Market Awaiting A Catalyst?

Yes, you heard me right. The current choppiness may be the market simply waiting on a catalyst before it provides us with its next 10+ point move. Now, while I do not believe the substance of the news should ever be a trading cue, a news event does sometimes act as a catalyst for a market move.

But, before you try to extrapolate that too far into believing that news causes the market direction, please remember this study I post quite often:

In a 1988 study conducted by Cutler, Poterba, and Summers entitled “What Moves Stock Prices,” they reviewed stock market price action after major economic or other type of news (including major political events) in order to develop a model through which one would be able to predict market moves RETROSPECTIVELY. Yes, you heard me right. They were not even at the stage yet of developing a prospective prediction model.

However, the study concluded that “[m]acroeconomic news . . . explains only about one fifth of the movements in stock market prices.” In fact, they even noted that “many of the largest market movements in recent years have occurred on days when there were no major news events.” They also concluded that “[t]here is surprisingly small effect [from] big news [of] political developments . . . and international events.” They also suggest that:

“The relatively small market responses to such news, along with evidence that large market moves often occur on days without any identifiable major news releases casts doubt on the view that stock price movements are fully explicable by news. . . “

In August 1998, the Atlanta Journal-Constitution published an article by Tom Walker, who conducted his own study of 42 years’ worth of “surprise” news events and the stock market’s corresponding reactions. His conclusion, which will be surprising to most, was that it was exceptionally difficult to identify a connection between market trading and dramatic surprise news. Based upon Walker's study and conclusions, even if you had the news beforehand, you would still not be able to determine the direction of the market only based upon such news.

In 2008, another study was conducted, in which they reviewed more than 90,000 news items relevant to hundreds of stocks over a two-year period. They concluded that large movements in the stocks were NOT linked to any news items:

“Most such jumps weren’t directly associated with any news at all, and most news items didn’t cause any jumps.”

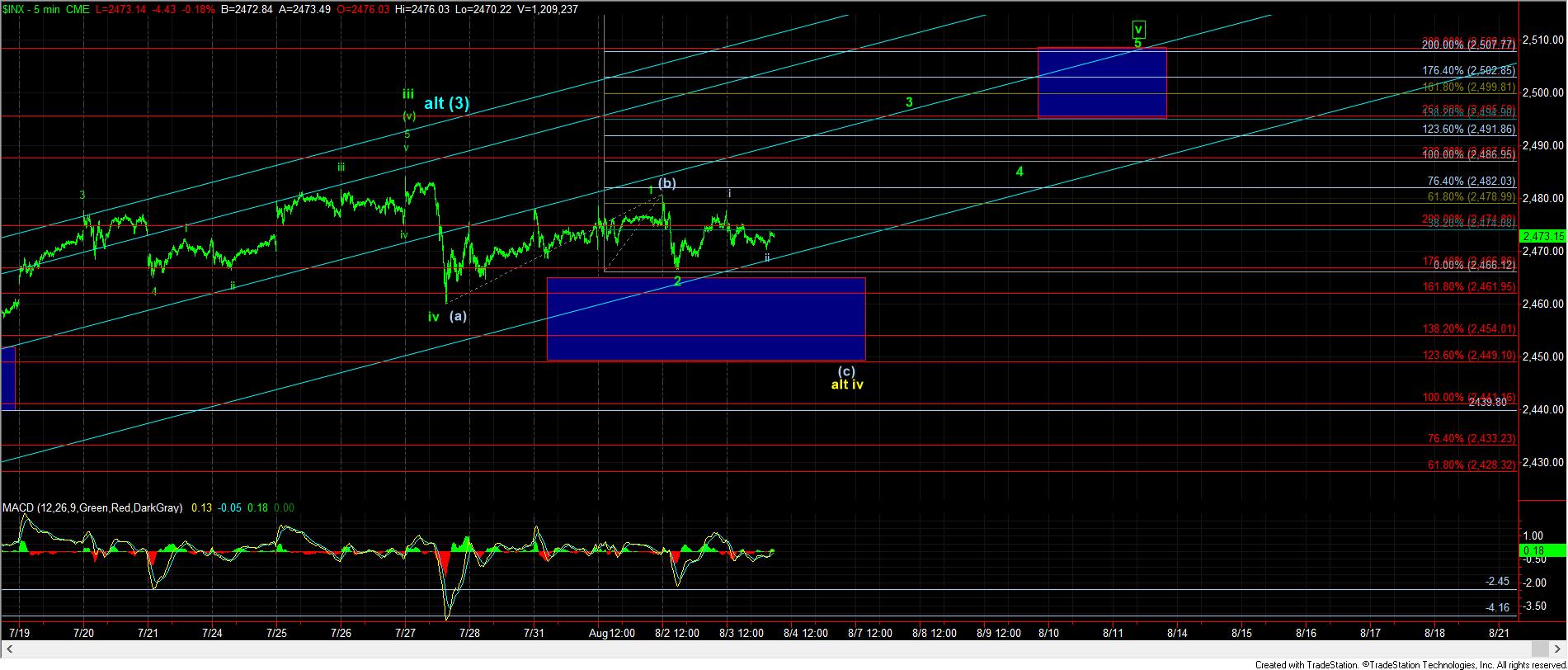

Now, moving on to my expectations, not much has changed for me in the micro chart. While I really would have preferred to see more of a full and standard 4th wave take shape up here, the structure has me ever so slightly leaning more immediately bullish, as shown on the 5-minute green count. But, that count remains valid as long as yesterday’s low holds. If we were to break yesterday’s low, that makes it quite clear that wave iv has not yet completed, and the market intends on fulfilling a full 4th wave structure.

