Market Holds Support and Pushes to New Highs

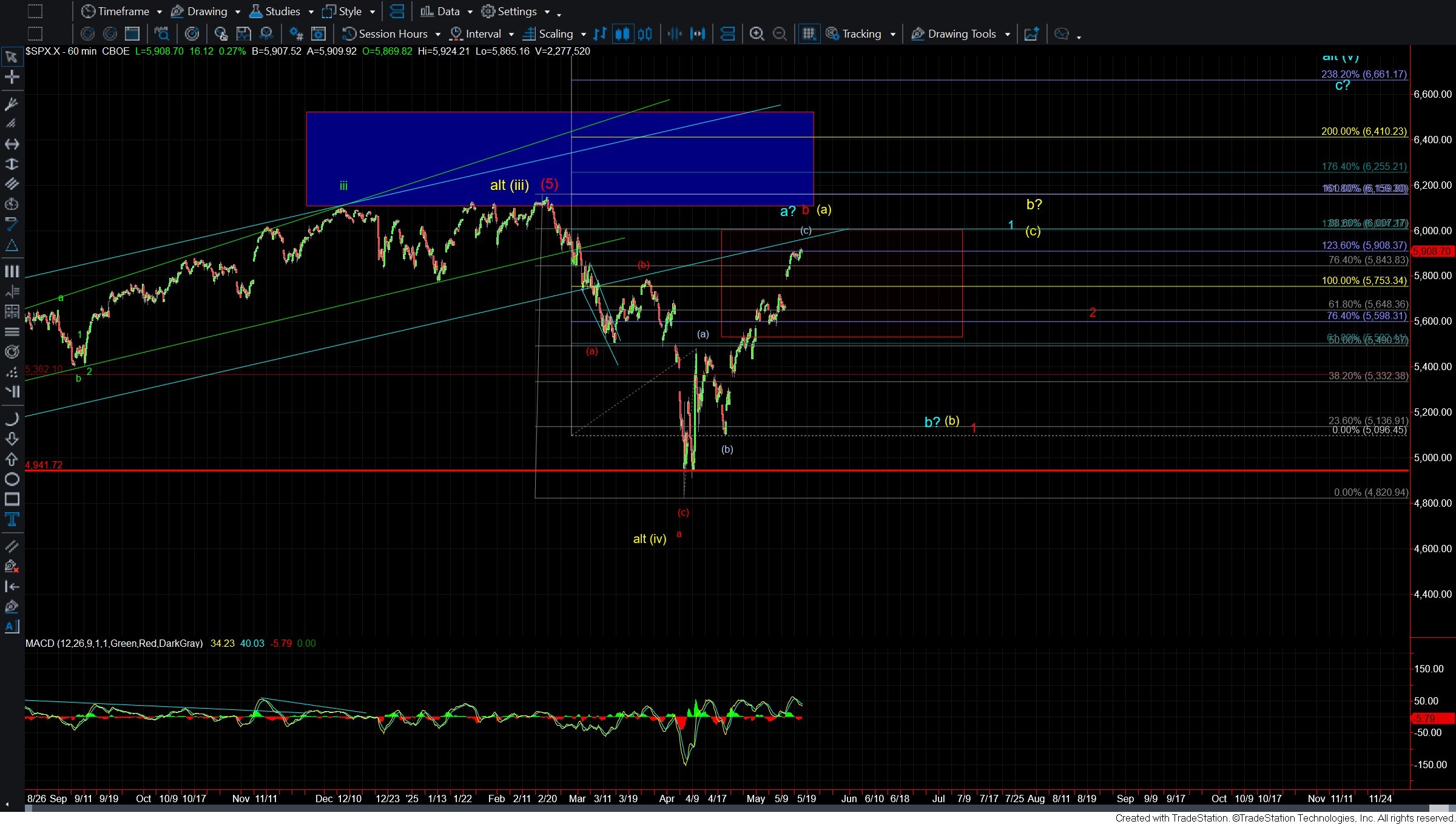

Overnight, the market broke the upper support level that I had discussed yesterday, but managed to hold the smaller degree support level just below and continued to push higher today. So from an analysis perspective, not too much has changed today, as the count still remains relatively full and quite extended from a Fibonacci perspective. While I do still remain cautious in this region, until we see an actual break of support and/or a clear five-wave move to the downside, we simply do not have any confirmation that even a local top has been struck just yet.

