Looking For Confirmation For Top Of (3)

Looking For Confirmation For Top Of (3)

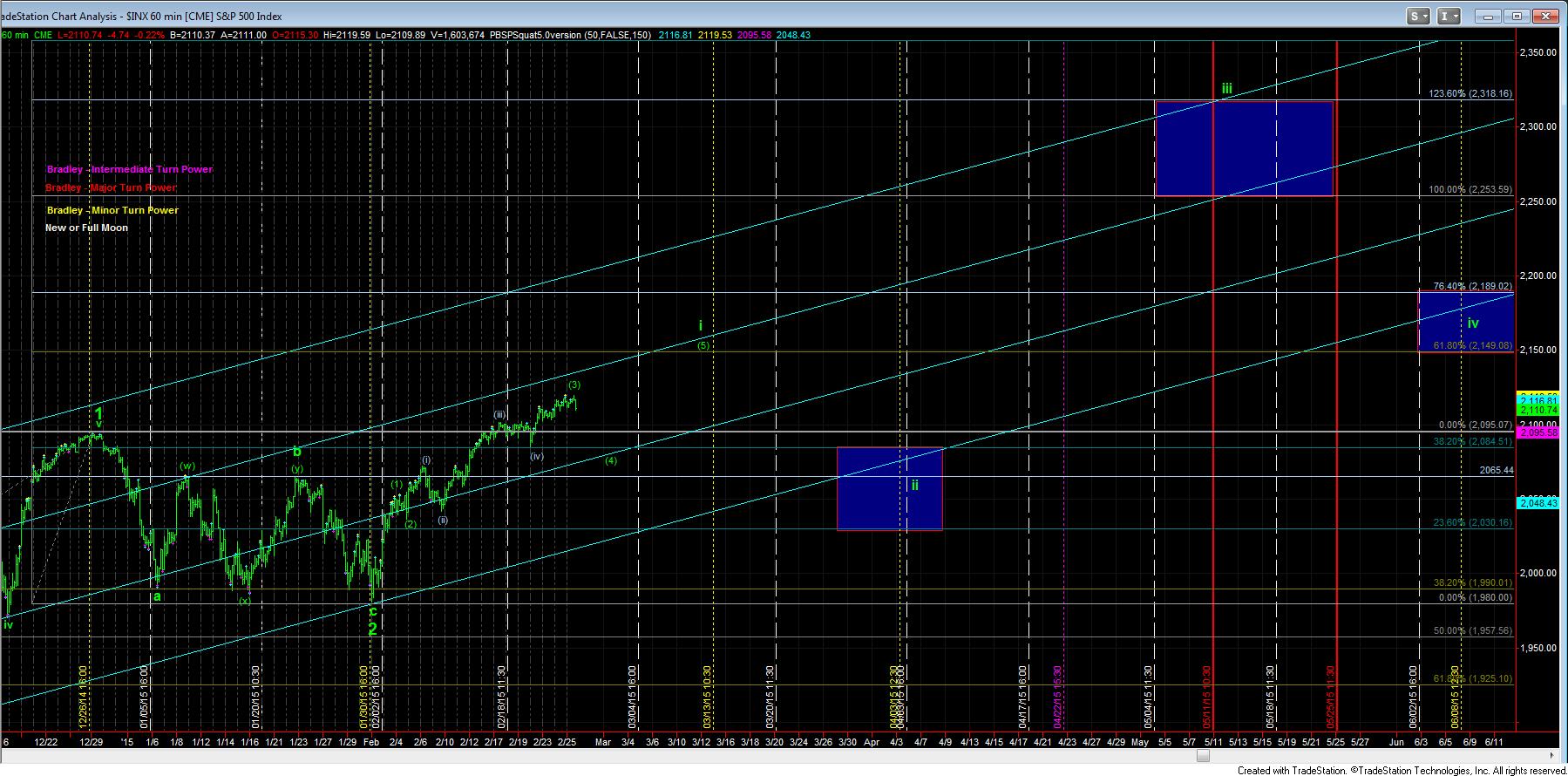

In our ideal scenario, the market would be targeting the .618 extension of waves 1 and 2 for the top of wave i of 3. That resides in the 2150 region. And, we would want to see 5 waves into that region.

Last night, as well as many times over the last few weeks, I have noted the following: “the minimum target we wanted to see for wave (3) is the 2119ES region. But, the more ideal target resides in the 2135ES region.” Today, we came within one point of 2119ES, and the market backed away quite strongly. This is an initial indication that wave (3) may have topped out at the 1.382 extension.

The next point of confirmation is to see it break this current uptrend channel, which has support just under the 2108ES resistance region we just broke through. But, should we have completed wave (3), then my minimum expectations for wave (4) would be the 1.00 extension in the 2092ES region, but, more ideally, it would be the 2080ES region. That is where the 4th wave of one lesser degree resides, and it is also the .382 retracement of wave (3), the most common target for a 4th wave.

And, since wave (2) was only about a day long, my expectation is that this could take us several days, to as much as a week to play out.

So, while it is certainly “possible” that higher levels can still be seen for wave (3), I believe that attempting to trade for those higher levels in the short run may not be worth the risk at this time.