Market Is Biding Its Time

With the market unable to break down below yesterday’s low to confirm a top being in place, it began to rally overnight off those lows. So, with the market unwilling to take advantage of the first downside set up we have had in quite some time, it continues to levitate up in this region in honor of Santa.

As one of our astute analysts on Elliottwavetrader has pointed out, this is a market of stocks, and it seems the market is biding its time until all those stocks complete their immediate upside patterns. While we are very close to many of the leading stocks completing those patterns, it is quite clear that we are not there just yet. But, again, it still seems we are very close.

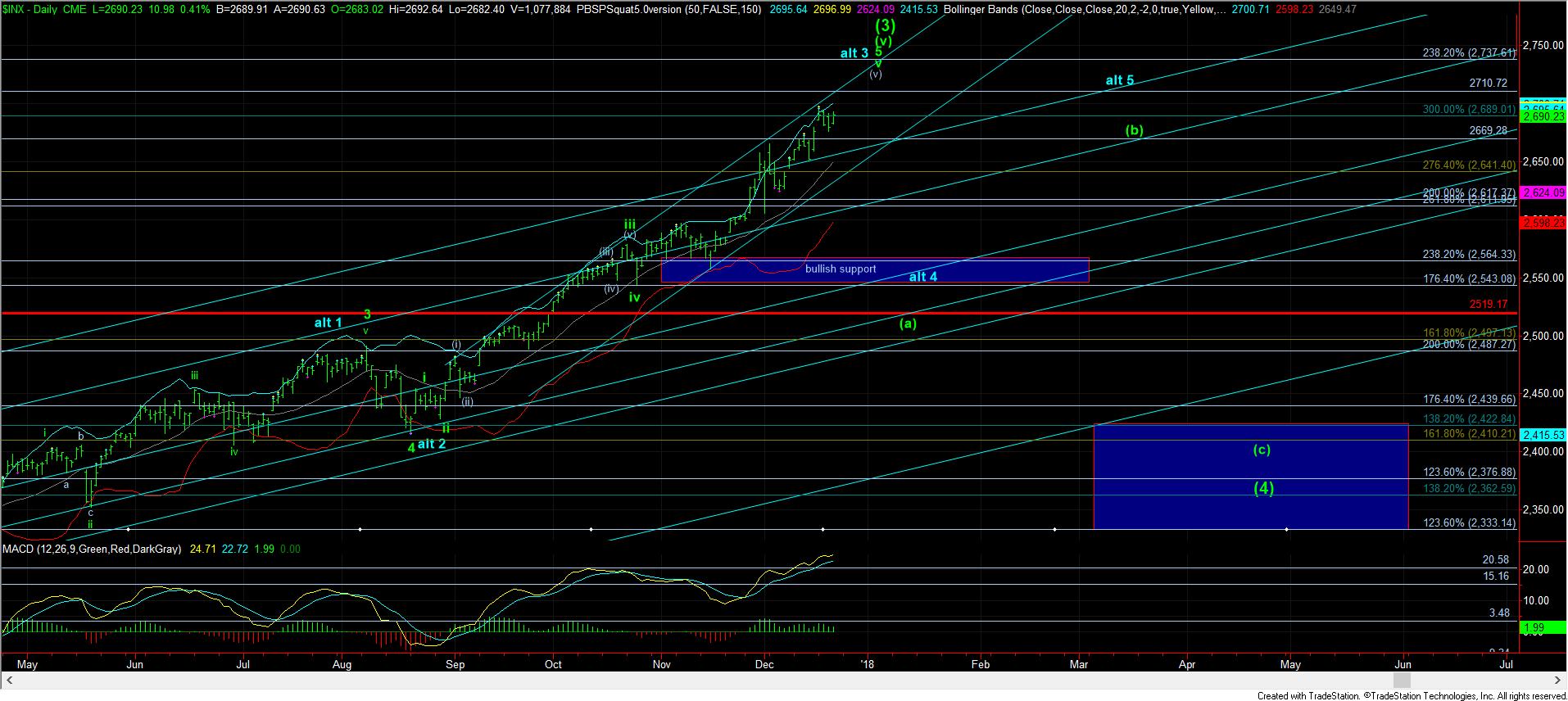

Despite the ES invalidating its “immediate” downside set up, it is hard for me to retain a strong bullish bias due to how stretched this market has become to the upside. As noted above, patterns are almost complete in many of the stocks we track. While this suggests that we can still see some upside left, it also suggests that we are fast running out of room to the upside once those stocks strike their tops.

