Market Continues To Push Higher Into the End Of Day

Overnight we saw the market break sharply higher only to be followed up throughout the day with a continuation of that move. This action is supportive of the green near-term bullish path that can still take this up towards the 6300-6600 region before any longer-term top is seen. Now while there are still some issues with this count along with the pattern on the other index charts as long as we remain over-support the near-term pressure is going to remain up on the SPX. Should we begin to see a breakdown of the key support/pivot levels then it would open the door for this to have put in the larger degree top that we are tracking but again unless and until that occurs we do seem to be following the green path higher.

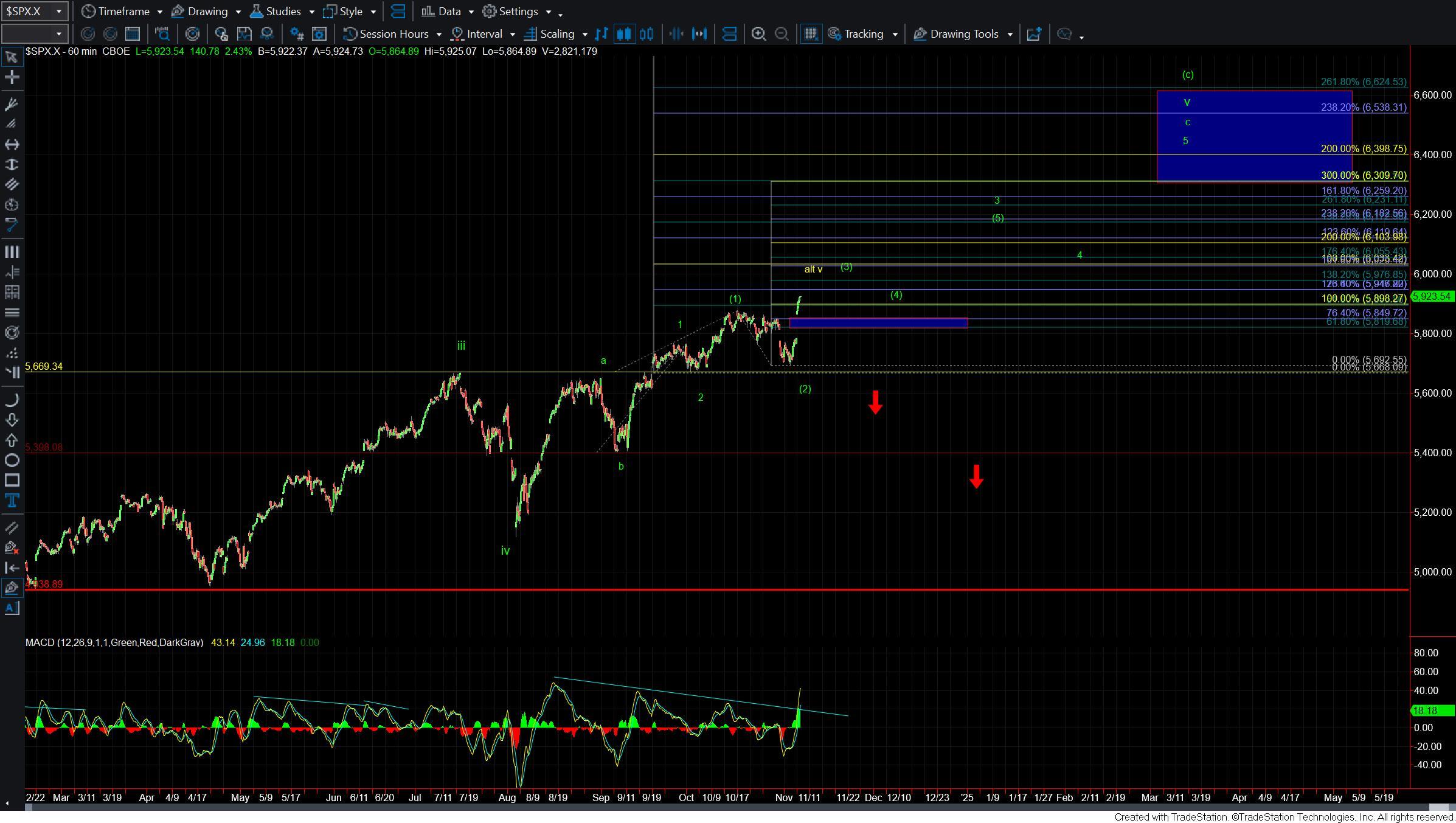

As shown on the 60min chart we are now sitting inside of the next key major pivot zone at the 5947-5893 zone. Should we see a breakout over this level then the 6033 level will act as the next key and major pivot level that will need to break to confirm that we are indeed following the impulsive wave count off of the 5400 low. This should then have us on our way toward the ultimate wave 5 targets in the 6300-6600 region overhead. Should we see a breakdown under the 5819 level followed by a break under the 5669 level then we would have an initial warning sign that we may have already topped in all of the wave v as shown in yellow. We would however need to follow that up with a break back under the 5400 low to further confirm the larger degree top is indeed in place.

