Market Holding Support as Downside Structure Remains Corrective

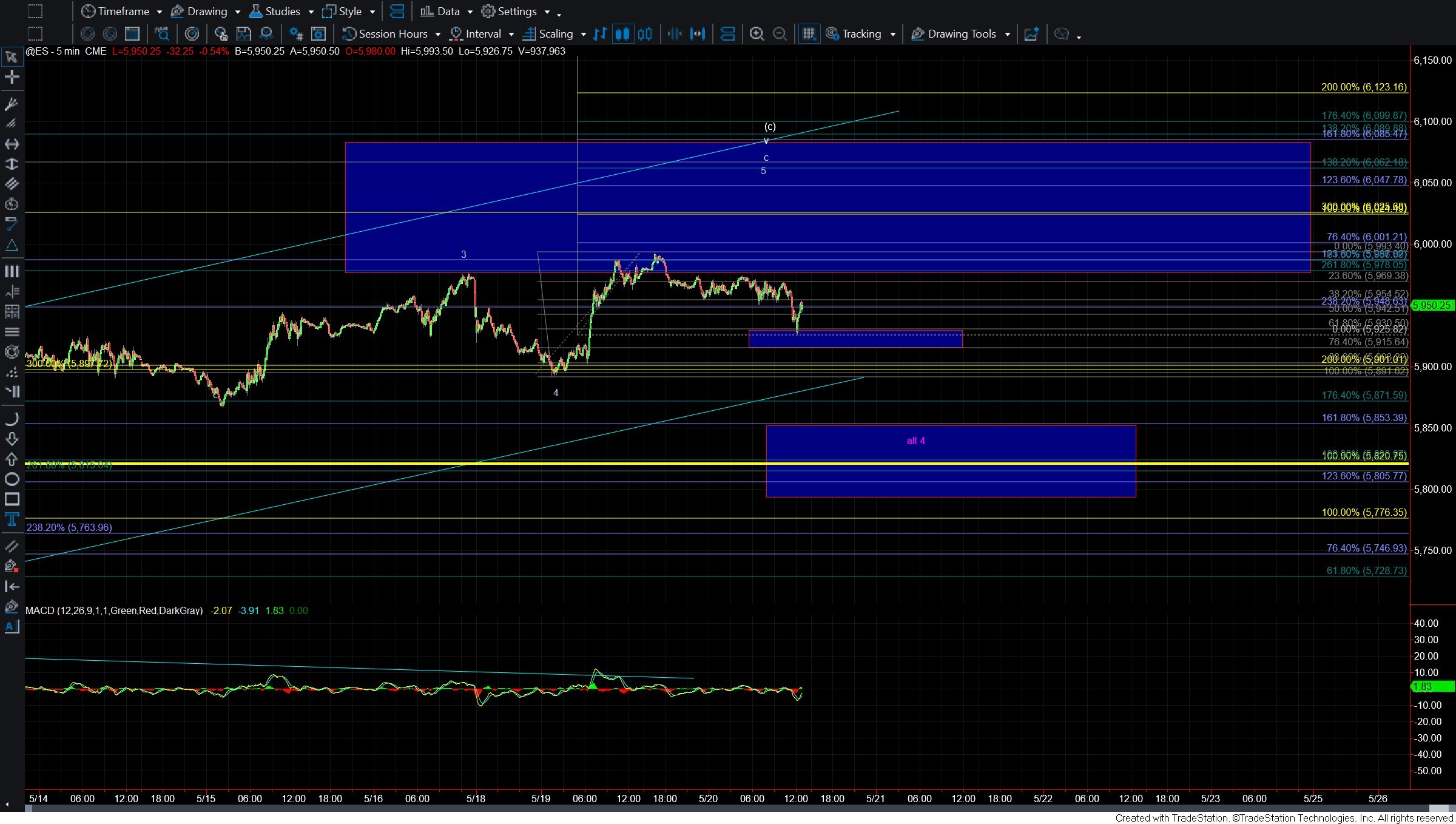

The market spent most of today’s session moving sideways within a very tight range, with a modest dip lower into the final hours. Despite that late-day weakness, the price is still holding above both yesterday’s low and the broader support levels below.

