It’s Now Or Never

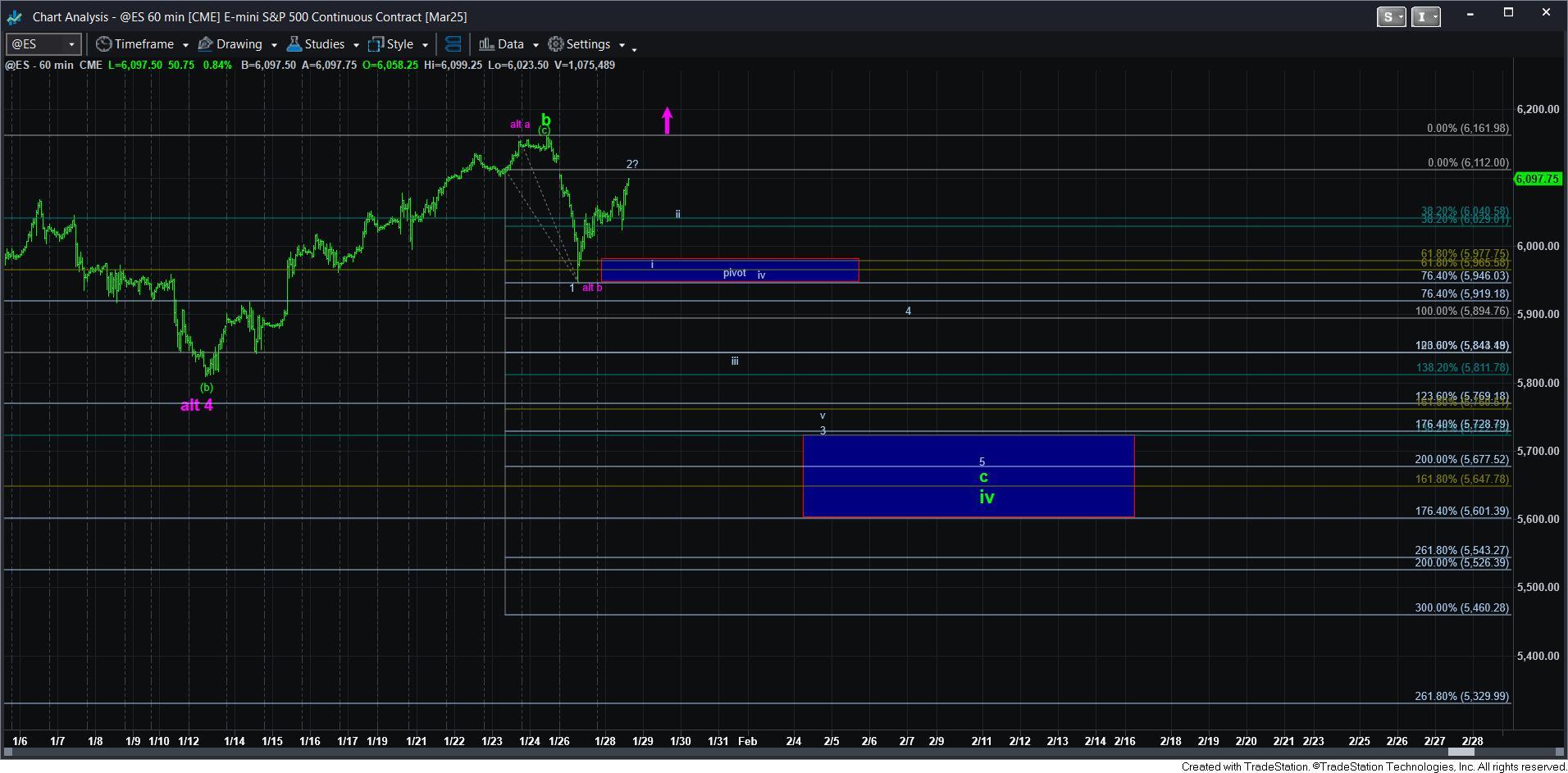

With the market pushing higher today for what can be a deeper wave 2, we are approaching the .764 retracement of wave 1 in the ES as I write this update. However, if we see a move through that resistance in the 6112ES region it begins to warn us of the potential for the purple alternative.

So, in order to keep this c-wave potential on the chart, we will need to hold the 6112ES region, and turn down in a 5-wave structure for wave i of 3, which ideally should hold over the pivot. Remember, the top of the pivot represents the .618 extension of waves 1-2, and it is the ideal target for wave i of 3.

Thereafter, a corrective bounce would be our wave ii, which would then set up the wave iii of 3 decline. Should the market instead rally over the high of wave 2 (assuming we do turn down at resistance), then it opens the door for the purple count as well.

So, the market will likely make a decision over the next 24 hours or so. And, while the parameters are relatively clear, it seems the Fed may act as a catalyst tomorrow yet again for one path or the other.

This is also a reminder that most of you should not be shorting this market as we have not yet transitioned into a bear market. But, those that still want to short a bit more aggressively, it may be wise to wait until we see AT LEAST the 1-2, i-ii set up, which allows you a relatively tight, low-risk short attempt on a wave ii bounce, with a stop at the wave 2 high.