Market Finds Support After A Sharp Move Lower, but We Are Still Not Out of the Woods

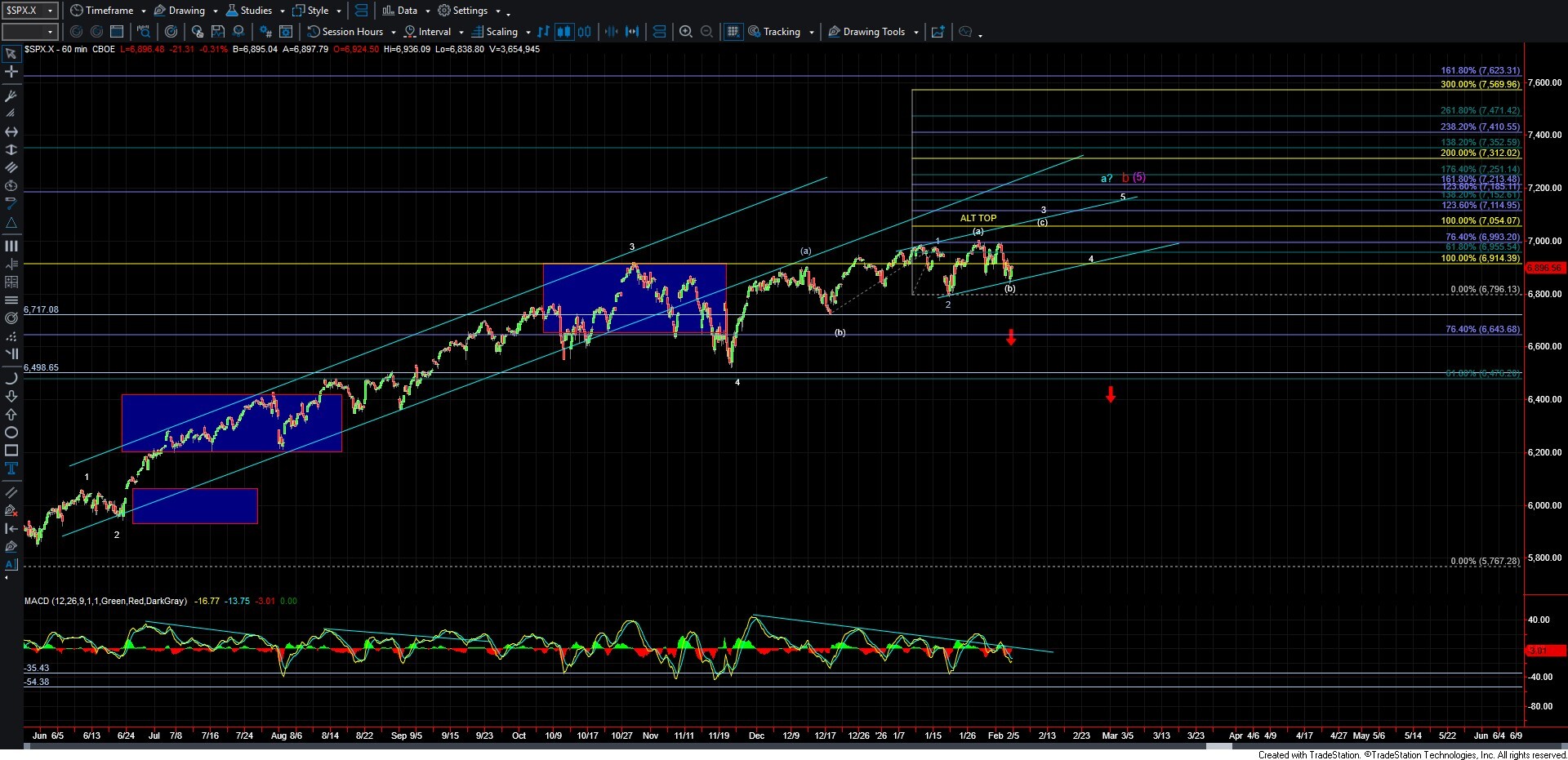

Today we saw the market move sharply lower, breaking yesterday’s low, but it managed to find support and keep the bullish path in play for the time being. While today’s move up off the afternoon low is a good start for the bullish count, we still have a bit more work to do before we can confirm that a bottom is in place and that we are indeed ready to push to new highs. Furthermore, as I noted previously, because we are likely trading within an Ending Diagonal off the December lows, even if we do push higher, the path to those highs is likely going to involve some twists and turns, much like what we saw today.