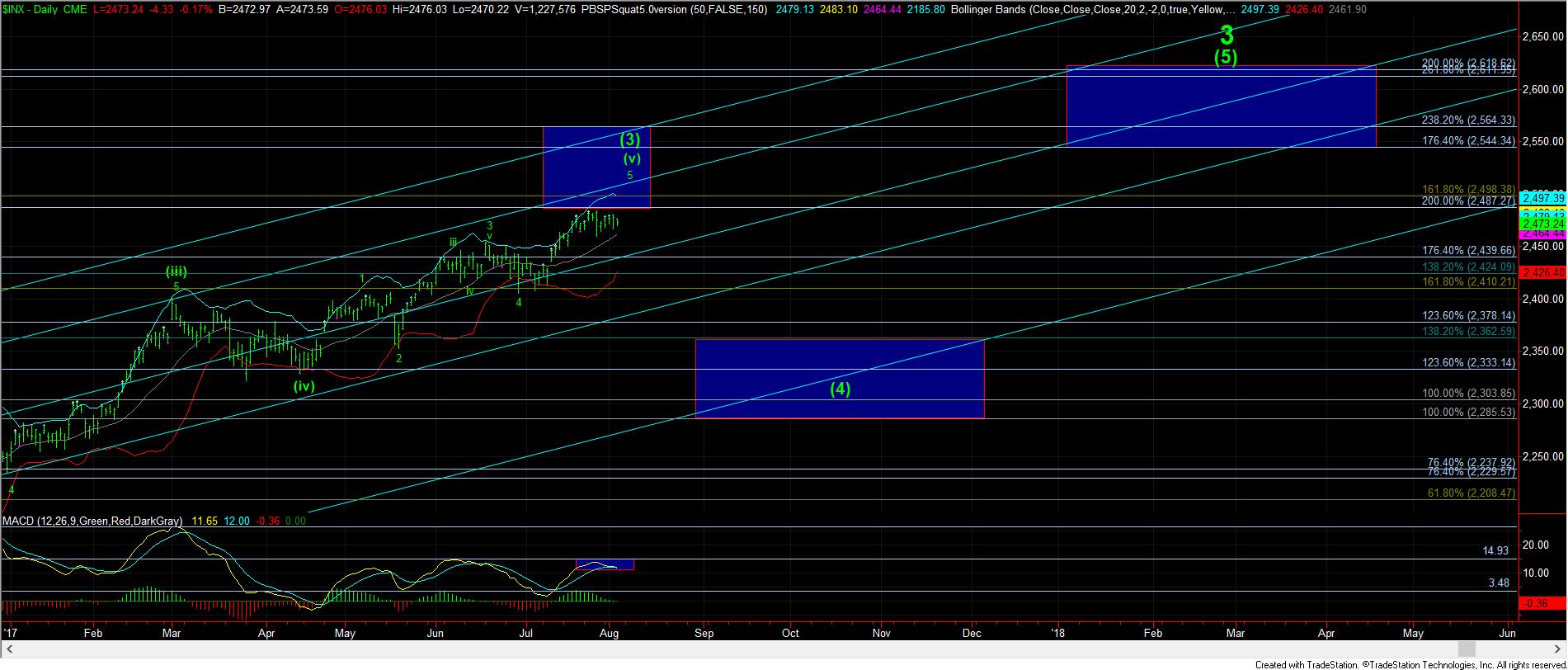

Again, the micro structure has me slightly leaning more immediately bullish, but remember that this bullishness is only for one more rally to complete all of wave (3) off the February 2016 lows. While I know what has happened to so many out there that have attempted to call tops in the last two years, I am still going to suggest that I believe we are approaching a target region at which we had expected the market to top, and initiate a pullback in the market back towards the 2300SPX region.

You see, we have now just about struck the 1.618 extension of waves (1) and (2) off the February 2016 lows, which is the most common target of wave (3). Moreover, we are striking the 2.00 extension of waves (i) and (ii) within wave (3), which is also where wave (v) of (3) commonly tops. They are both coinciding around the 2500SPX region, which is what we consider a strong confluence region for a top to be struck in wave (3).

So, while I am still looking for some smaller squiggles to still potentially take us a bit higher, I just want you to maintain the appropriate perspective as to where I believe we now stand in the larger picture.