Market In A Holding Pattern Ahead Of Heavy End Of Week Data

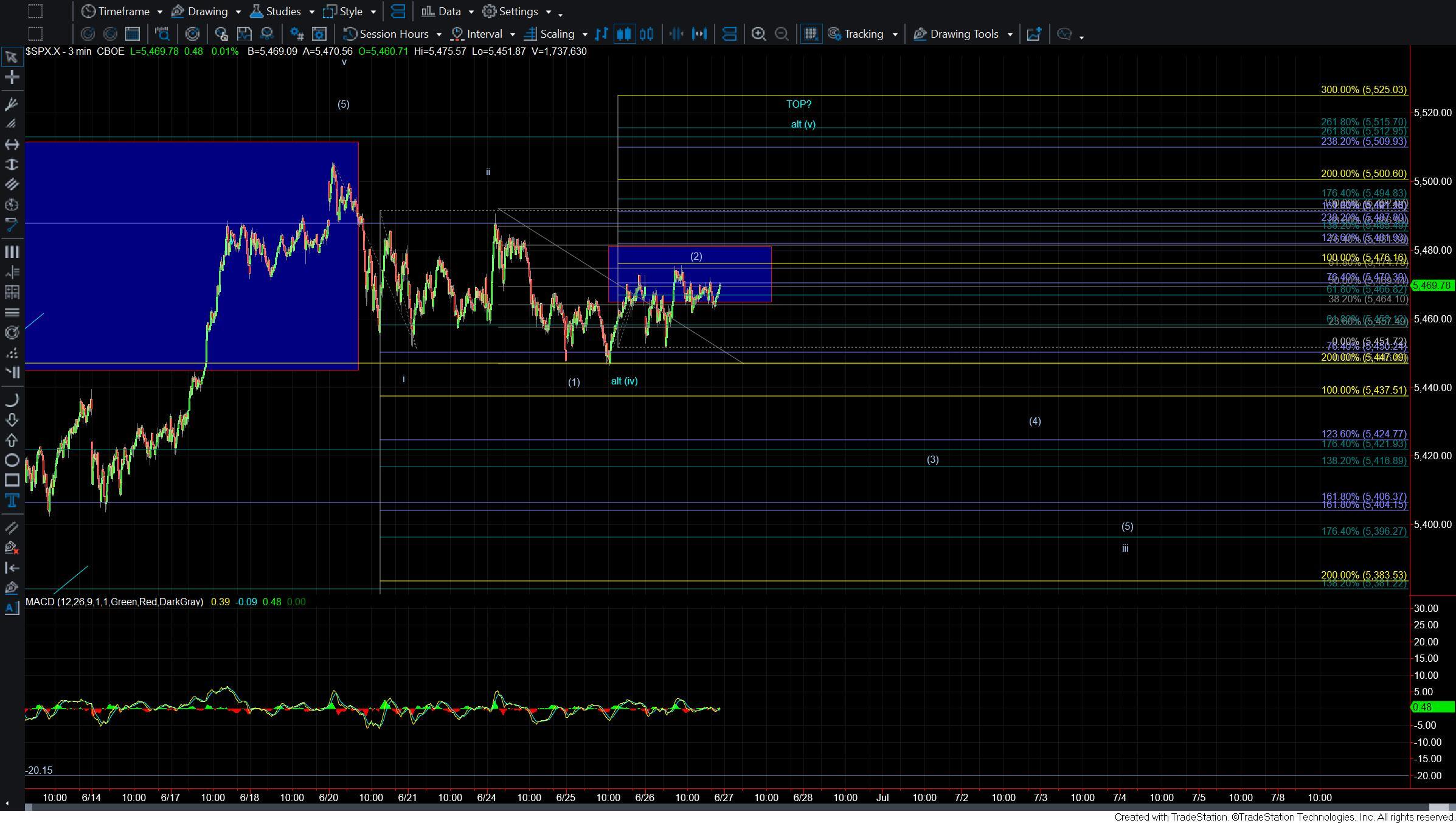

Overnight we moved higher only to open up lower on the day. We then saw the market push higher into the afternoon session and we are now trading about flat on the day. We are still holding the potential i-ii (1)-(2) count that was in play yesterday and as long as the SPX remains under the 5491 level this count will remain valid. So while the market has yet to break in either direction we are running out of room so we should have an answer over the next few trading sessions.

