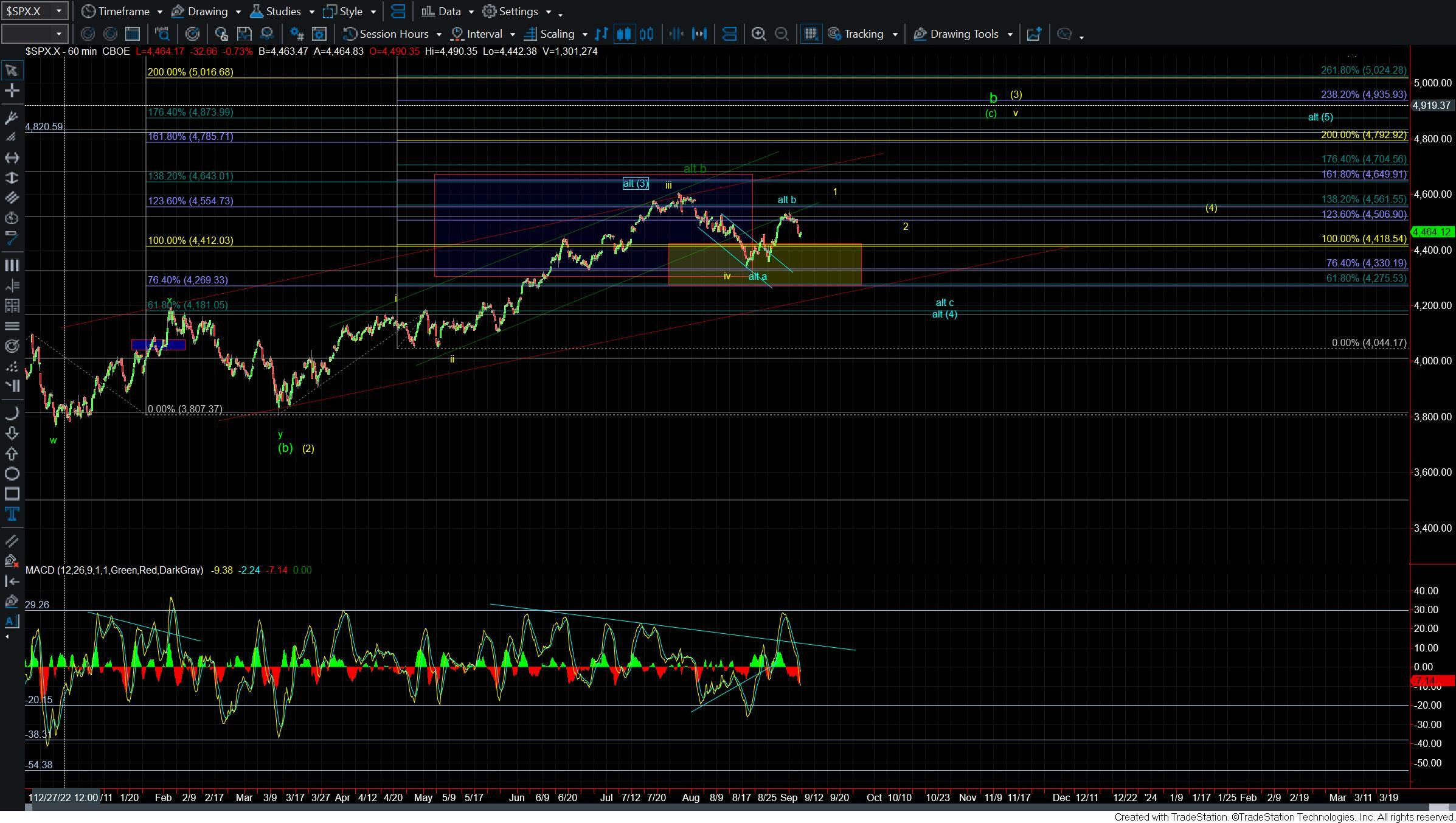

Market Breaks Support Opening The Door To Further Downside

Today the market moved lower and broke under the 4470 support level that we had been watching for the past several days. The break of this level has removed the possibility for us to see a clean impulsive five wave move up off of the 8/17 low and has opened the door for this to have topped in the blue wave b. We do however still only have three waves down off of the highs so far. So while the break of support has certainly made things much more complex in regards to seeing follow-through per the yellow count, until we actually see a full five waves down per the blue count, the door does still remain open to seeing this move higher under the yellow count in a more complex leading diagonal form. Where we head over the next several days should help give us a better idea as to whether we have indeed topped in the blue wave b or whether the yellow count will make a comeback in that more complex leading diagonal form.

Drilling down to the 5min chart we can see that with the break of the 4470 level and move down into the 4442 low today we now have overlap with the wave (i) of the move up of off of the lows. This has invalidated the potential for this move up off of the 8/18 low to still be forming an impulsive wave structure for a larger wave 1 up off of the lows. With that overlap of the wave (i) we now would have to look for a leading diagonal to complete that wave 1 off of the lows. So if we can manage to hold today's low and move back up over the 4550 high then we could still consider the yellow wave 1 in place and would then look toward a corrective retrace lower for a wave 2. That would then need to be followed up with a break back over the top of the wave 1 to confirm that we are indeed ready to move higher in the wave 3 ultimately to new all time highs. Of course, leading diagonals are far from a reliable pattern so until we actually see the break over the 4550 level we still have to be cautious about this seeing further downside follow-through per the blue count.

Under that blue count we still only have three down off of the highs so we still do not have confirmation that we have topped in the blue wave b just yet. Under the blue count we would need to see a full five down off of the highs to begin the wave c down. So under that blue count we should hold under the 4471-4481 zone and make another lower low under the 4442 low at which point we could make the case for five down off of the highs. From there we would look for a corrective retrace higher for a wave 2 of larger wave c which would give us a fairly clean short setup for a push back under the 8/18 low.

So while today's drop has certainly opened the door for this to have made a larger topping the blue wave b we still have a bit more work to do to confirm this. Given how complex and sloppy this market has been over the past several months until we actually see the pattern fill out to the downside I still remain somewhat cautious on both sides of this market. We should however have an answer one way or the other within the next few trading sessions as we simply do not have too much room before a decision will have to be made.