Market Digesting Yesterday's Drop

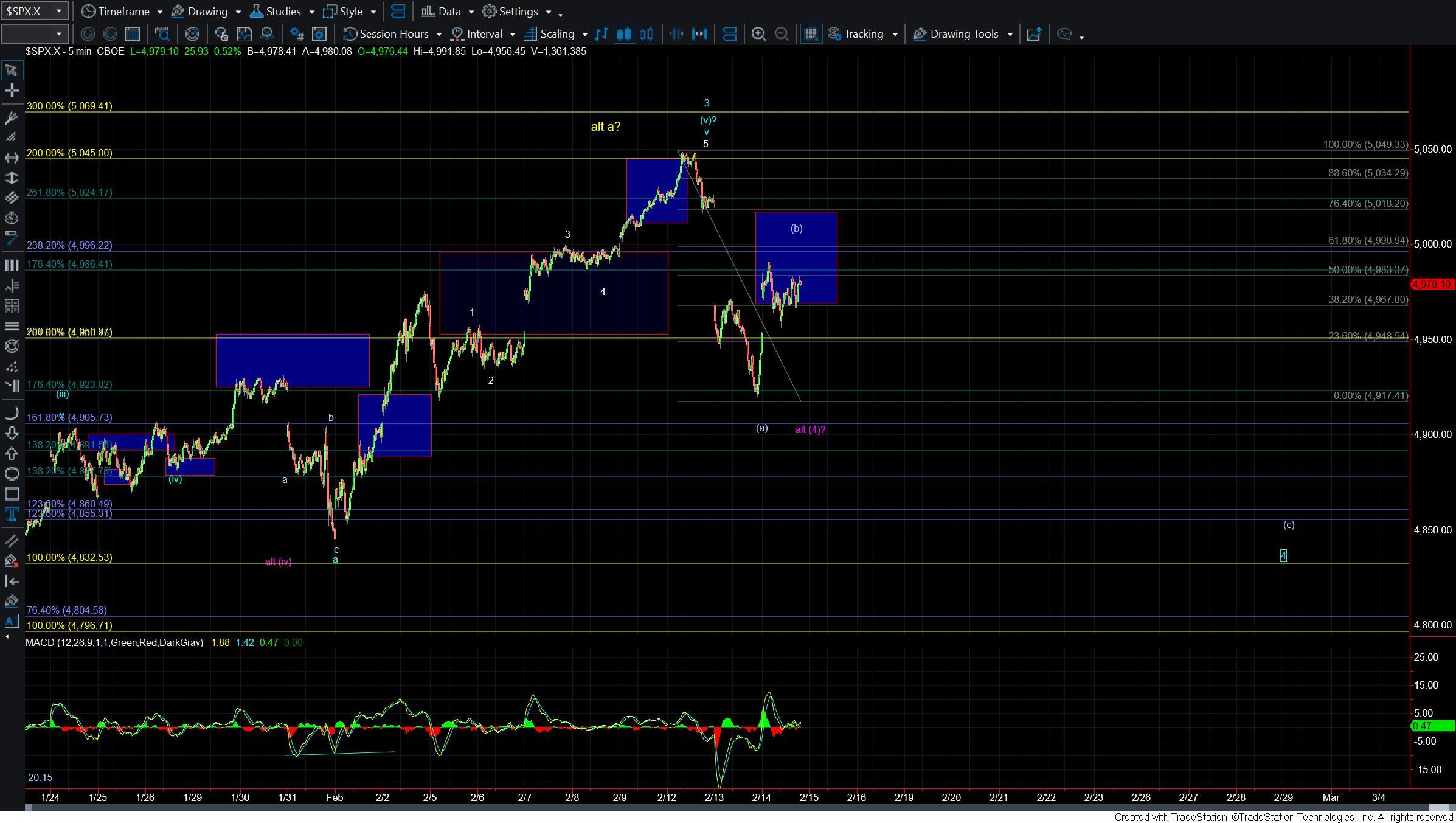

After seeing a fairly sharp move down yesterday we saw the market consolidate today and move higher thus taking a bit of a breather from yesterday's move lower. So far the move up off of the low is corrective in nature which is supportive of seeing a move back under yesterday's low before a larger bottom is seen. With that being said we may still have a bit more consolidating to do in this region before that breakdown begins. We do however have some fairly clear parameters to work with that will help guide us as to whether we are ready to break down or continue to see further upside consolidation.

The move down off of the high counts best as five waves. This is especially true when viewed on the ES futures chart. So with that it is suggestive that we still have more work to do to the downside to fill out the larger wave 4. Udner that case this move up off of yesterday's low can count as a wave (b) still needing a wave (c) down to fill out the wave 4 down into our larger support zone. The overhead resistance zone for that wave (b) comes in at the 4967-5018 zone and as long as that zone holds I still will view a downside resolution for the wave (c) of 4 likey.

We will need to see a full five wave move to the downside to give us initial confirmation that we have indeed topped in the wave (b) and this should then be followed up with a break under the 4926 level and then ultimately under the 4917 low. From there I will be watching the 4862-4800 zone as support for the wave 4 and as long as that zone holds I would expect to see another higher high for the wave 5 of c of larger wave (5).

So while yesterday's move down did certainly open the door to further downside action and the structure of the move down is certainly supportive of seeing lower levels we still have some work to do before we can confirm the next local top. The parameters are fairly clear however as we are dealing with standard impulsive patterns off of the high so we will have a better idea as to when and if things will indeed see that further downside follow-through.