Lessons I Learned In My Career

When I was young and first starting out in trading, if the market would come to a point at which I thought it would turn, I was often quite impulsive and impetuous, so I would aggressively short at that point. And, since I was following analysis being provided by others, I would often find myself in the hole with those short trades, as the analysis I was following often turned out to be wrong (there are a lot of bad analysts out there).

It took me a while until I learned that most of the analysis I would follow only had a bearish bias, which is why I lost a significant portion of my trading account. Yet, it ultimately forced me to begin to do my own analysis. Yet, even then, I would sometimes find myself on the wrong side of a short squeeze because I really did not have appropriate risk management rules which I learned.

So, over the years, I gained quite a bit of experience and knowledge, and have learned a few things I would like to impart this afternoon.

First, you must have a high probability way to identify the larger degree trend. For example, in our case, I believe the longer degree trend is still bullish. Therefore, with that knowledge, I have to approach all my decisions from that perspective.

And, I am sure many of you are asking “what does that mean?”

Well, it means that even though I expect the market to pullback in a 2nd wave, my primary focus is to be looking for stocks and positions to add to the long side for the rest of the primary trend. It also means that if I am EVER going to take a short trade, that trade MUST have very focused, narrow and defined parameters.

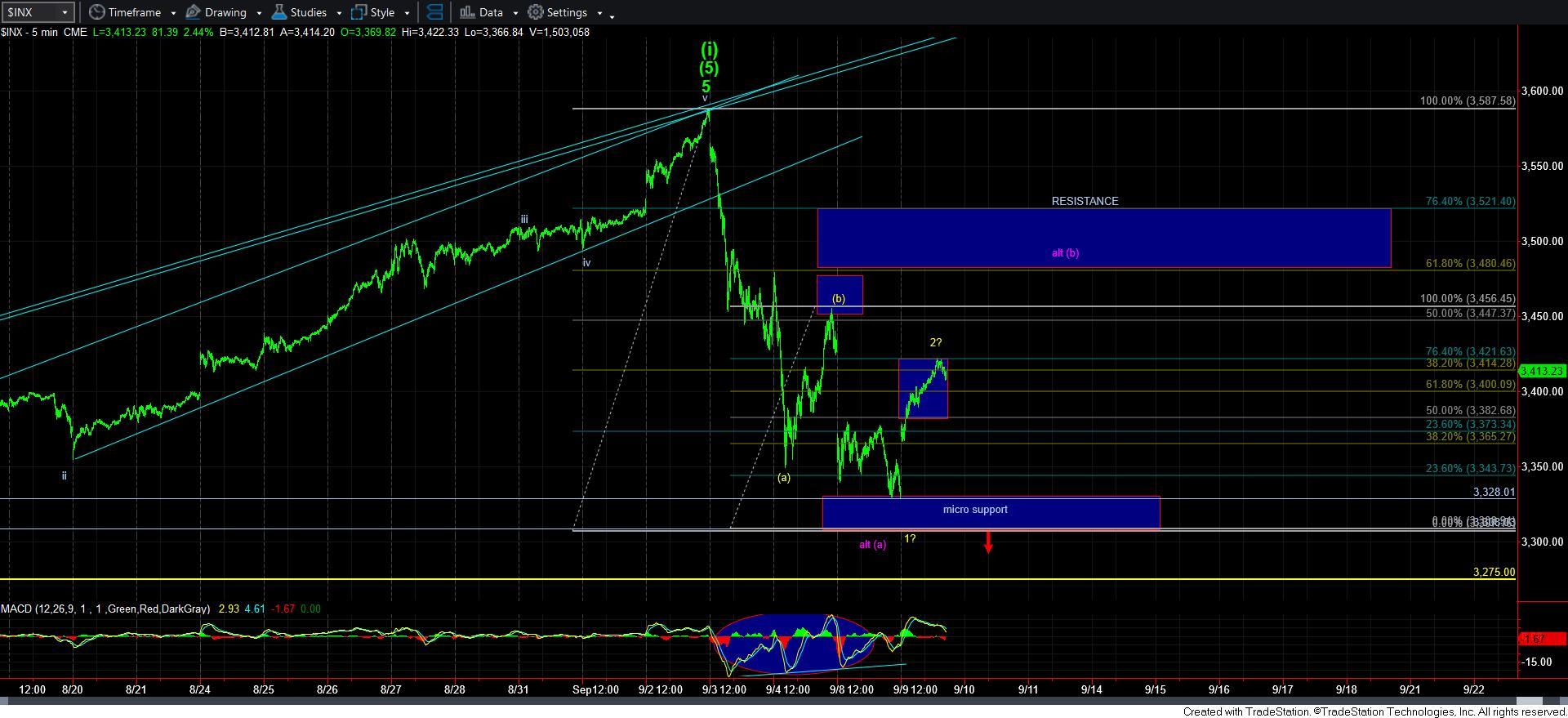

For example, my expectation is that the market should take us down to the 3200SPX region, and potentially lower. And, while I have several paths identified as to how we can get there, I will NOT take an aggressive short trade until I have a 1-2, i-ii [c]-wave decline set up. You see, once we have an initial 5-wave decline off a corrective retracement, I really want to see the second 5-wave decline for wave i of 3 take shape, and then short the wave ii retrace of that move so that I have a very limited risk on that position with a stop at the top of the wave 2 retracement. This is the type of defined risk short trade I am willing to take while we are still in a bull market. Anything less is really much more risky than I am willing to enter.

