Market Is Always Taking Us To The Edge

For those following my work for some time, you would know that the market breaking below 2880 on the S&P 500 (SPX) back in the fall had me raise cash because it suggested that a 20-30% correction was likely beginning. And, in December, when we were calling for the market to drop precipitously from the 2800 SPX region, I provided a downside support in the 2250-2335 region from where I believed we would see a rally back to at least the 2800 region.

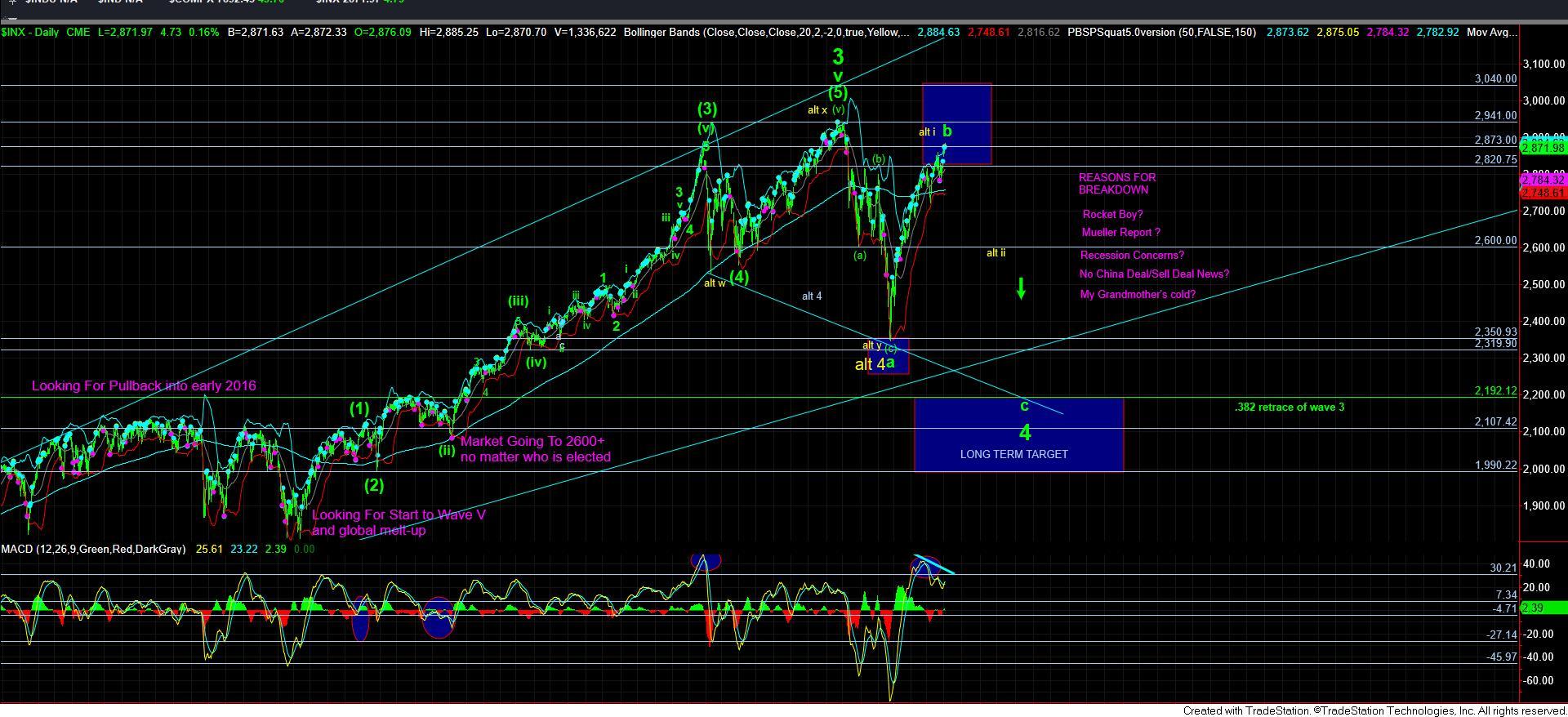

In fact, even before we bottomed in December, I had considered that we could even see a higher all-time high in the rally from our expected bottoming region, with the potential to target as high as the 3011-40 SPX region before breaking back down to the 2200region.

But, once we broke down in the market in the fall, it really became a trader’s environment, and we truly were able to take advantage of it. And, once we approached our downside initial target for what I view as the a-wave of wave 4, I expected to see a rally back up towards the 2470-2520 SPX region. While my initial expectation was that a rally to that region could still send us back down into the target below one more time, when the market pulled back from that region in a corrective fashion, I was forced to begin looking higher to the 2600-2680 region from the 2445 region, as that shifted my thinking to the bottom of the a-wave being in place.

When we reached the 2600-2680 target region, I expected the market to provide us a corrective pullback before heading up to my ultimate target of at least 2800 on the SPX. But, the pullback was terribly small and the market continued higher without providing much of a pullback at the time.

So, as the market rallied through February, I lowered my “ideal” target zone for the b-wave rally to 2865-2885 on the SPX due to the internal structure of the market during the February segment of the rally. It just did not provide me with the appropriate projections to take us back to the market highs, and potentially the 3011-40 region I had been mulling for so long. And, now, the market is at our target region.

However, the structure with which we have now rallied to that target has opened the door again to the potential I was mulling back in the fall of 2018 – that we can still approach the 3011-40 SPX region in the rally off the December lows.

So, this has now caused me to modify my ALTERNATIVE count . . . not my primary. Again, I want to stress that my alternative count has now been modified, meaning that the second most likely scenario I see is the rally to a higher b-wave target. And, today, I sent out an alert to all our members explaining how that would take shape.

As you can see from the 5-minute chart, the market will have to now break below 2858 SPX to give us much more confidence in the b-wave topping now scenario. While we have finally hit the top of our target we set out quite some time ago, I really do not have much more room above this target for extensions for a “topping now” b-wave. For if we see acceleration through 2910, it makes it much more likely that the market is pointing us to the bigger b-wave structure I had been thinking about those many months ago, which will likely point us up to the 3011-3040 region. And, I have now highlighted this potential in the alternative yellow count.

Our support now resides at 2845 on the SPX, which would be the .382 retracement of the grey wave 3. As long as we hold that support, I still can see further upside in the market, the extent of which will provide confirmation as to where this b-wave will finally top this week or early next. It takes a break below 2830 to provide us with initial indications that the b-wave has indeed topped.

Moreover, I also want to note that I have to still maintain the count that this rally is a b-wave for all the same reasons outlined many times before. In fact, the Bayesian probabilities have been raised to 74% that this rally is a b-wave. So, until the market tells me otherwise, I will be following the current b-wave count, even if it is able to provide us with a higher market high, as I warned about and discussed quite in depth well before we began the drop in December.

In the bigger picture, keep in mind that our expectation remains that the market can rally up to the 3500-4000 region within the 2022/23 time frame. That leaves a lot of room on the upside with a lot of time left on the clock. So, I really want to be confident before I become an outright intermediate term bull, and the structures of many of the stocks we are tracking do not induce confidence in me at this time that we now have the set up in place to traverse towards that longer term upper target.