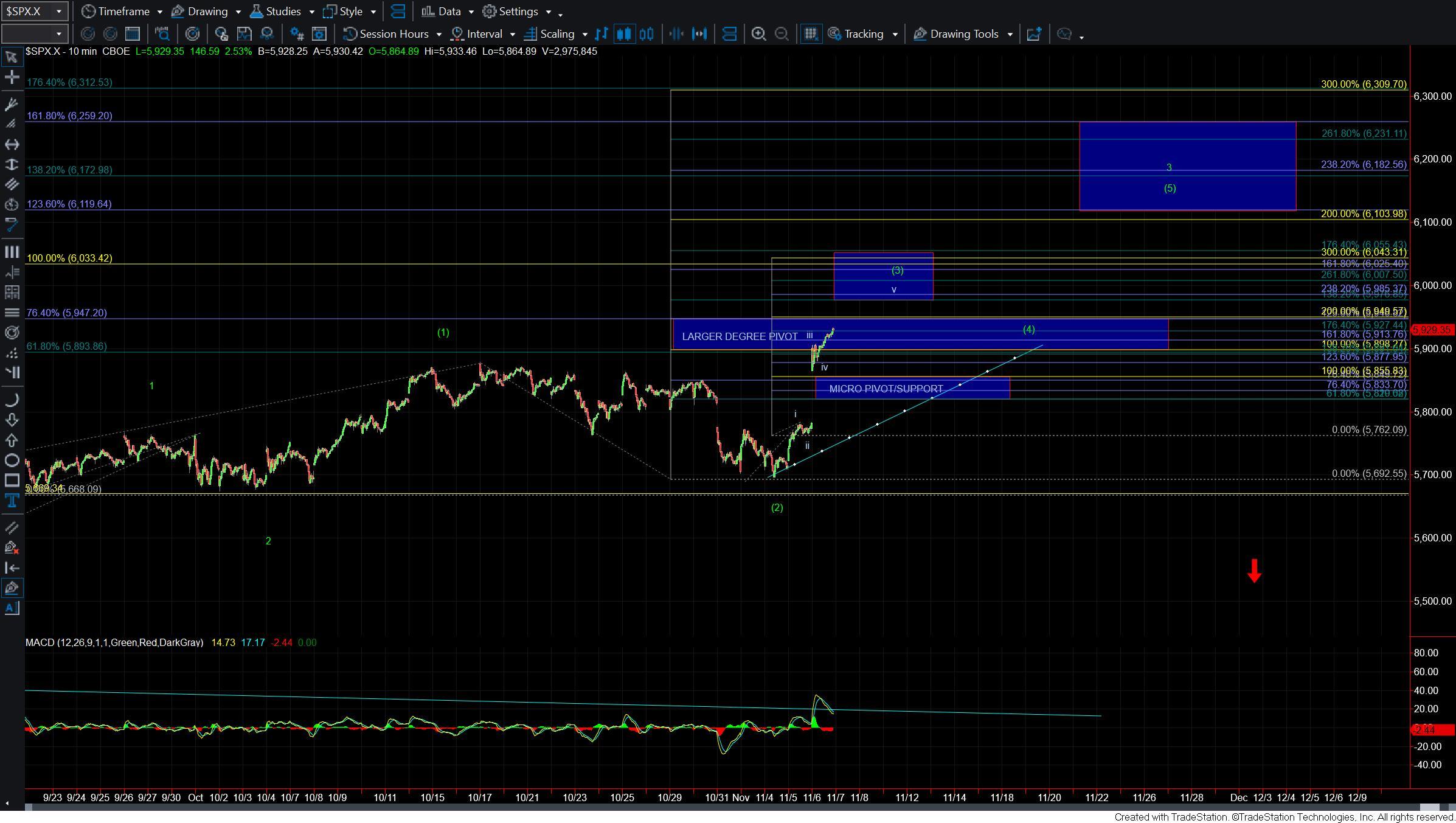

Zooming into the 10min SPX chart we have near-term targets for the wave (3) of 3 coming in at the 6000-6055 zone and as long as we are able to hold over the 5855-5820 zone then this is the next near-term upside target. From there we still would need to see the wave (4) hold support and then another push higher to gill out the wave (5) of 3 towards the 6119-6259 zone overhead. If and when we do move higher we can further update the support levels but for now, the key micro support is going to come in at the 5855-5820 zone.

So while we are still likely nearing a longer-term topping pattern until the market begins to breakdown under support this still has the ability to continue to push higher. Should those support levels get taken out then we will have to look towards that larger degree top being in place but for now the near term pressure does remain up.