Market Has Sill Not Tipped Its Hand

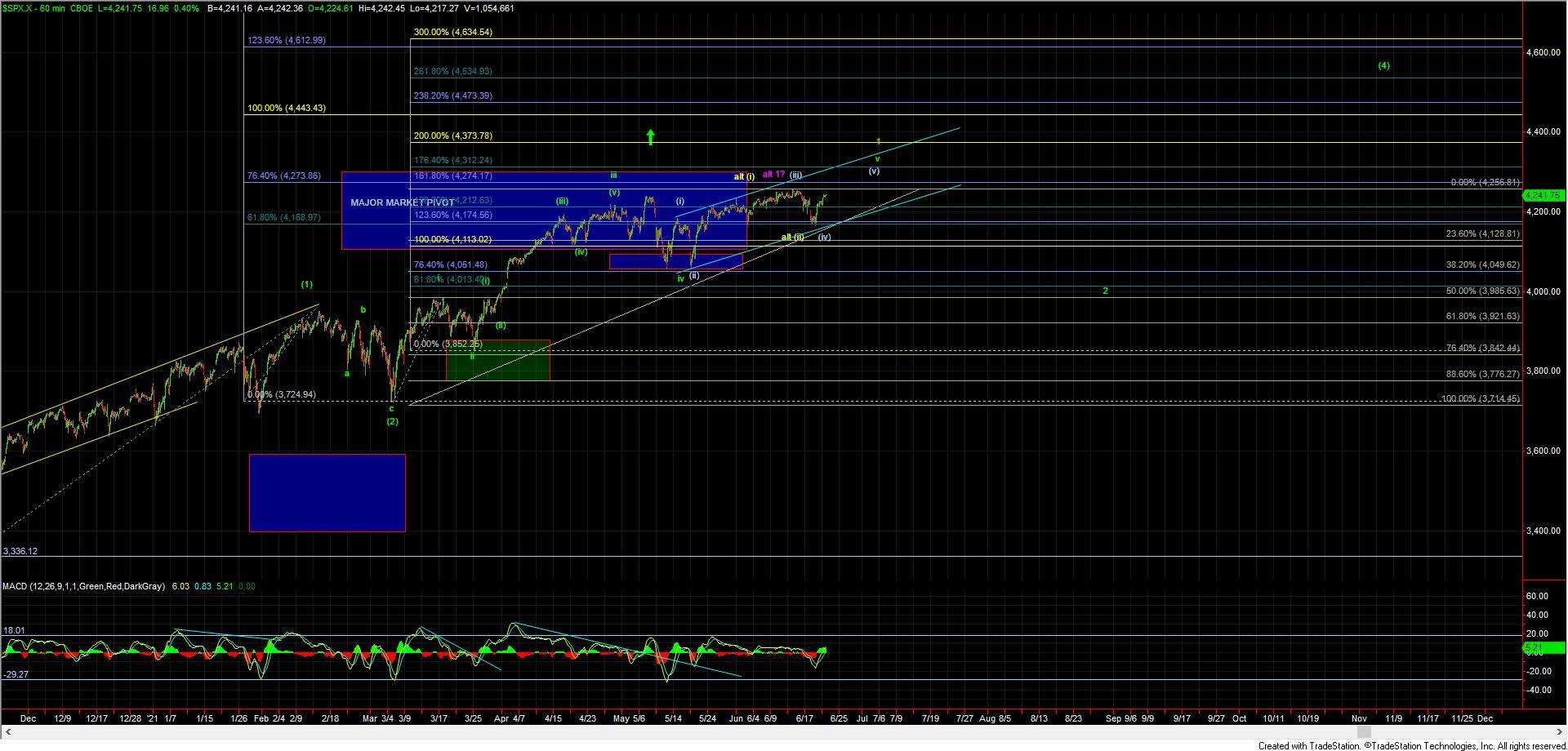

Today we saw the open slightly lower but hold over key support which managed to keep alive the most immediately bullish yellow count and still allow for the ES/SPX to develop a full five up off of the lows. Since the open, we have now pushed higher and made another higher high and are closing in on the standard target zone for a wave iii/c at the 4235-4255 zone.

Assuming we can indeed make the final push up into that target zone it will continue to allow for this to be a wave iii under the yellow count but we still would need another wave iv and v up to further finish off this five up off of the lows. The current support zone for the wave iv under that yellow count resides in the 4204-4196 zone just below.

As Avi had noted yesterday if we are able to get that full five up under that yellow path it would signal that the market is trying to push up towards the 4400+ area and would provide us with a nice buying opportunity upon a wave (2) pullback in yellow as shown on the ES 5 min chart. We do however need to take this one step at a time and first see if we can manage to fill out that full five up off of the lows as indicated per the yellow count.

If we drop below the 4196 level before developing a full five up off of the lows, then it would signal that we have topped in the green wave a at which point we watch the 4180-4140 zone below as support for the green wave b. This wave b would likely be part of a larger wave (v) diagonal which should ultimately still take us higher for one more high before topping out at which point we would be looking for that 200-300 point pullback into the summer for the larger degree wave 2 as shown on the SPX 60min chart.

Finally, if the next drop off of the high takes the shape of a full five-wave move to the downside it would open the door to this having topped in the purple wave b. This purple count would suggest that we have already topped in the wave 1 as shown on the SPX 60min chart. There are some structural issues with this count off of the May lows so I am viewing it as lower probability at this point in time. That being said until we are able to breakout back over the 4256 high on the SPX I do have to allow for it as a possibility.

So while the market did give us a nice push higher today we are still unable to remove any of the possible paths that were laid out yesterday. We do however have some fairly clear parameters on the smaller timeframes which should help give us some guidance in the days ahead.