Market Down But Not Quite Out

Today we saw the market move lower with the Russell 2000 leading the drop moving down more than 3%. While this move lower is certainly a warning sign that we may have already put in a larger degree top we still are sitting over some key support levels on all of the indexes which is leaving the door open to seeing yet another higher high.

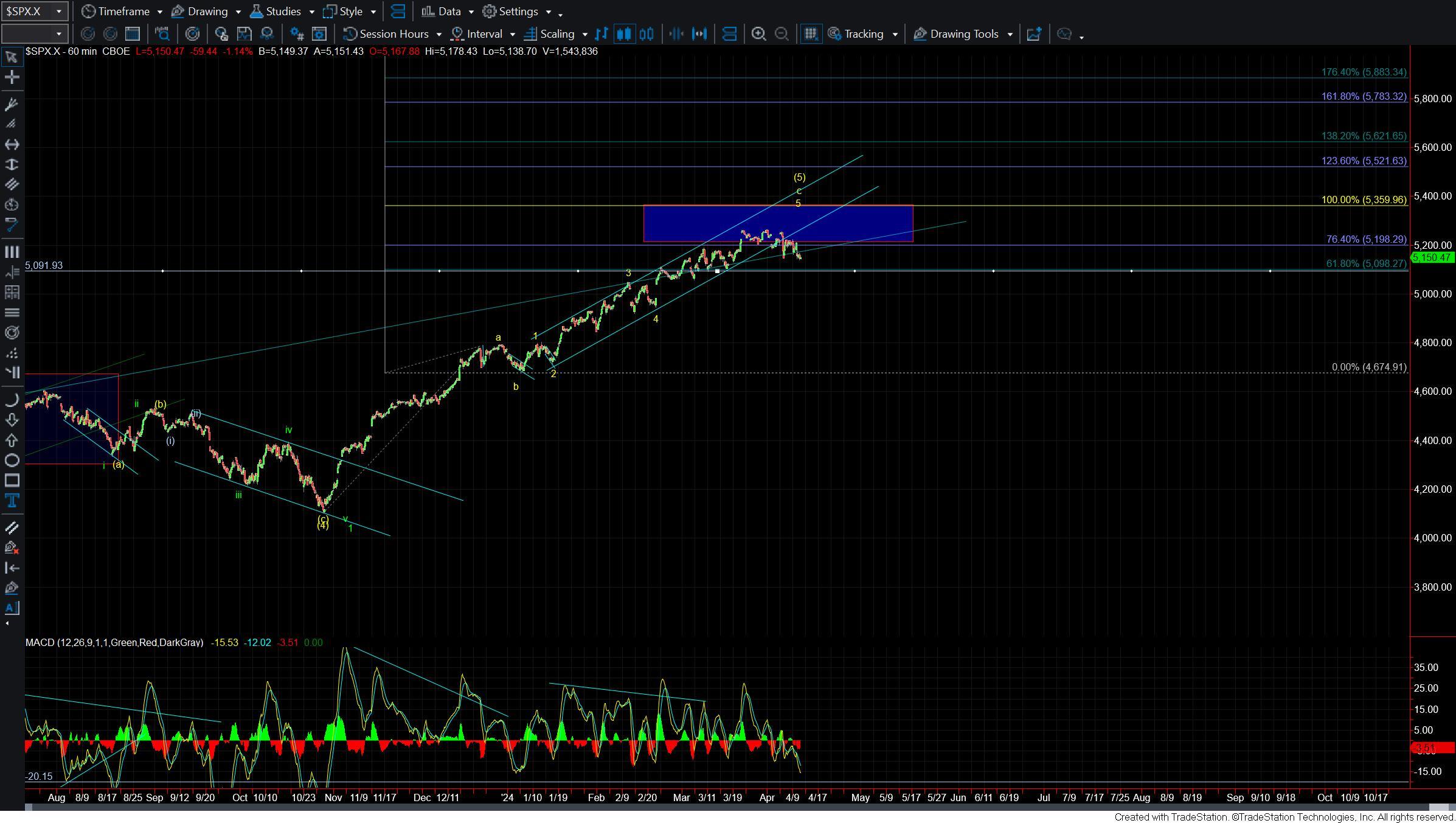

Should we begin to break down under these key support levels we likely will see the start of an accelerated move lower in the weeks ahead. This is because all three of the indexes are likely wrapping up ending diagonal patterns into this region and when an Ending Diagonal comes to completion the reversal out of that pattern is typically quite sharp in the opposite direction. For now however and until we break down under support we still do not have a full signal of a top just yet.

With the break under the 4/4 low I have to count the SPX in a larger ave (c) of iv per the yellow count. Under this case, we still may have a few more squiggles left to the downside to finish off that wave (c) of iv. If however, we break back over the 5224 level then it would be an initial signal that we may have put in a bottom in that wave iv and are heading to new highs. Just keep in mind that even with a push to new highs the structure of that move is likely going to be quite sloppy as we are dealing with a larger ending diagonal pattern and all of the sub waves within that pattern are going to be corrective.

If we are unable to break higher but rather continue to move lower and break the 5090 level then it would give us an initial signal that we have topped. In that case we still likely will be dealing with corrective wave action however I would expect the beginning portions of this move to be fairly sharp given that we are likely finishing off an ending diagonal pattern from the February lows.

So while this market may still have a little bit of gas left in the tank this pattern is quite full and caution remains warranted as we trade in this region. I will continue to watch the key support and resistance levels laid out above in the days and weeks ahead as they should help give us further guidance as to whether this is ready to see a more significant drop in the near term or if we still have yet one more push higher left in the tank.