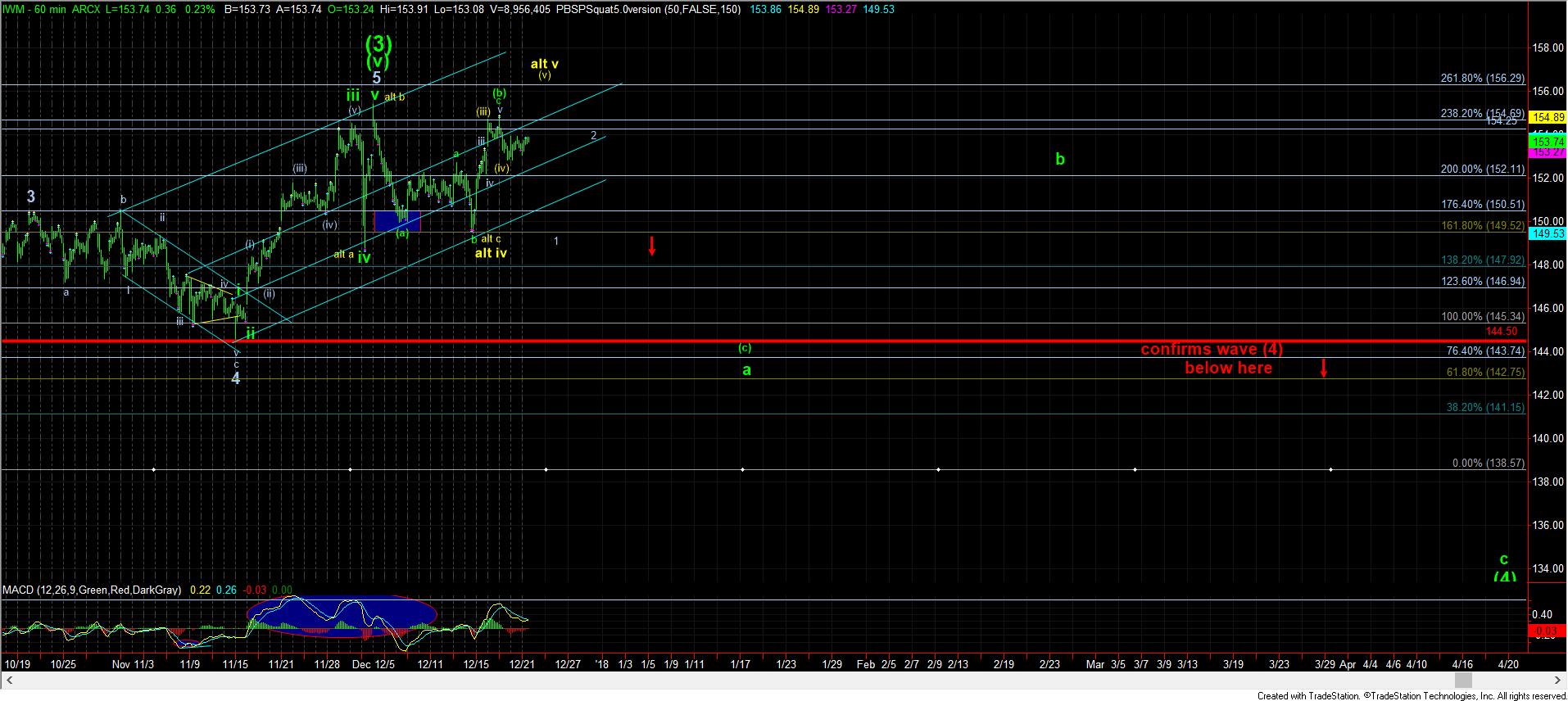

So, at this time, I am going to suggest that you do not get overzealous about aggressive long positions. I am also going to suggest that you do not get overzealous about downside potential until the market takes out some minimal level of support. Specifically, I would want to see the SPX break below the 2670 level and the IWM break below the 152 level. Until such time, the market can certainly continue to extend over 2700SPX, but one has to make their own determination as to whether they will retain an aggressively long position up here. Personally, I still abide by the old perspective: “Bulls get fat, bears get fat, but hogs get slaughtered.”