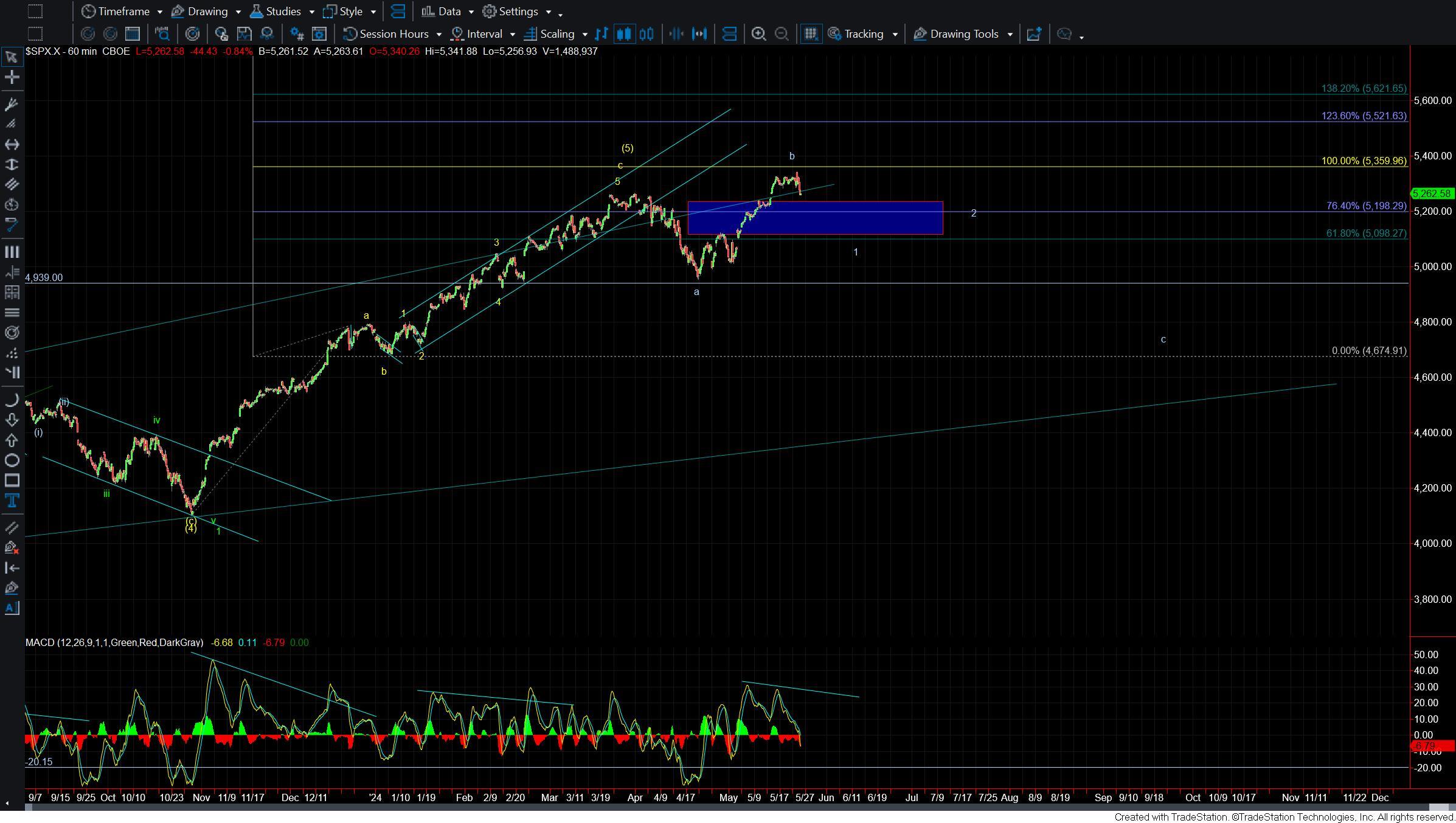

Market Breaks Upper Support But Still Awaiting On Five Down

After trading in a very tight range over the past several days we finally saw the market break over the 5/16 high completing the micro pattern only to be followed by a sharp intraday reversal.

This reversal broke under the micro support level that we had been laying out over the past several days giving us a very early signal that we may have put in a larger degree top. Now with that being said we still need to see a full five down off of the highs, which we don't have just yet, and a break of the lower support levels to give us further confirmation that a top has indeed been struck.

While today's action is certainly a good start to a potential top, we do still have a bit more work to do before we can further confirm a larger degree top.

