Market Follows Through on Downside Setup but Continues to Hold Larger-Degree Support

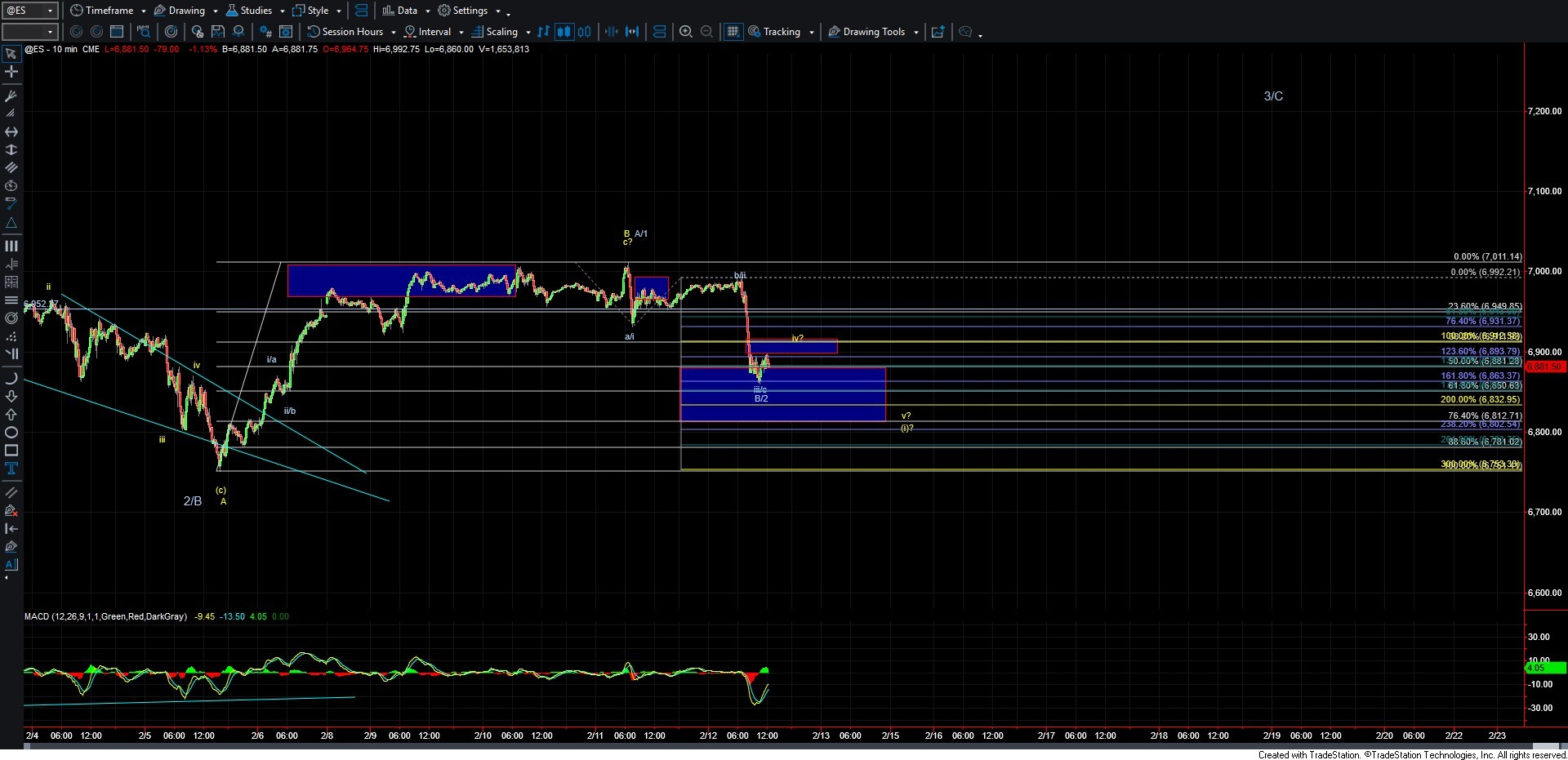

Today the market followed through on the downside setup we outlined yesterday. However, we are still holding the larger-degree retracement support zone. In addition, as of this writing, the decline from the 2/11 high still counts best as three waves. That keeps the white count alive, which would allow for another push to new all-time highs.

If this move down develops into a full five-wave structure off the 2/11 high, it would open the door to a larger-degree top being in place per the yellow wave B. The parameters are fairly straightforward at this point, and we should have more clarity over the next few trading sessions as to whether we see a completed five-wave decline or continued support holding that sets the stage for another move to new highs.

Today’s drop hit the 161.8% extension almost on the nose before seeing a modest bounce. We remain below the key overhead pivot in the 6893–6912 zone, this keeps the potential for a continued five-wave move lower per the yellow count in play. If we hold below that zone on any retrace and then follow through with another lower low, it would give us a strong case for a completed five-wave move off the highs, increasing the probability of the yellow count.

Conversely, if we see a five-wave move back above 6912, it would suggest that the white wave B/2 has bottomed and that the market is preparing for another push to new all-time highs.

At this stage, the parameters are fairly clearly defined. How the market reacts at the pivot levels noted above should provide a much clearer picture of where we are headed in the weeks ahead.