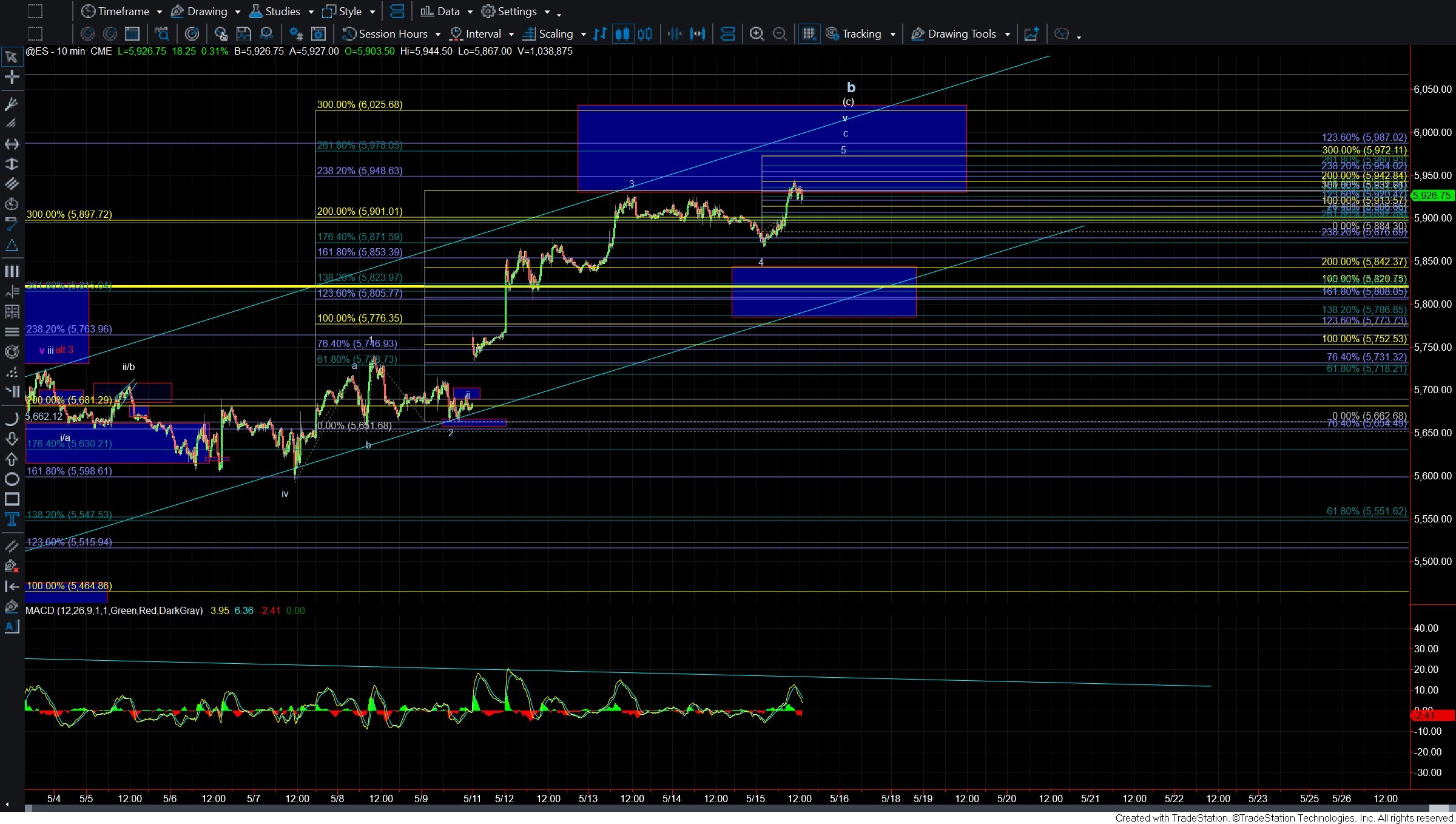

Zooming into the ES chart, support has now been moved down to the 5842–5776 zone. This is now the uppermost region that will need to break to give us initial confirmation that a top has indeed been struck. This zone also has confluence with the lower end of the trend channel that has been established from the move up off of the April lows. So while a break below the 5776 zone would offer an early warning that a local top may be in place, for confirmation of a larger degree top, we would still need to see follow-through to the downside with a five-wave structure. The nature of that decline will be key in helping us determine whether we are heading directly beneath the April lows or instead setting up for a more complex correction, such as those outlined in the yellow and blue counts discussed in prior updates.

Until we see a break below these critical support levels, the market remains extended but without confirmation of a top being in place. As I noted yesterday, I’ll continue to approach this region with caution and vigilance as we await confirmation that a top has been struck.