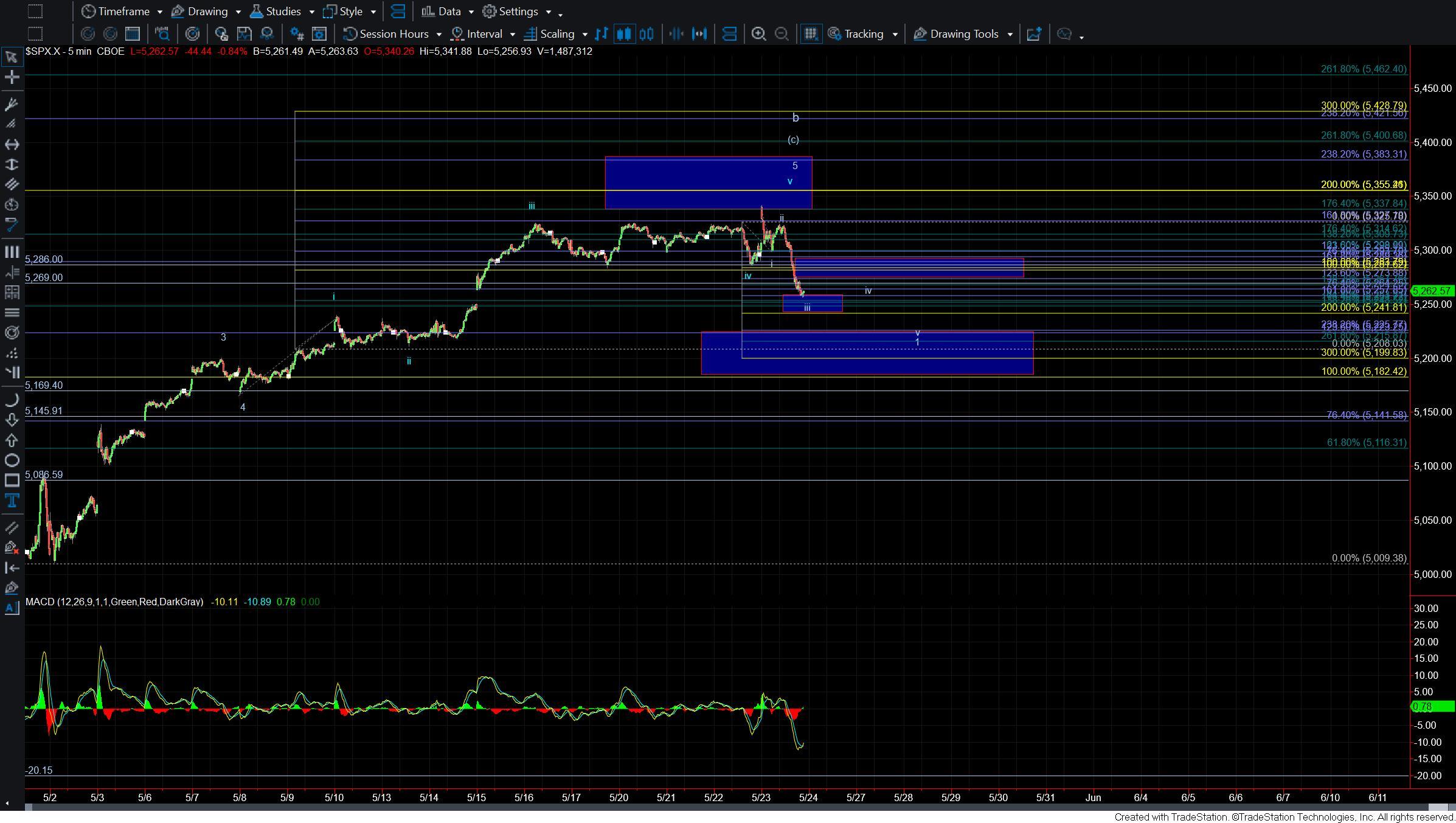

Zooming into the five-minute chart we can see that we have broken under the 5264 key resistance level. This is giving us an initial signal that we have indeed put in a local top. The move down off of the high is however still only three waves off of the high. At the time of this writing, we are in the ideal target zone for the wave iii of an initial five down. From here we should ideally hold under the 5273-5293 zone for a wave iv followed by one more wave v down. This would count as a wave 1 of larger wave (i) of C. From there we would need a corrective retrace higher followed by a break of the bottom of that wave 1 to further confirm a top.

If we are unable to hold under the 5273 resistance level it would open the door to still seeing yet another higher high before a top is seen. We should have an answer to whether we can indeed hold that zone and push lower in the next couple of trading sessions. So with that we should be getting very close to giving us a potential confirmation of a top in the days ahead.

If we do indeed push higher then I would once again be looking at the 5335-5383 zone overhead as resistance. For now however and as long as we hold under resistance the very near-term pressure remains down.

The bigger picture there is not too much to add to the previous analysis but for now I will keep a very close eye on the pivots and levels that I have laid out overhead for guidance.