Market Consolidates After Moving Higher Overnight

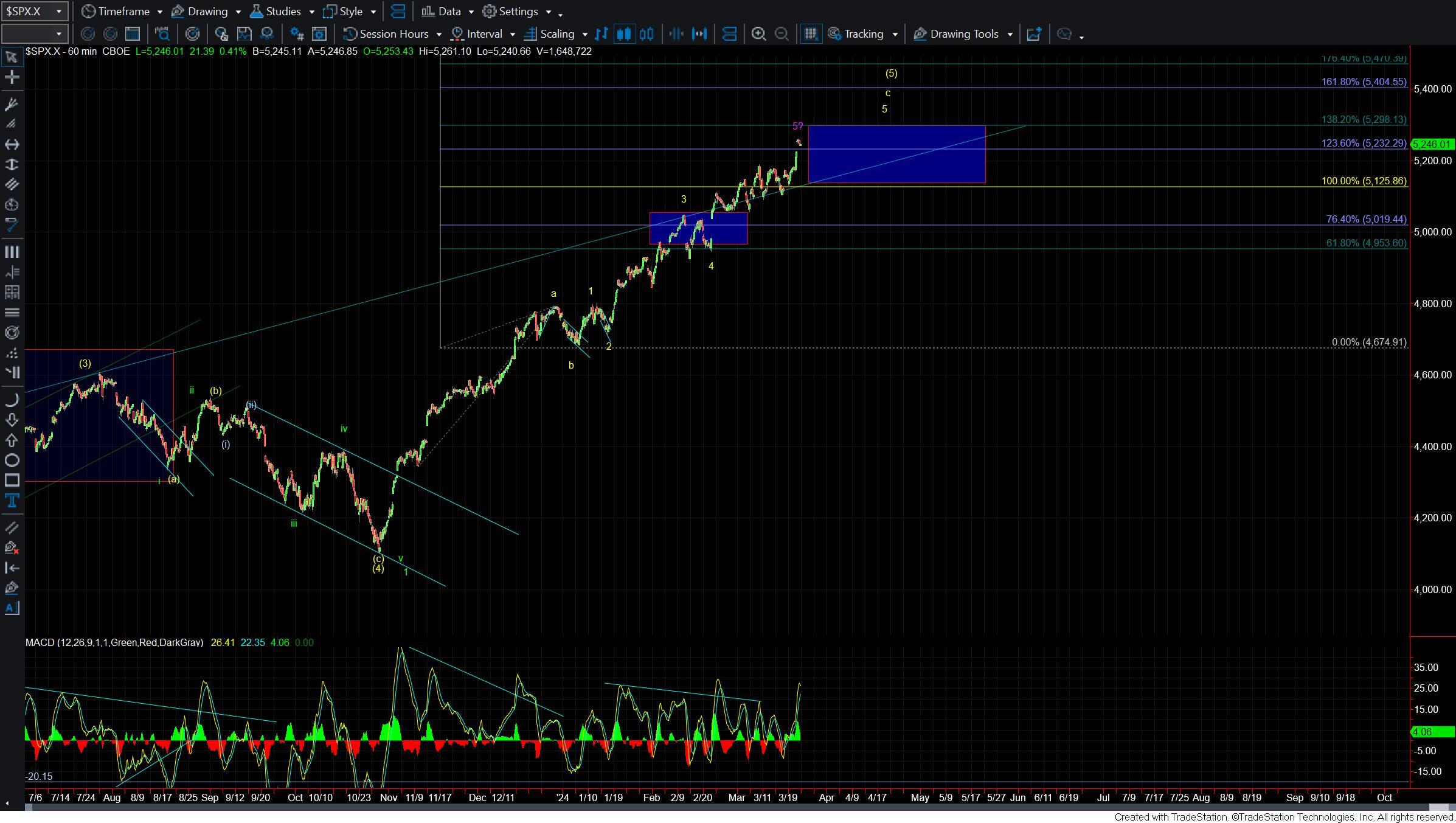

The market continued to push higher overnight moving into the target/resistance zone for the wave (iii) of 3 under the yellow count. Today we saw the market pull back and consolidate off of the high of the day. The parameters are fairly clear at this point and as long as we are over support the near-term pressure will remain up and we still do not have a signal that we have topped just yet.

With the push-up today I have moved upper support to the 5222-5205 zone. This is the ideal spot to hold to keep the very near-term pressure up under the yellow count. Assuming we can hold that zone then the next target overhead comes in at the 5250-5279 zone. From there we still should see a consolidation for a wave 4 followed by wave 5 push higher to finish off the wave (c) of iii. Once we top in the wave iii I would expect a deeper pullback for the ave iv towards the 5150 area but we still have some work to do before we can even look towards that wave iii target overhead.

If the market is unable to hold over the upper micro support at the 5205 level then it would open the door for a local top to be in place. We still would however need to break back under the 5131 level followed by a break under the 5090 level to give us a signal that we may have put in a larger degree top as laid out per the purple count.

So while this action remains a bit sloppy on the bigger picture we do appear to be following an impulsive path off of the 5090 low. This is giving us at least some short term guidance and parameters that we can watch as the market continues to grind it's way to the final stages of this larger degree pattern.

While the move up off of the February low remains quite sloppy since we are likely dealing with an ending diagonal we do have a bit more clear of a pattern off of the March 11 low. This is allowing us to lay out some fairly clear fib pinball parameters to watch as we navigate this market in the weeks ahead. With today's push higher as long as we can hold over the 5177 pivot then the near-term pressure will remain up and we should continue to see higher levels per the yellow count.

If we break under that level followed by a break under the 5131 level and then ultimately under the 5090 level then we would have initial confirmation that we have indeed put in a top as shown per the purple count. As I noted yesterday once we do top the reversal should be quite sharp to the downside based on the ED pattern. For now however and as long as we continue to hold support we still can continue to grind higher as we move into the end of this month and the early part of next month.