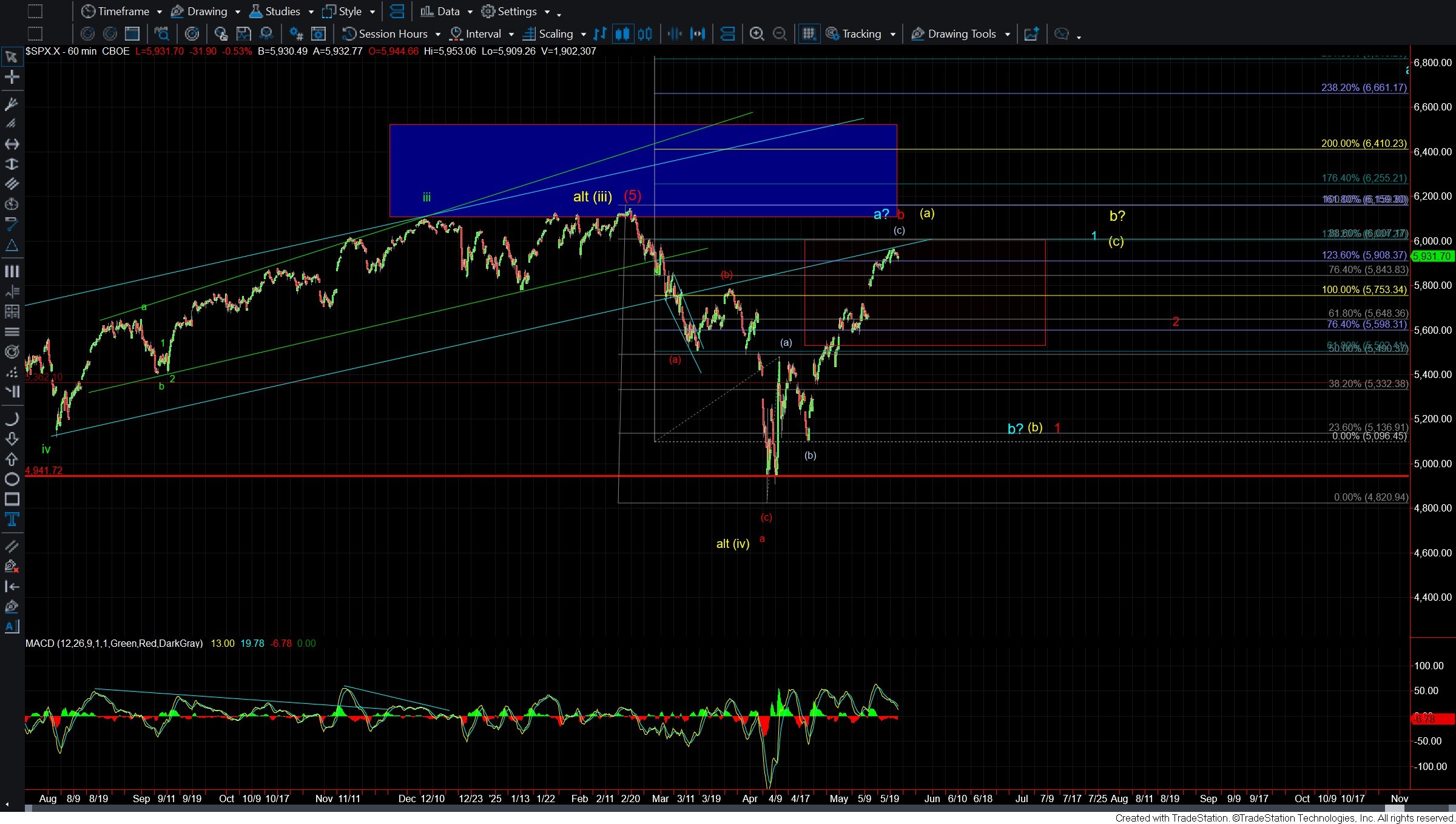

Importantly, the move down off the recent highs continues to present as a three-wave structure. As such, we still lack confirmation of even a local top. Until we either break key support zones or see a clear five-wave move to the downside, the potential remains for the market to push higher before any meaningful top is struck.

As highlighted on the ES chart, micro support comes in at the 5930–5915 zone, representing the 61.8%–76.4% retracement of the rally off yesterday’s low. A break below this level would offer the first signal that a local top may be in place. From there, the next level to watch is yesterday’s low at 5891, taking that out would strengthen the case for a local top.

Should that level break, I will then look for the more significant support below at 5853–5776. A break of that zone could open the door for a larger degree top to be in place. At that point, the structure of the initial move down will help give us guidance as to whether we may have topped in the larger wave b, per the red count on the SPX 60min chart, or as a wave a of a larger corrective structure per the yellow or blue counts.

For now, while I remain cautious, particularly as we near higher-degree fib resistance zones, the lack of impulsive downside action and the resilience of key support zones means there is still no confirmation of a top. Until we either see a clean five-wave decline or support gives way, the door remains open for higher highs in the near term.