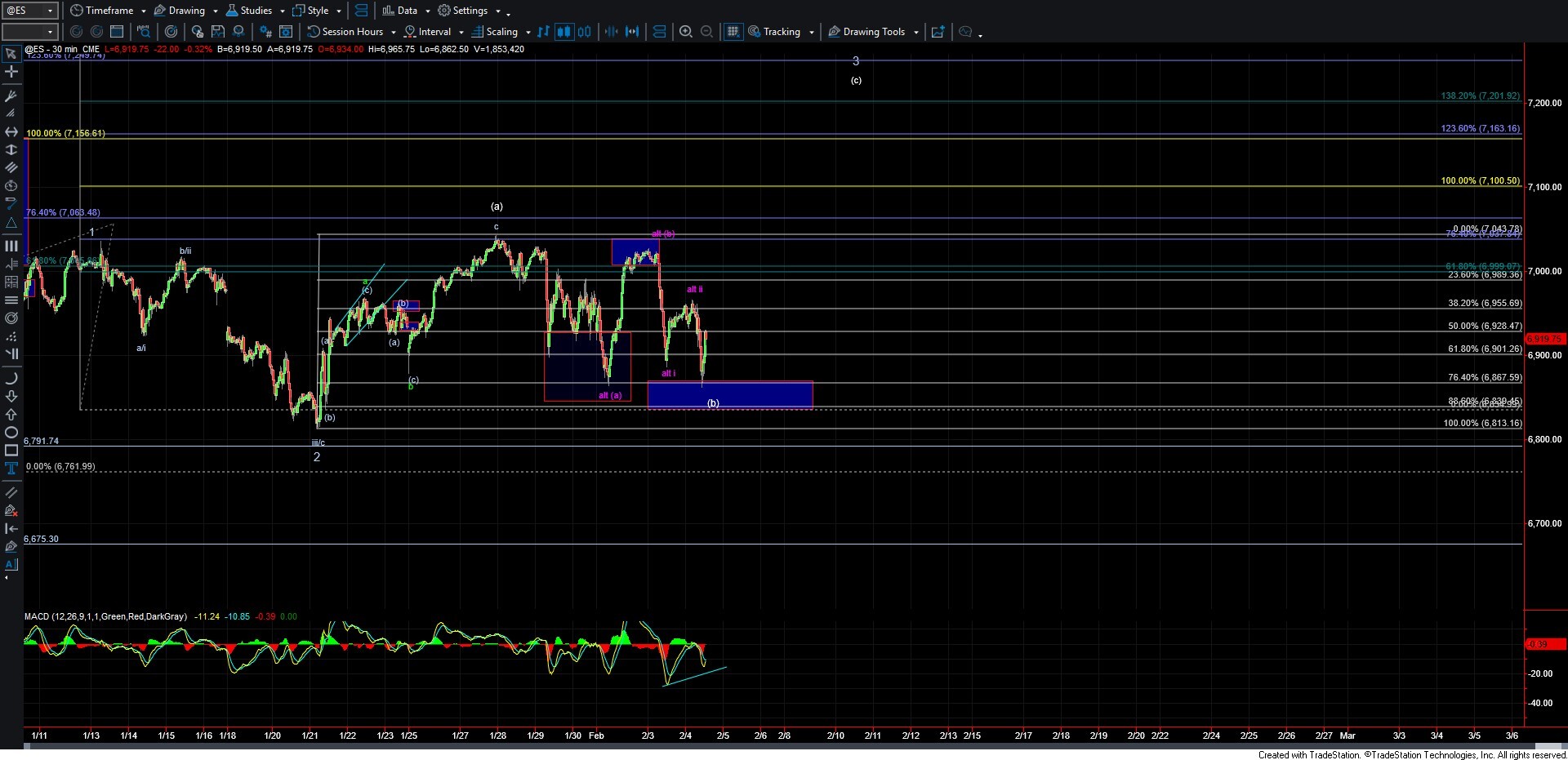

As shown on the ES chart, today’s low hit the 76.4% retrace level almost exactly before turning sharply higher. However, we still need to see a push back over the 6966 level to further confirm that a bottom is in place, as this would invalidate the most immediately bearish count shown in purple. From there, we would then need to see a break back over the 7023 high, which should put us on the path to new highs in wave (c) of the larger Ending Diagonal.

If, however, we are unable to push back over the 6965 level and instead move lower once again, breaking under today’s low, followed by a break under the 6839 level, this would make the purple count much more probable and open the door for a larger-degree top to be in place.

For now, though, as long as we can hold over support, I am still cautiously giving the benefit of the doubt to the bullish count shown in white. That said, please keep in mind that even if we do move higher, the path to those highs is likely to be anything but straightforward. Given that we are not following a standard impulsive structure, so caution and nimbleness in any trade execution will be key.