Market Grinding Higher as We Hold Over Micro Support

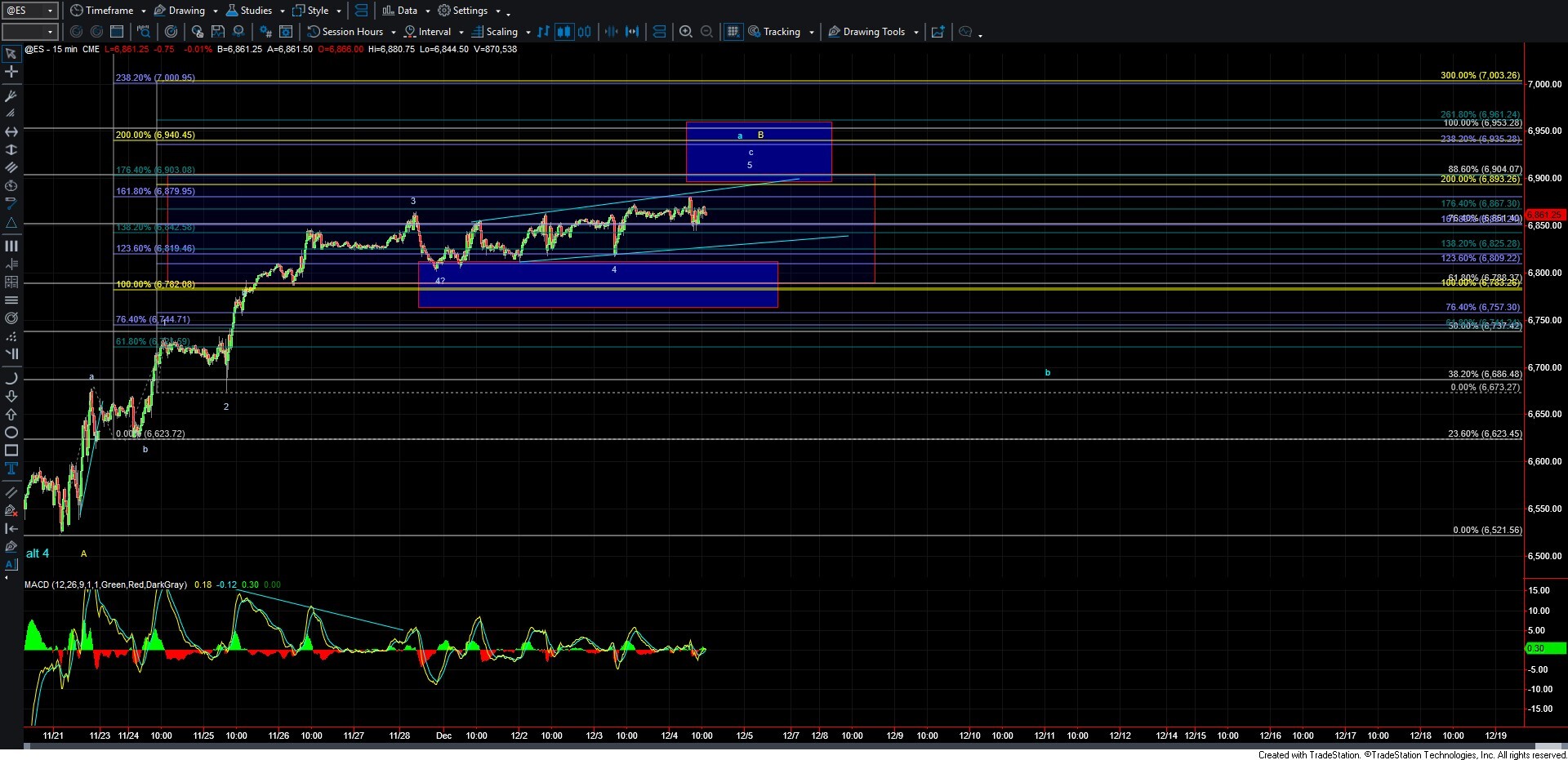

The market has continued to grind its way higher over the past several sessions following the stronger ramp we saw during Thanksgiving week. With this continued, steady push to the upside, we’ve now opened the door to the potential that an ending pattern is developing off the 11/30 low. I’ll note that it’s not the cleanest ED structure, so I don’t have a high degree of confidence in that specific pattern. From a practical standpoint, however, it doesn’t make much difference at the moment. In either case, I’m counting this advance into the overnight high as part of a wave 5 of C, as labeled on the charts.

We still need to see a break lower to confirm that we’ve indeed topped in that wave 5 of C. But for now, and as long as we remain below resistance, this will stay my primary count heading into the end of the week and early next week.

Overhead resistance currently sits in the 6,983–6,940 region. As long as that region holds, I will continue to treat this structure as a wave 5 of C. A sustained break above that zone would open the door to a more directly bullish interpretation. For now, though, I’m looking for at least a local top to develop in the coming days. Micro support remains at 6,809–6,757, as shown on the ES chart, and we will need a decisive break of that area to signal that a top may be in place, either for the blue wave A or the yellow wave B.

From there, the next move lower becomes key. It will help clarify whether we are dealing with a top in wave A per the blue count, suggesting a larger ending diagonal that could still take us back to new highs, or whether the market may be putting in a larger wave B top per the yellow count. A corrective decline would support the blue count, while a five-wave move lower would open the door to the larger top implied by the yellow count. Additionally, a move back over the 6,904 level would increase the probability that the blue count is the operative structure.

For now, we simply need more price action to better distinguish between these paths. At this point, both remain viable, and we’ll continue to follow the market as it provides more clarity.