Market In A Holding Pattern

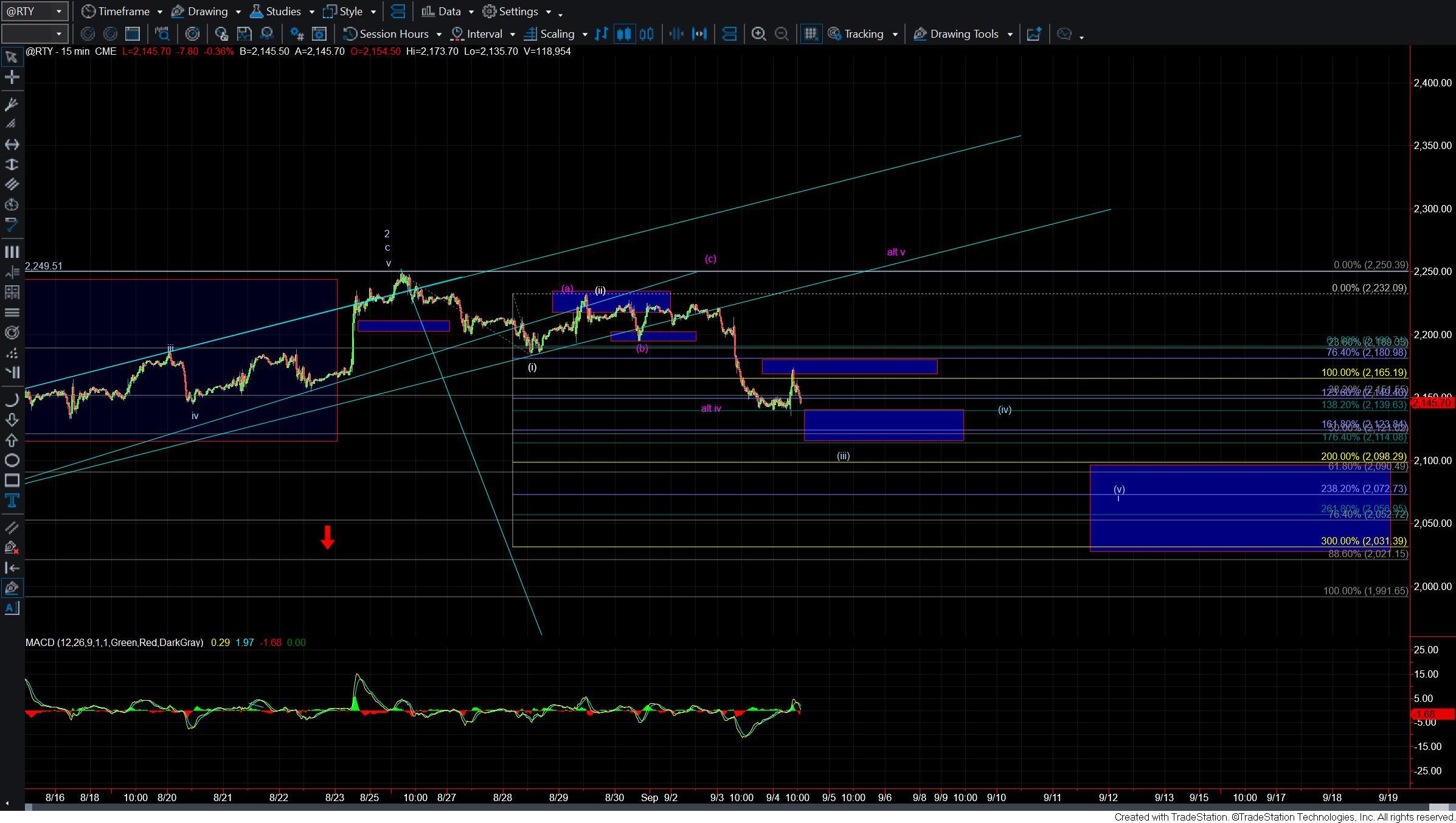

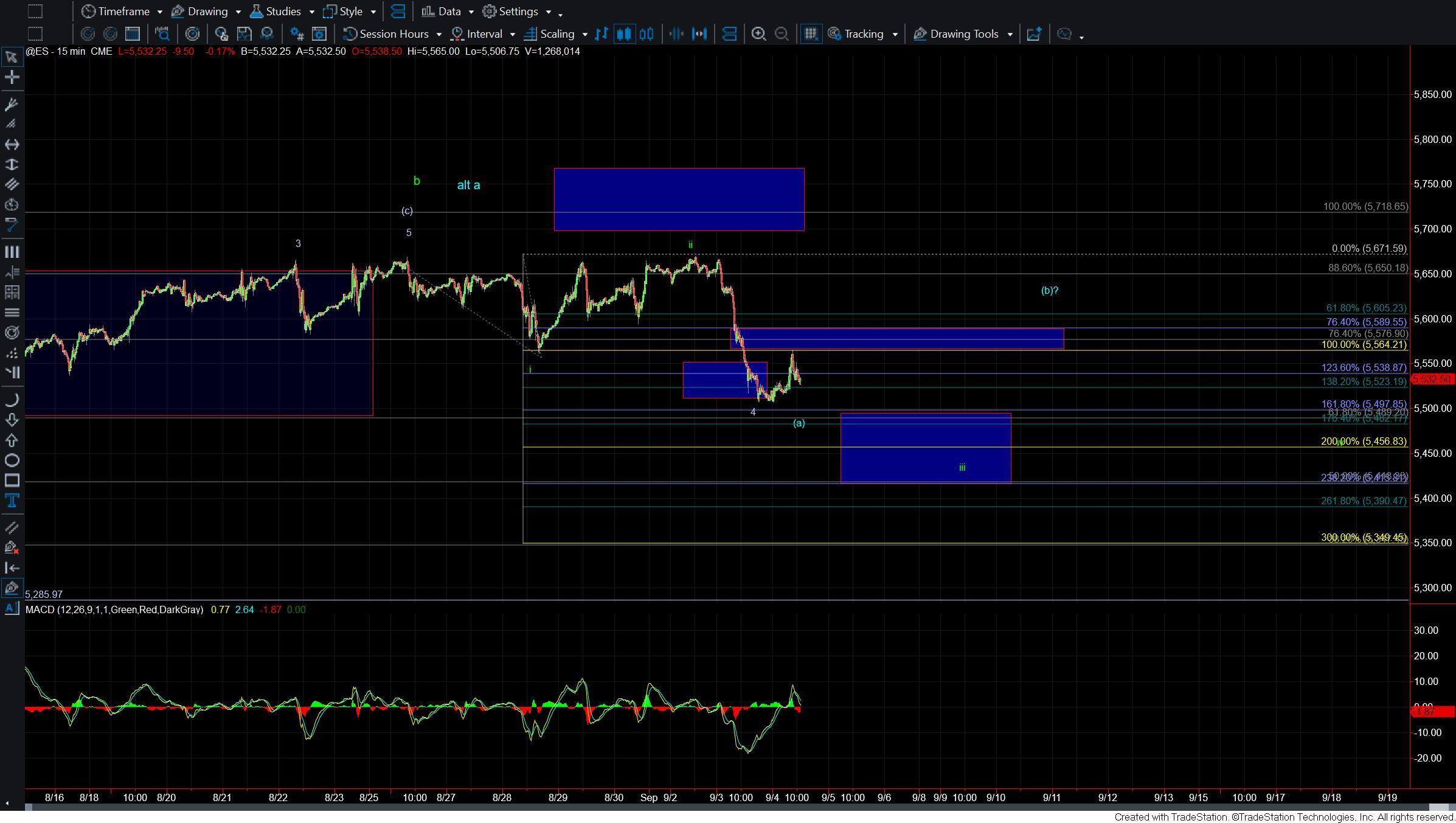

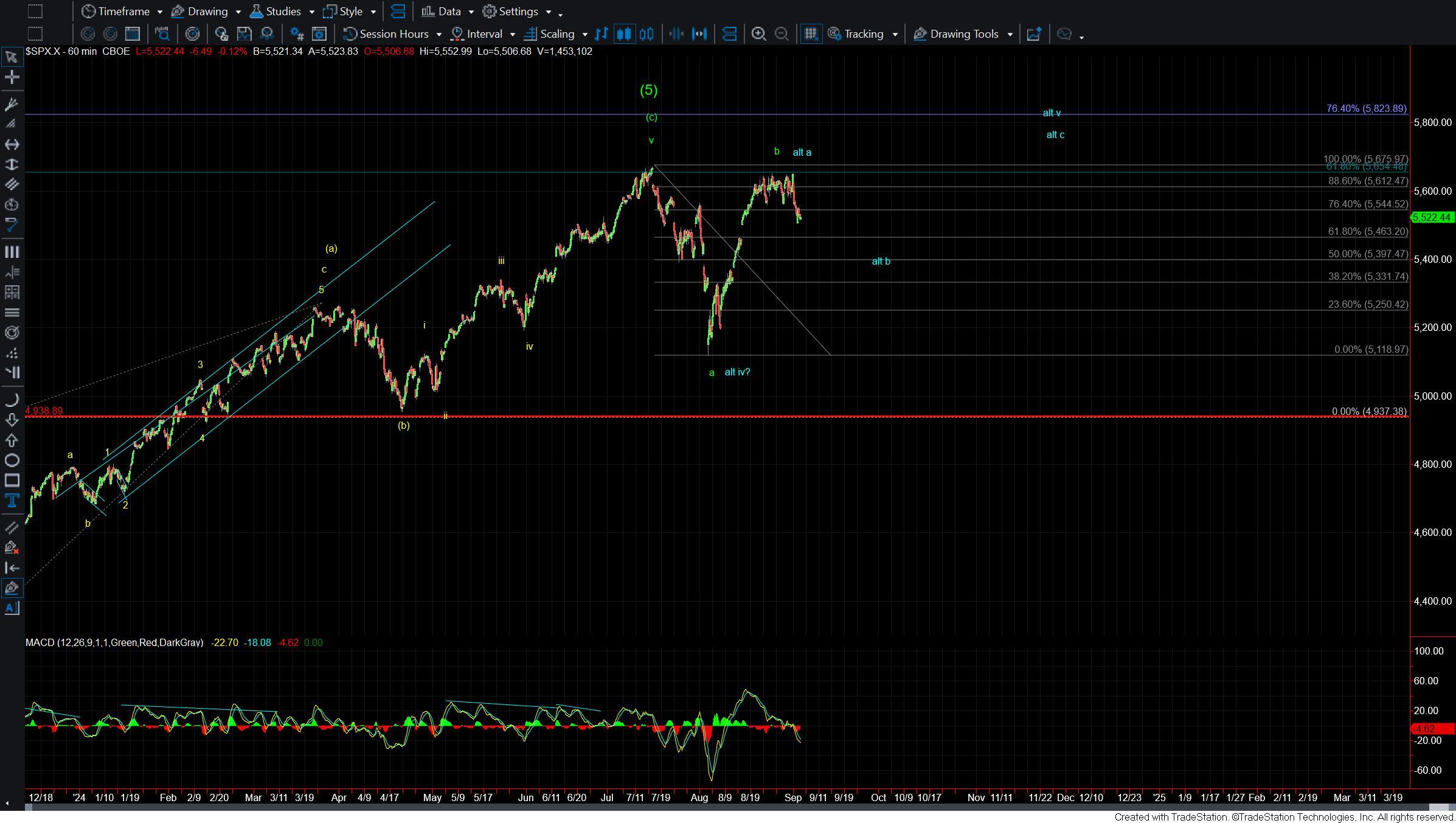

There really is not too much I can add to the analysis today as the market has simply consolidated in a very tight range today. We managed to hold under the resistance level to the upside on both the SPX and the RTY but have yet to see a break of yesterday's low to further confirm that we are ready to see the next leg lower. I am viewing the RTY as having the cleanest pattern down off of the highs so I am focusing most heavily on this chart for guidance but still will need to see cooperation from the SPX chart as well.

Today I was watching the 2165-2180 zone on the RTY as key overhead resistance/ pivot zone. We moved up into that zone today but turned it down lower. We however still trading over today's low of the day so we still do not have further confirmation that we are indeed in the wave (iii) down off of the highs. With that being said as long as we can hold under the 2180 level I am going to give the benefit of the doubt that we are indeed following the wave (iii) down into the 2139-2114 zone below. From there I would want to see another wave (iv) and (v) to fill out a full five down off of the highs.

The ES/SPX chart is not nearly as clear as the RTY chart but I can also make the case that we are in a wave iii down off of the highs. The overhead pivot on the ES comes in at the 5589 level and as long as that level holds I will continue to look directly lower on the ES. Should we see a break of that level then it would open the door for this to be following the blue count under which case we likely are following a larger ABC down off of the highs as part of a larger corrective pattern as shown in blue.

For now however and as long as we remain under the pivot levels noted above the near-term pressure will continue to remain down.