telling a bit of a different story, with what can be counted as five waves down off the 1/22 high, followed by a corrective retrace into today’s high, which was then followed by another potential five down into today's low. This gives us a possible 1–2, i–ii setup to the downside. So again, while the ES and NQ are both still holding over support, this potentially bearish setup on the RTY certainly has the caution flag waving.

I will continue to watch all three of these indices closely, but given where we are within the counts on all of them, we are getting some mixed messages in this region. We should however, have an answer as to which way this is going to break before the end of the week as we are running out of room for this to hold support.