Market Finally Breaks Upper Support

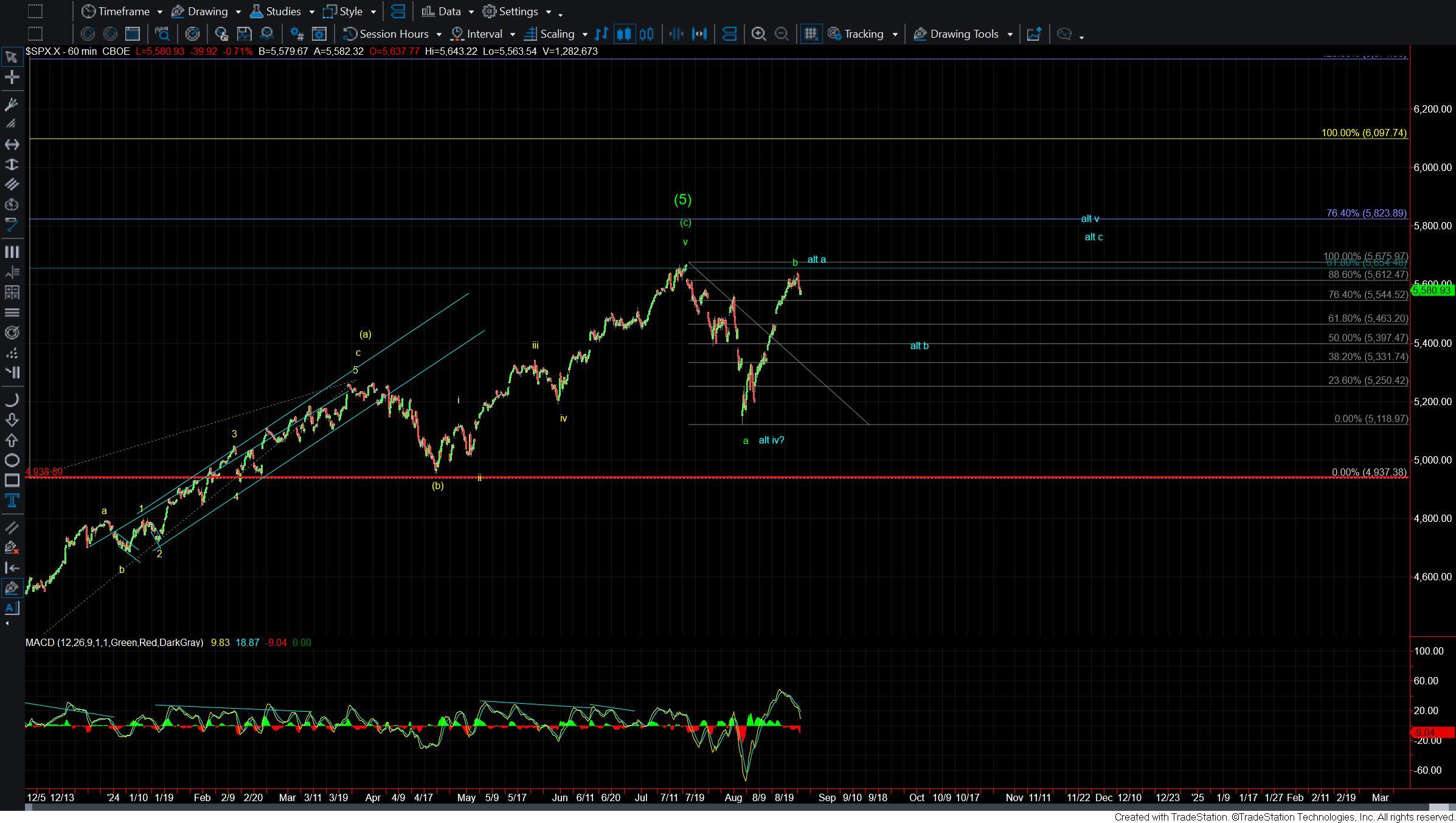

After trading in a very tight range all week we finally saw the market break the upper support zone giving us the initial signal that we have put in at least a local top the third wave. We are still trading over the support for the potential fourth wave.

So we will need to see how the market reacts over the course of the next several trading sessions in regards to both price and structure to help guide us as to whether we are going to see this push higher once again before any significant top is seen or if the market has other intentions to see a larger degree top sooner rather than later.

Drilling down to the smaller timeframe ES charts the break of the 5605 level today did give us initial confirmation that we have indeed topped in at least the wave 3. So far the move down off of the high is still only three waves which is supportive of this being a wave 4 pullback rather than the start of the larger wave c down. Support for that wave 4 remains in the 5551-5507 zone. As long as we are able to hold over that zone then the base case will remain that we need another wave 5 up to finish off the larger degree pattern.

If we begin to break that zone and that break comes on five waves to the downside then it would open the door for this to have already topped in all of the wave (c) of b. We would however still need to see a break of the 5435 level followed by a break under the 5319 level to further confirm that a larger degree top is indeed in place. As long as we remain over those levels however we still likely need to see at least one more wave 5 to finish off this wave (c) up off of the lows.

The bigger picture still has no change from the weekend update. We still need to see the structure of the next move down after we top in the wave 5 of (c). That will help determine whether we are going to see a top in the larger green wave b or simply just the blue wave a that would then be followed up by a wave b down and another wave c up to finish off the larger degree pattern