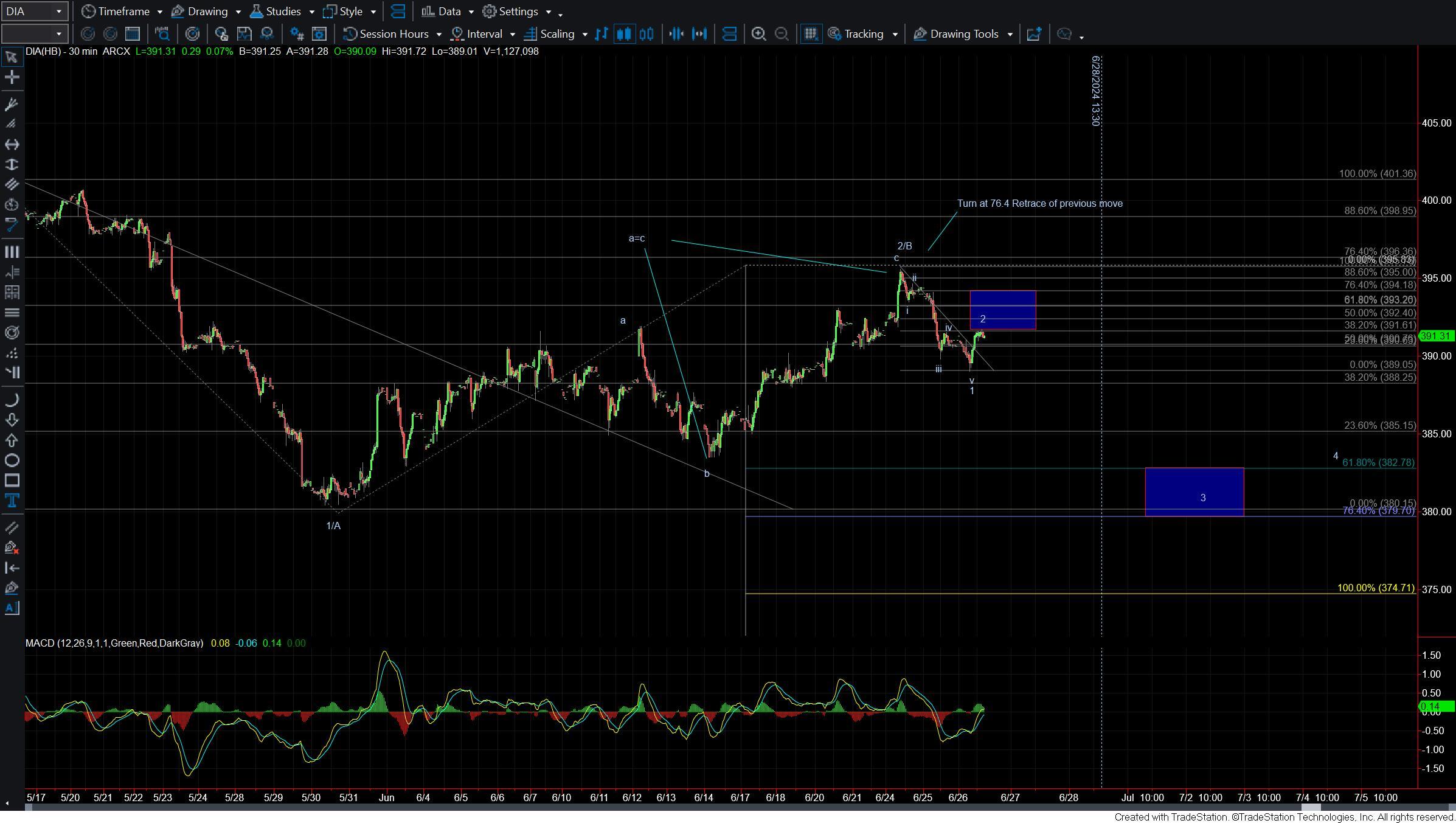

We also have some data releases (Bank Stress Test Info, GDP, CPI) coming out over the next several days that could act as timing catalysts as the market continues to hold its near-term downside setup. Additionally, there the DJIA is showing a very clear five-wave move off of the 6/24 high which is also supportive of the downside pressure in the markets as we head into the end of this week.

As far as the SPX is concerned we still need to get back under Monday's low to confirm a local top and that should be followed up with a break under the 5437 level on the SPX.

If we can get through that 5437 level then it would open the door for a fairly direct move down towards the 5424-5400 zone for the wave (3) of iii.

We then would need to fill out the full five down of one larger degree as laid out on the SPX chart to give us the initial signal that we have indeed put in the larger degree wave b top.

If we move back over the 5491 level on the SPX it still leaves the door open to see another higher high before any significant top is indeed struck.

The setup on the Dow is a bit more clear at the moment and it is about as textbook as they come in regards to an impulsive fib pinball five-wave move to the downside. This move came down after a larger degree clearly corrective A=C move up that tagged and turned right on the 76.4 retrace of the previous move down. So while no setup will carry a 100% probability this is about as clean as they come and certainly has my attention as we move into the end of the week.

I am showing this setup on the attached DIA chart which is again is supportive of the market continuing to see downside pressure in the days and weeks ahead. Should we move back over the 396 level on the DIA then it would invalidate the most immediate bearish setup but as long as that level holds I will continue to look lower.

In either case, whether we hold the setup to the downside or not, I think the tight range that we have been seeing this week will likely come to an end before the week is out but based purely on what I am seeing on the charts and as long as we can continue to hold under resistance the very near term pressure does remain to the downside.