Market Continues to Push Higher Toward the Smaller-Degree Target Zone

Today we saw the market push slightly higher and then consolidate for most of the afternoon. As we approach the close, we are still sitting over key micro support and continuing to follow our Fib Pinball path as expected so far. With that, today’s update is fairly straightforward: as long as we can remain over key micro support, the pressure will remain to the upside.

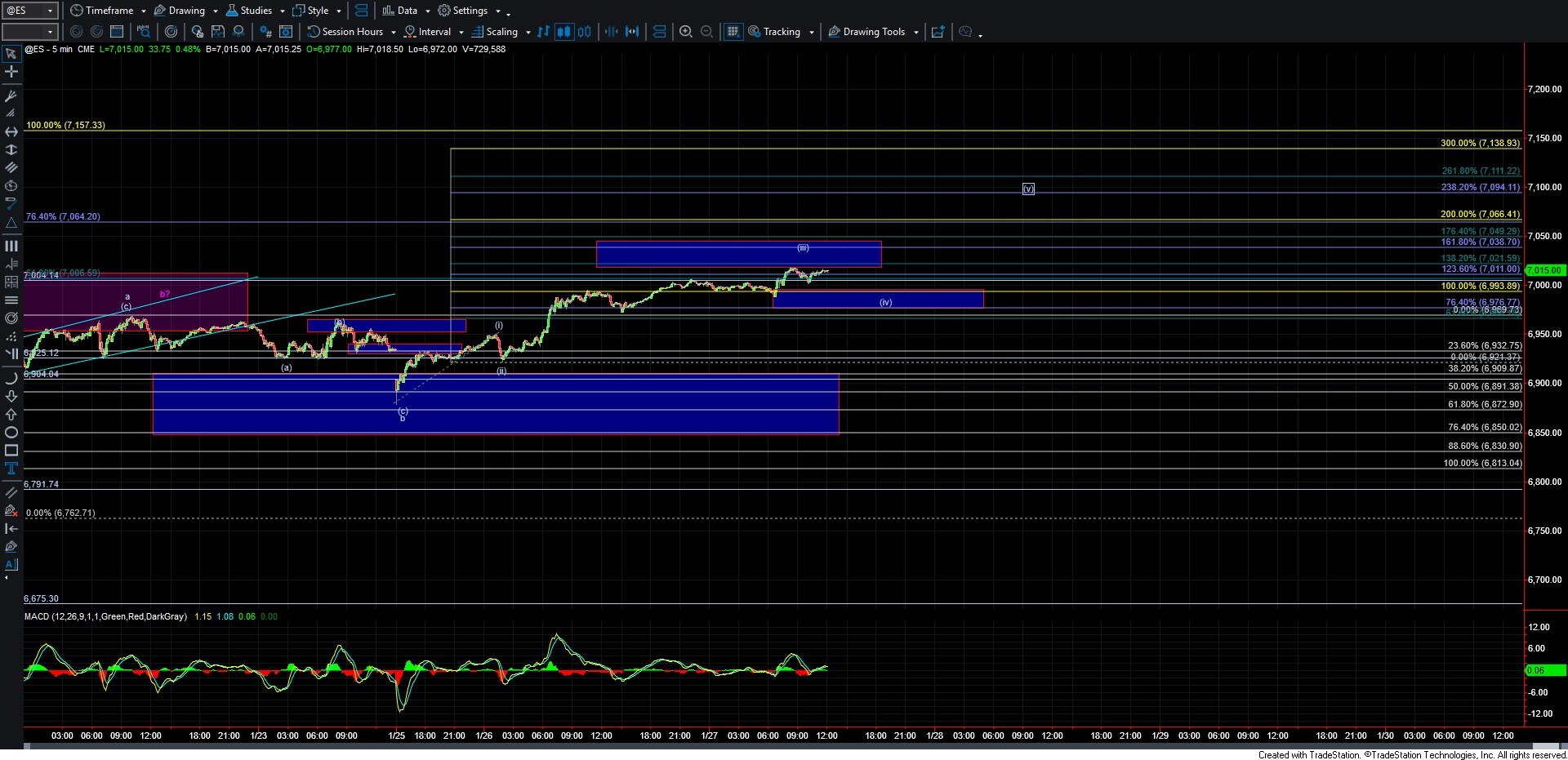

Earlier today, we hit the 138.2% extension of the initial wave (i) up, as shown on the charts, which sits at the lower end of the target region for a standard wave (iii). From there, we saw a flat consolidation for much of the afternoon. We are now pushing higher once again into the close after holding over the 6993–6976 support zone, which continues to keep the standard impulsive wave structure off the Sunday night low intact.

With that in mind, as long as we continue to hold over the 6993–6976 zone, the near-term pressure should remain up, with overhead targets for this move coming in at the 7038–7111 region.

If and when we reach that zone, we will need to evaluate the structure of the next pullback, as well as how the market reacts at support. That analysis can be laid out more clearly once we have a local top in place, which will give us a better sense of where the market may be headed into the latter part of this quarter. For now, I will remain focused on the smaller-degree support levels noted above, and as long as we continue to trade over those levels, the pressure, at least in the near term, will remain up.