Keeping It Simple - Market Analysis for Jun 4th, 2020

Yesterday, I attempted to simplify my micro perspective presented on the 5-minute SPX chart. Today, I will attempt to reiterate that simplification.

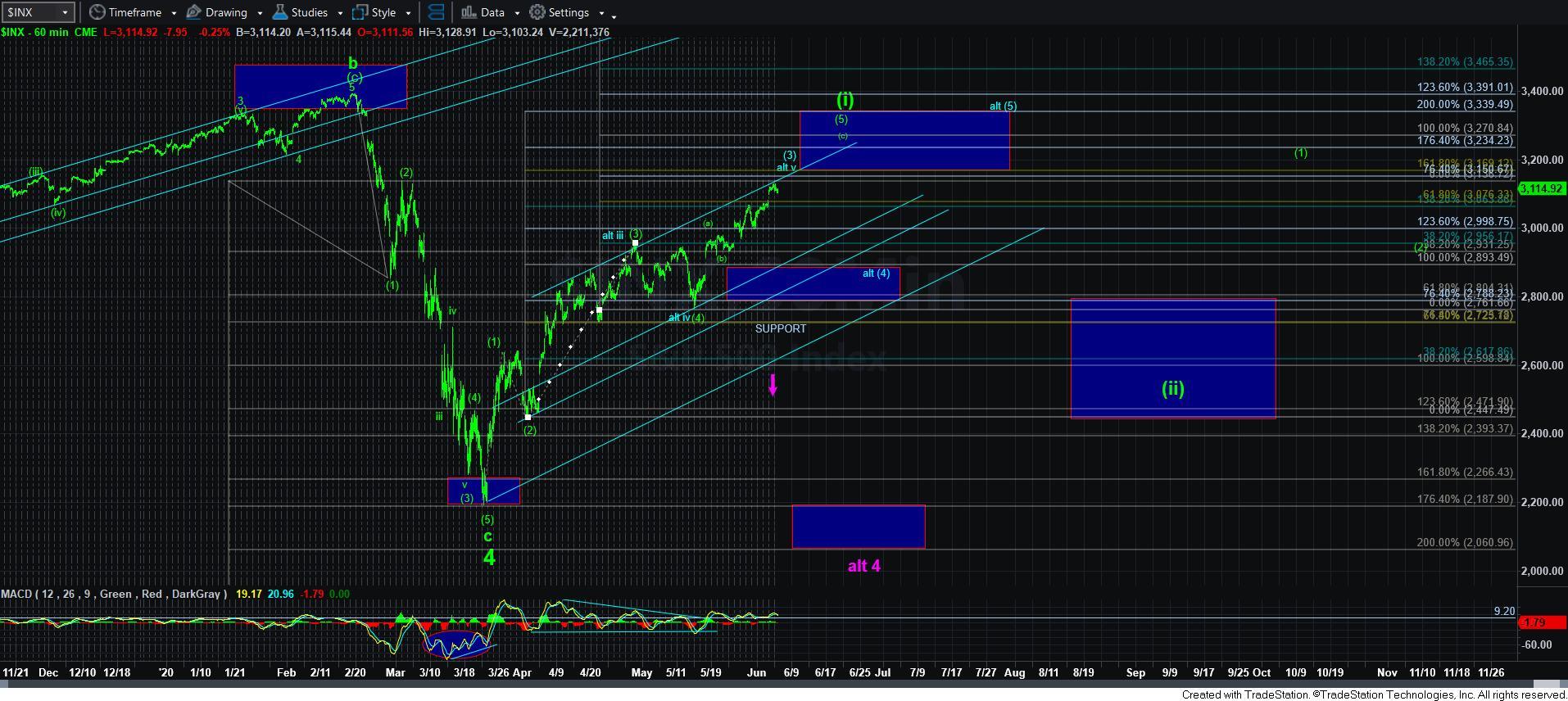

But, first, I want to make a point about the bigger pattern presented on the 60-minute chart. As you can see, we are now approaching that target zone we have had for quite some time for wave [i] off the March low. Moreover, we are sitting under the uptrend channel that has kept us in check during this rally. And, the closer we move towards that target, the higher the risks rise that a larger degree pullback will begin.

So, with that in mind, let’s look at the smaller degree. Yesterday, we struck the ideal target for wave iii of the c-wave in wave 3 in the green diagonal count. And, today, we dropped down to the support for wave iv in that same count. Ideally, we should hold the 3095/3100SP support region, and then set up to target the 3165-70 region to complete the c-wave of wave 3 in the diagonal count.

Yet, I still want to reiterate the support levels in the market. Support for wave iv in the c-wave of 3 is in the 3095-3100SPX region. A break of that support will point us down to the 3040/50SPX support region for wave 4 in green. And, it would take a sustained break of that support to point us next to the 2890SPX support region for the alternative blue wave [4]. I outlined the progression of patterns in yesterday’s update, so please review that for clarity on the break-down of the bigger perspective.

In very simply terms, as long as we hold 3095/3100SPX support, then I am looking up towards 3165-70 sooner rather than later. It would take a break of that support to suggest that green wave 3 (or blue wave [3] in the alternative) has completed. But, if you are still trying to trade for higher levels, please do recognize that risks continue to rise the closer we get towards our target box overhead for wave [i] off the March lows.