Market Is Down, but Not Quite Out

Today’s decline has opened the door to the possibility that a larger top may finally be taking shape. That said, the market is still holding above a key support level, which keeps the more immediately bullish count intact for now. As long as this support holds, my base case remains that the market will resolve higher before we see a more significant top develop. However, a decisive break below support would increase the odds that a larger-degree top is indeed in place.

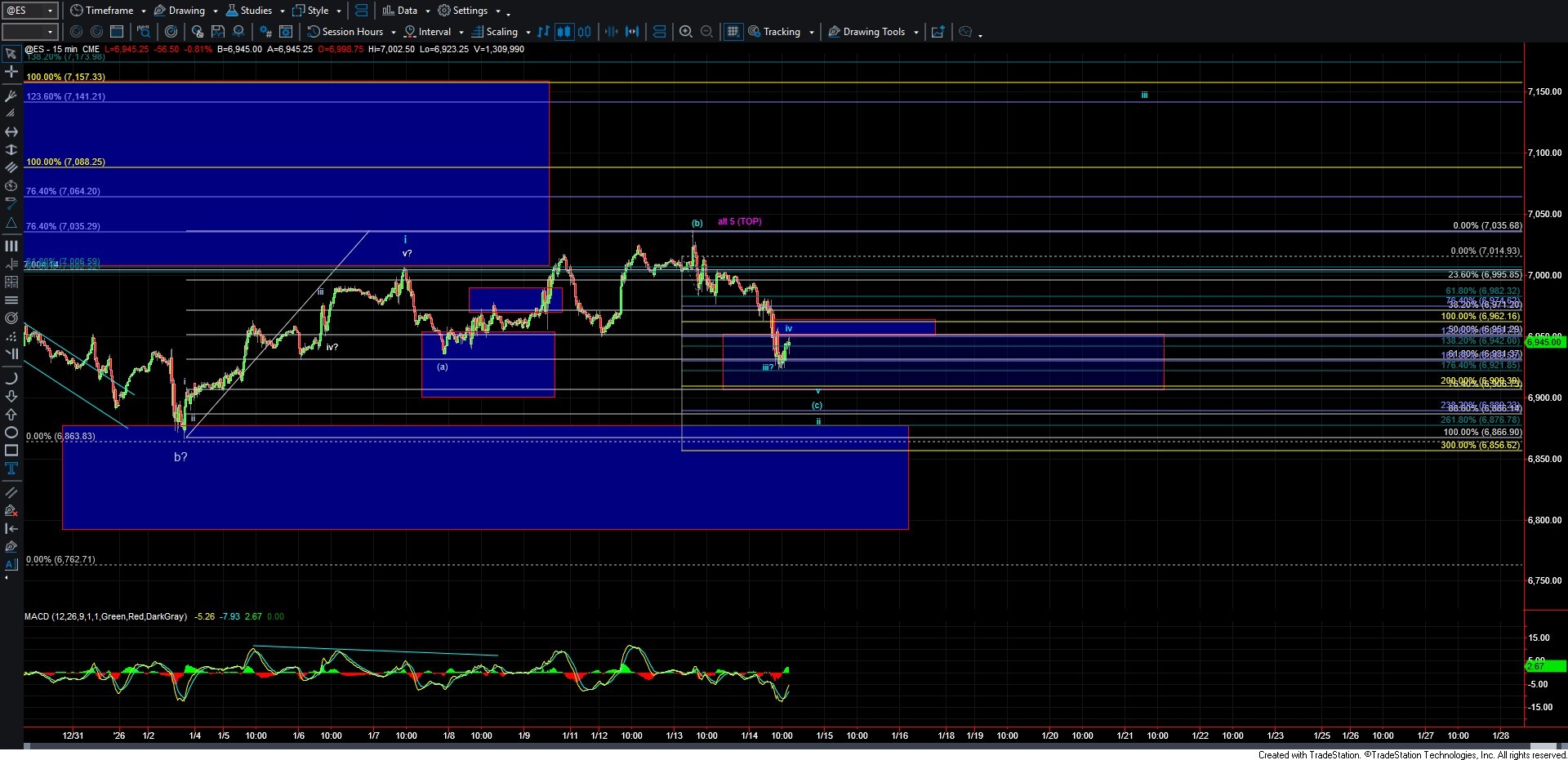

As shown on the ES chart, current support resides in the 6951–6906 zone. I continue to view this as a critical area for maintaining the immediately bullish count, shown in blue on the charts. To confirm that a bottom has been established in blue wave ii, we will need to see a move back above 6962, followed by a break over 7000, and ultimately a push through 7035. If this sequence unfolds, I would then look for wave iii to target the 7100–7150 region.

Should the market break below the support zone noted above, followed by a sustained move under 6792, it would open the door to the conclusion that a larger-degree top is finally in place. For now, however, and as long as support continues to hold, my primary count remains the blue scenario, with expectations for a resolution to the upside.