Market Finds Support But We Are Still Not Out Of The Woods

Today, the market pushed higher after finding support yesterday. While that is a constructive development, we are still not out of the woods. At this point, we only have three waves up off the low. Even if we do continue higher, the most likely scenario would be in the form of a larger ending diagonal. That would imply a choppy and overlapping path toward new highs that will be difficult to track with a high degree of certainty.

From here, my focus is on the structure of the next pullback. That structure should provide important information as to whether the market is setting up for a sustained push to new highs or whether this bounce is simply corrective before another move lower.

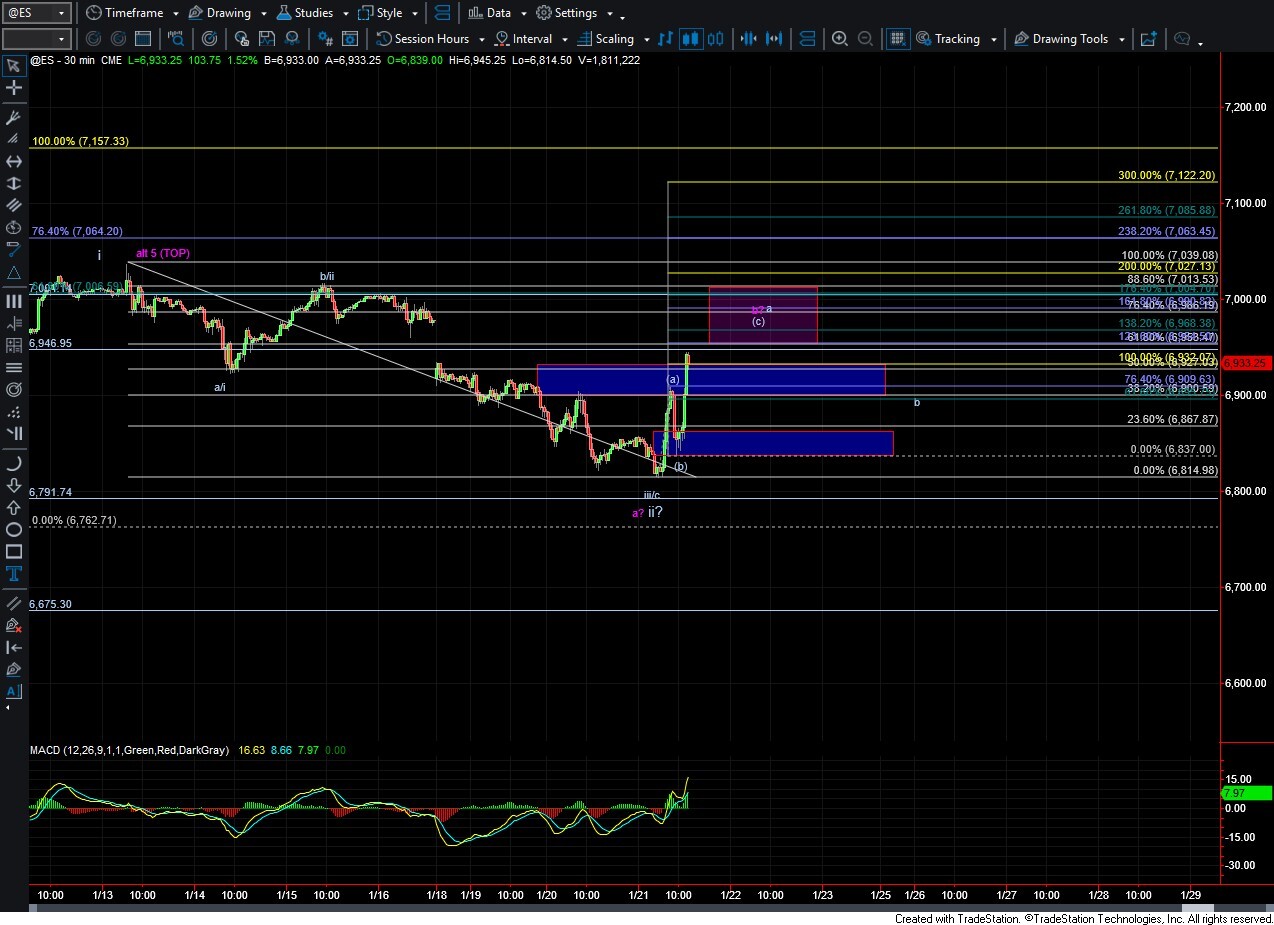

As shown on the ES chart, I am currently tracking two paths. The bullish path, which targets new highs, is shown in white. The bearish path, which takes us back below yesterday’s low, is shown in purple. The fact that we only have three waves off the low does not invalidate either scenario since the white count allows for additional upside within a larger ending diagonal.

The key will be the structure of the next pullback. If we see a clear five-wave move to the downside, then the purple count becomes more likely, and the door remains open for a larger degree top to already be in place. If, however, the next pullback unfolds in three waves, then the probability shifts toward the white count and a push to new highs in the days and weeks ahead.

For now, patience is required. We need to let the next pullback develop and allow the market to provide the guidance we need as we move toward the end of the week.