But, others may differ from my perspective. I am simply trying to provide some lessons I have learned over the years. Along the same lines, another lesson I have learned is that I really try to avoid trading within a b-wave. They are simply too unpredictable for my trading purposes.

So, at the end of the day, the two main points I am trying to make in this write up is that you should ALWAYS focus your efforts on the primary trend, and ONLY trade counter-trend when you have a low risk set up in place.

This brings me to where we now reside in the SPX. With the market finding support at the top of the upper-support box on the 60-minute chart, and the overnight action being unable to break down below the pivot I provided on my 5-minute chart, today’s rally seems to be a counter-trend rally, at least based upon the probabilities as I see them right now. So, knowing that the primary trend is up, I have been very focused on my trading/investing plan, as I have outlined them to you.

First, over this past weekend, I reviewed the StockWaves300 list put out by Garret and Zac (and I have to add that they have done an outstanding job in their analysis). I then culled through the list to find those stocks which would work best in my portfolio and round out my long-term holdings. Now, that means that I have to take into account what type of weighting I have in certain sectors so that I do not go too heavily into some and too underweight in others. So, when many of you ask for my list of stocks, my answer to you is that is not going to help you as you need to balance it within your own portfolio.

Second, since these stocks are at different points in their rally off the March lows, I have separated them into 3 groups: 1- stocks that are now at their retracement targets for wave [ii]; 2 – stocks that need another decline (with the market dropping to 3200SPX or lower) before they complete their respective wave [ii]; and, 3 – stocks that really need a larger degree a-b-c for wave [ii].

Third, yesterday, I was busy buying those stocks that are now at their respective retracement targets for wave [ii]. Clearly, I will have stops on those positions should they break lower than appropriate. But, I have a plan and am following through on that plan - - which ALIGNS WITH THE LARGER DEGREE TREND I AM FOCUSED UPON.

Now, as the market is still likely trying to take us down to the 3200SPX region or potentially lower (yellow or green has not yet been determined), I am not going to aggressively short for that potential until I have a 1-2, i-ii downside set up in place for that potential.

As we stand right now, AT BEST, we have a 1-2 in place as I write this update. While I cannot say that the wave 1 down as I see it in the futures is clearly a 5-wave structure, it does meet the minimum requirements, but it may be a leading diagonal. And, as you may know if you have been following me for some time, I really do not trust leading diagonals for strong trading cues.

But, as I have said before, at least for my own purposes, this initial 1-2 potential downside structure is not enough for me to be willing to trade downside aggressively (especially with wave 1 as a potential leading diagonal). Rather, I have added a market pivot to the 5-minute ES chart now – which represents the .618-.764 extension of that wave 1-2 downside set up. And, within out Fibonacci Pinball structure, we know that wave i of 3 often targets the .618 extension. So, I am now looking for a 5-wave decline taking us down towards that pivot.

If the market provides us with that structure, I will then look to short on a wave ii corrective retrace and use the top of wave 2 as my stop. Should the market then follow through below the pivot, I will then move my stop down to the top of the pivot, as we should not break back up through the pivot on the wave iv retrace, assuming we are going to continue down to follow through on the 5-wave [c] wave decline.

So, what has this done for me today? Well, the market has now rallied quite strongly and the purchases I made yesterday are nicely green. However, when the market is ready to provide me with a downside low risk set up, I can short the market and protect those positions.

Remember, we will NEVER know what the market is going to do with CERTAINTY. Rather, we deal in probabilities. Therefore, we need to always focus on the primary trend first, and worry about capturing downside in a pullback secondarily.

So, should the market provide us with the next i-ii structure on the downside, as outlined on my 5-minute ES chart, then I will gladly take a short attempt. But, until then, I intend on riding my long positions until the market gives me that short opportunity. Moreover, when we do go down deeper into this decline, as I am expecting, then my primary focus again will be my second tranche of additions to my long positions, in addition to covering my short position on that trade.

For now, the market has not made it clear whether we have begun the [c] wave down to 3200SPX or lower. In the current 1-2 structure, assuming we do see follow through, it is pointing well below 3200SPX. But, we still need to see that i-ii downside set up to make it a much higher probability. Until such time, keep in mind that there is certain potential for the low struck yesterday to be all of the [a] wave, as shown in purple on my 5-minute chart, which means we can still push much higher to the target box above for the [b] wave in purple. So, again, I really do not want to prematurely short and find myself on the wrong side of a short squeeze. I would much rather have a lower risk set up to take advantage of before I am willing to get aggressive on the downside.

I hope this outlines my general approach to the market, especially as we prepare for a big 3rd wave rally which we see as quite likely taking us well into 2021.