Market Breaks Out Higher But We Are Still Not Quite Out Of The Woods

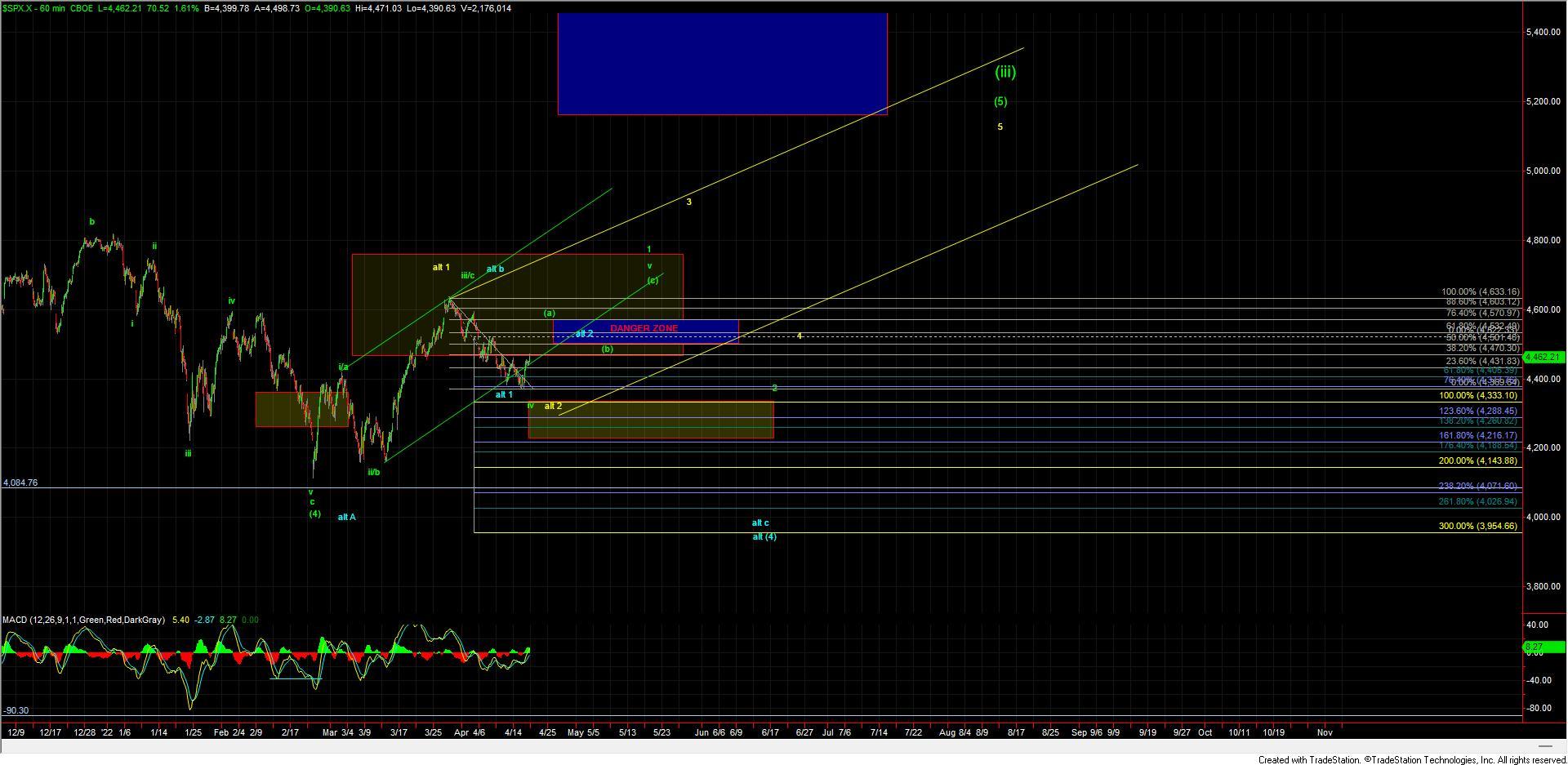

After moving lower yesterday the market made a very strong push higher today with the ES moving up more than 1.5% at the time of this writing. This move is certainly giving us a good sign that we have indeed bottomed in the primary green count as the move came while holding over the key support zone at the 4333 level noted in the previous updates. Now I do want to caution that although this strong push higher is certainly a good sign that at least a local bottom is indeed in place we do still need to push through the overhead resistance zone, or the "Danger Zone" as noted on the charts, before we are fully out of the woods thus making a push to new lows under the blue count less likely.

So with the push higher from here we now ideally should hold over the lows that were struck at the 4369 level on the SPX level on the SPX. Now I do want to note that while we certainly can begin the next push up to new highs with a full five wave move because we are likely dealing with an Ending Diagonal we do not have to begin this with a full five wave move up off of the lows. This will make tracking the next leg up more difficult and is why we still very much need to get through the 4501-4570 zone on the SPX before we have further confirmation that a bottom is indeed in place. I have laid out how this should subdivide on the charts in green with an (a), (b), (c) but because of the corrective nature of this path I do expect it to take a few twists and turns along the way and certainly not be completely smooth sailing. With that being said this push up through the smaller degree resistance zone and over the 4458 high we do certainly have a good signal that at least a local bottom is indeed in place.

So while the smaller timeframes are still likely going to be sloppy over the next several weeks bigger picture we do still have fairly well-defined risk parameters as Avi noted in the weekend update. If and when we can get through the Danger Zone and then over the high struck at the 4633 level on the SPX then we will have further confirmation that a bottom is indeed in place at which point we can be on the lookout for the larger pullback for the green wave 2. Until that occurs however the shorter timeframe will are still likely to be more difficult to track as we continue to move higher in the diagonal up off of the lows that were struck in February.