Market Down But Not Out

Today we saw the market move down off of the high that was struck yesterday but we are still trading over support so we do not have confirmation that we have put in a top just yet. Now with that being said the case could be made that we have a very small degree five wave move to the downside in place on both the ES and the RTY. This is increasing the odds that we have put in at least a local top however until we actually see a break of some larger support levels below and/or a five wave move of at least one larger degree I still cannot fully rule out that this will still see yet another push higher before finding an ultimate top.

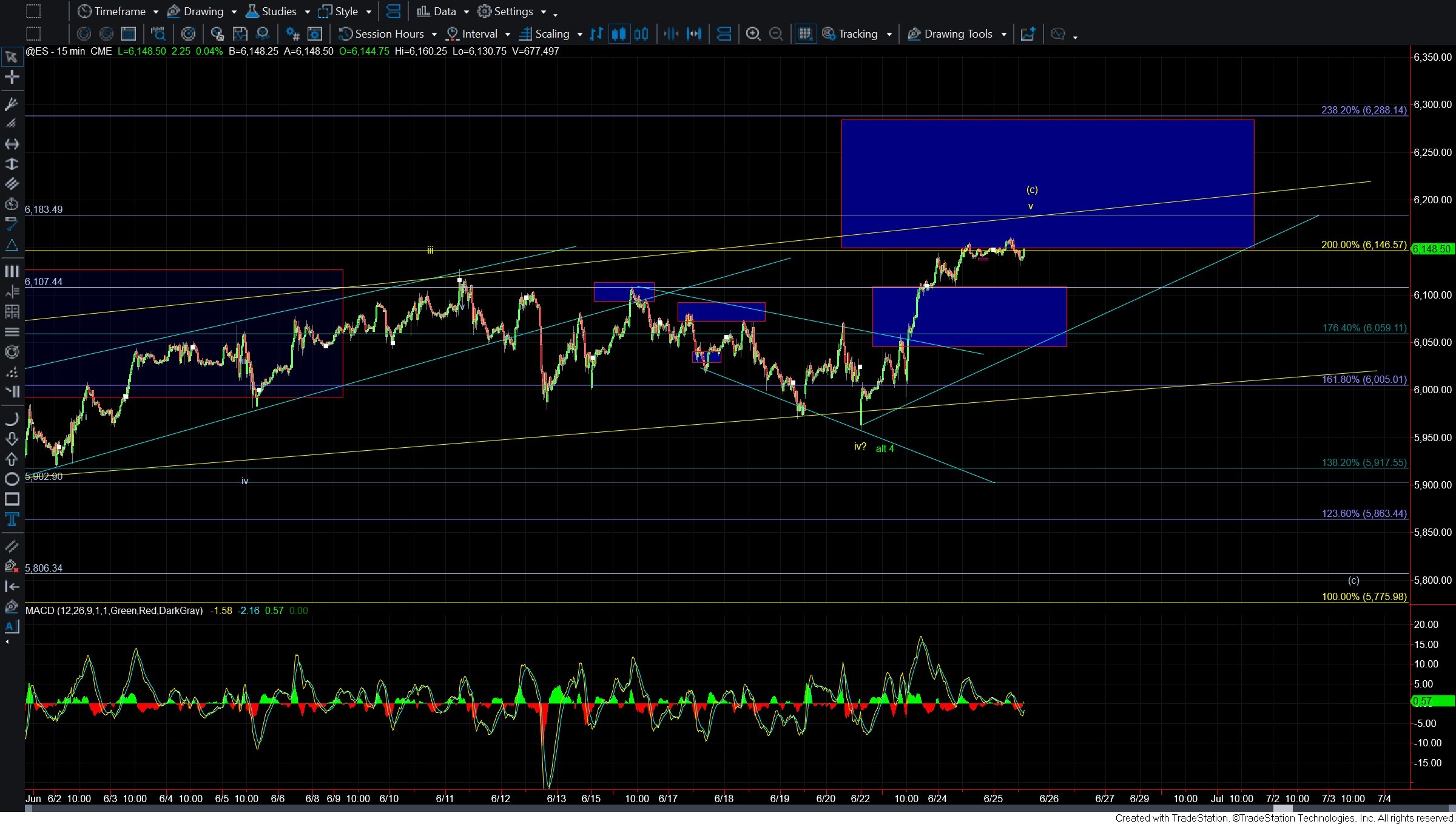

Bigger picture, I am still counting this as being in a larger Ending Diagonal, so from that perspective, not too much has changed from yesterday's update. If this larger Ending Diagonal count is correct, we should eventually see a sharp reversal back toward that 5806 region. That said, we do not yet have confirmation of a top in place. For initial confirmation, we would need to see a break back below the 6108 level, followed by a break under 6000. Final confirmation would come with a move beneath the 5960 low, which should then open the door to a deeper move back toward the May 23rd low.

However, if the market continues to push through the 6183 level, that would invalidate the yellow ED count and suggest we are instead in a larger fifth wave up. In that scenario, we could see a continued rally toward the 6300 region before any meaningful top is found.

Unless and until that breakout occurs, I’m maintaining the yellow ED as my primary count on the ES chart. But as always, until we see confirmation with breaks of the key support levels noted above, this ED remains unconfirmed.