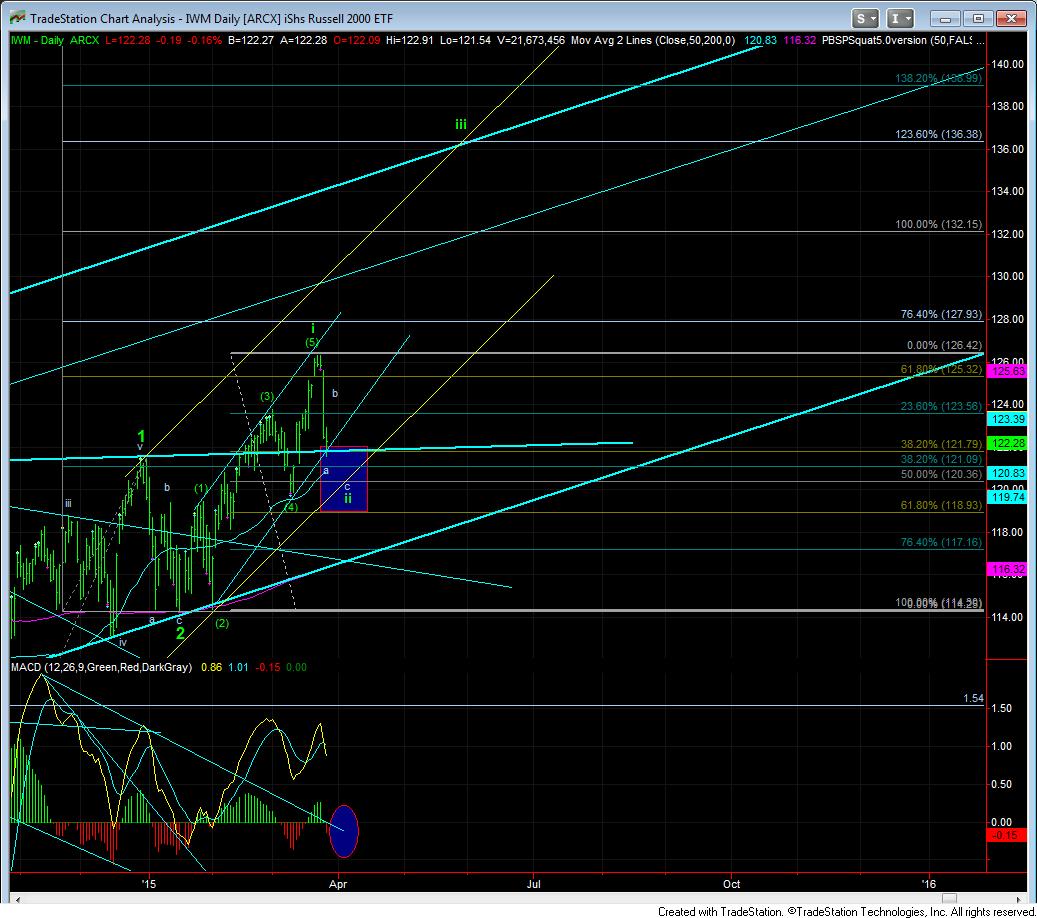

Lows Are Not Likely In Yet

While I was clearly wrong about holding the 2050ES level into today, the market is subdividing lower as expected. Last weekend, I noted that we were expecting a top to the market, with a decline that “should” take us into next week. Ideally, that decline was going to be deep and take us towards the 2020ES target we have had for quite some time.

With the continued overnight weakness, it would seem that the market could very well have completed the 3rd wave in this c-wave down. The only thing that would change my mind at this time is if we saw significant weakness into tomorrow, which would then take us down to the 2020-2027ES region to complete wave 3, as noted the purple alternative wave 3 count.

As for when this correction completes, we have some interesting timing considerations. The (a) wave down took a Fibonacci 8 days and the (b) wave rally took a Fibonacci 8 days. So, my expectation is that this (c) wave will also take a Fibonacci 8 days, which plays our target for bottom timing right at the bottoming window we were targeting around April 2-4.

So, if the3rd wave is actually completed, then I think we may yet see a very complex 4th wave taking us into early next week.