Market Is A Bit Of A Mess

The market has been relatively flat over the past several days, not giving us much movement to work with. Furthermore, the movement that we have seen has been quite sloppy and corrective in nature in both directions. This makes it difficult to have a high degree of certainty as to which direction this will move in the near term. Additionally, there are several viable paths that we have to be on the lookout for as we move into the end of the week.

Avi did an excellent job of laying out these potentials on the smaller timeframes, so I am going to use this write-up as a baseline for this update with some additional color commentary.

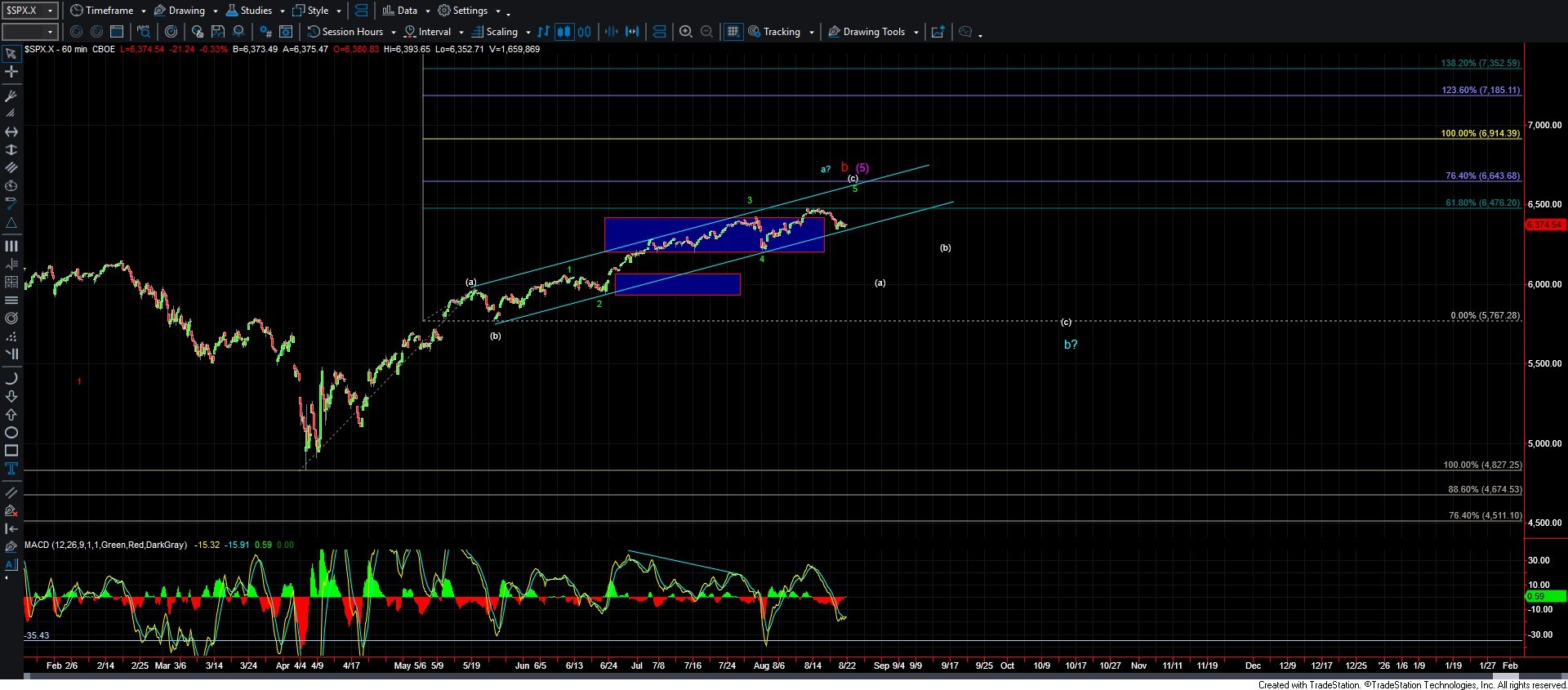

As shown on the ES chart, there is potential that the top is in for this move, which we are showing in red on the charts. Yet, we have no indications that is the case just yet. But, even if we assume yesterday's low is going to hold, any rally is going to be an a-b-c corrective-looking structure, as we are likely dealing with either an ending diagonal to the upside or a corrective retrace higher that would ultimately resolve lower.

You see, if the top is in for the red count, and we had wave 1 in red down, then wave 2 will be an a-b-c rally. If the top is in for the purple count, and we had an (a) wave down, then the (b) wave will be an a-b-c rally. And, if the top is in for wave (3) and this decline is a c-wave in wave (4), then wave (5) takes shape as an (a)(b)(c) rally to new highs (as per green on this chart), and the (a) wave also takes shape as an a-b-c structure the great majority of the time.

So, again, this will NOT be easy. The only way to differentiate between these scenarios is either by an immediate breakdown below 6287 SPX (not seeming likely at this time), or by how the market pulls back to the downside after the a-b-c rally. If it is impulsive to the downside, and we break the low we make in this bottom, then probabilities significantly rise that a local top is in place. If the downside is corrective, then we prepare for a move to new highs in wave (5), as laid out per the green count, to finish off the larger Ending Diagonal.

Bigger picture, there is no change, as again the market has been relatively muted over the past several days.

So, as Avi noted earlier, please make sure you understand the parameters and the potential complexities being presented in the current structure, no matter which way you want to trade.