Just How Bullish Does This Market Want To Be?

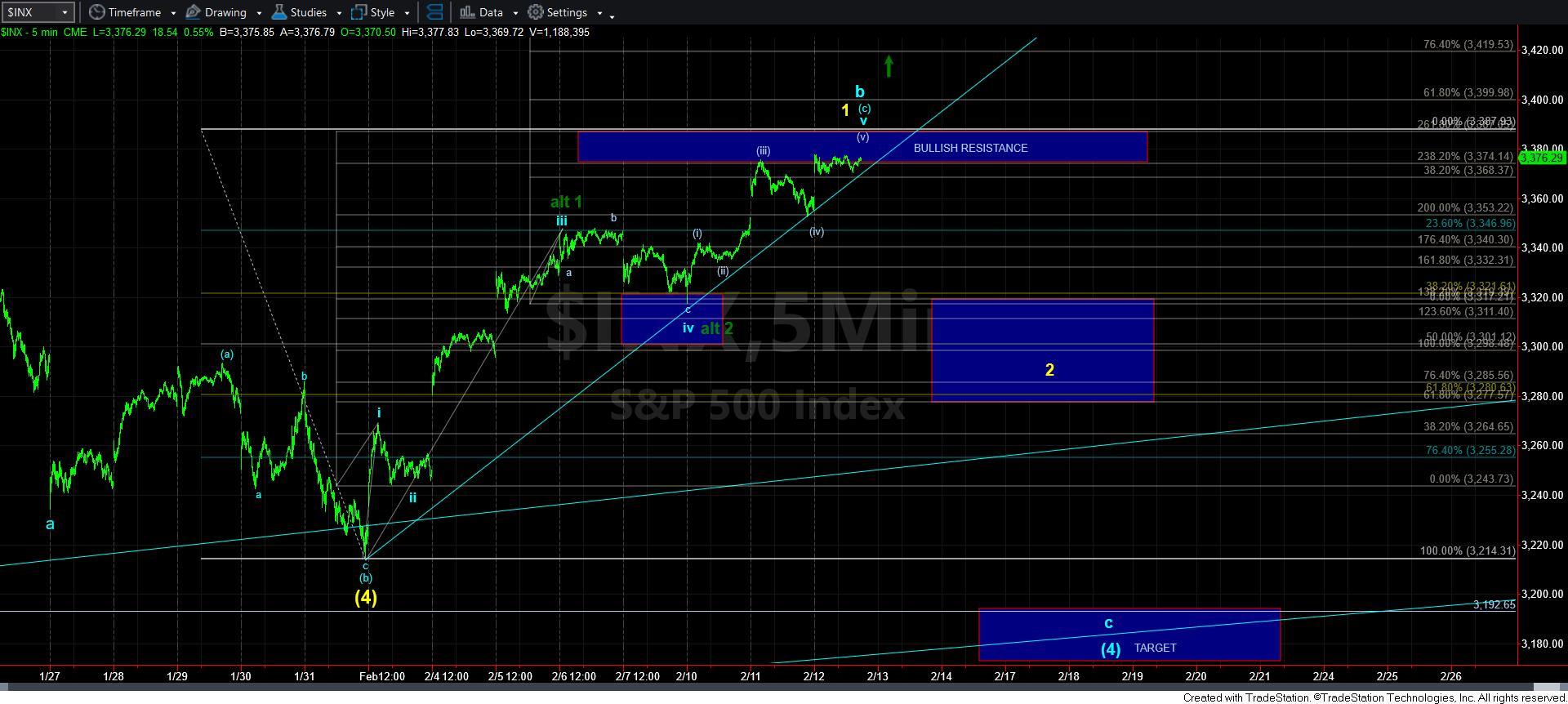

With today's continuation move higher, we now have a clear and clean 5 waves up off the January 31st low. And, as I outlined in prior updates, that will either count as wave 1 of (5) in yellow in the more immediate bullish market potential, or a [c] wave in an expanded b-wave within wave [4], as presented in blue.

How we separate the differences between these two potentials is determined by how the market takes shape below the 3350 region low struck yesterday. If the decline is clearly corrective, then I am expecting the market to hold over the 3280/90SPX support for wave 2, and then point us much higher in wave 3 of [5] in the coming months.

However, if the market provides us with a clear impulsive decline which then breaks down below 3280SPX, it points us down towards the 3155-92SPX region in a larger wave [4] structure, as outlined in blue.

Take note that both of these counts rely upon the markets ability to break down below 3350 very soon. A break down below 3350 places us into the 2/c pullback scenarios, so that is our confirmation point. This also means that the market must respect the resistance overhead in the 3388SPX region.

As we have seen many times over the last year, the market has often been quite stingy with pullbacks. For this reason, I am at least placing an alternative to be aware of in the event the market chooses a direct path higher rather than providing us with a standard pullback.

In that more extreme-bullish case, which is presented in dark green, the high struck on February 6th just below the 3350 region would be wave 1 of wave [5], and the ensuing pullback would be wave 2. Again, this is only an alternative count at this time, as the projections for such a 1-2 structure come way short of our ideal target for wave [5] of iii. But, if the market breaks out directly over 3388SPX, and follows through over 3405SPX, then 3375SPX becomes our micro support and we have likely begun wave [iii] of 3 within wave [5] of iii. And, based upon the manner in which the market has acted over the last year, I have to at least keep this on our radar until we see a break down below 3350SPX.

Overall, the market is still providing us indications that it wants to head to the 3711SPX ideal target for wave [5] of iii later this year. It would take a sustained break down below 3150 to even consider otherwise at this time. So, for now, we are going to continue to track the more bullish potential until the market provides us a reason otherwise.