It’s Not Easy Being Green

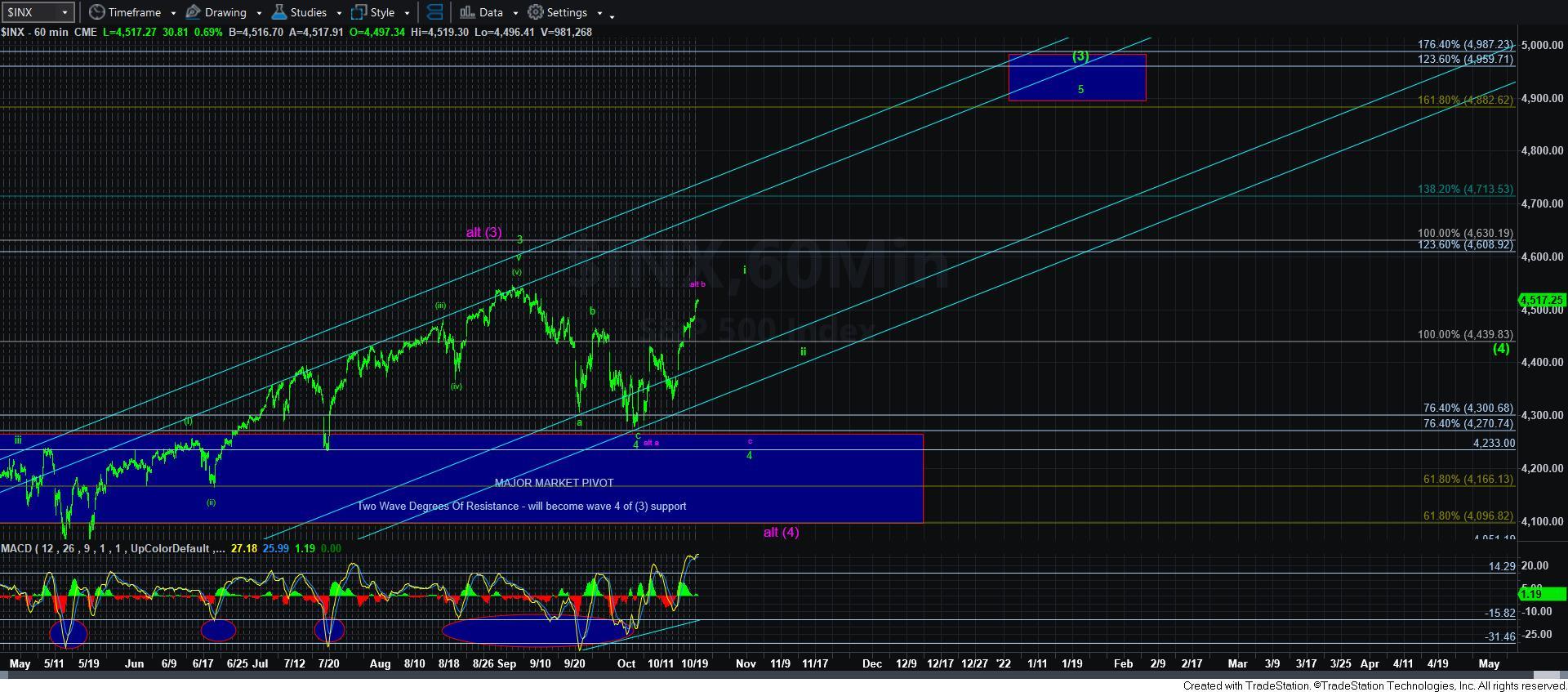

With the volatility we have had over the last few weeks, the market is still trying to prove to us that the bottom is in place, and the green count has begun to take us to 4900SPX. And, now that we have struck the 1.136 extension today, it certainly seems like the bulls are trying to take control.

What this now means is that the nature of the next pullback is going to become of utmost importance.

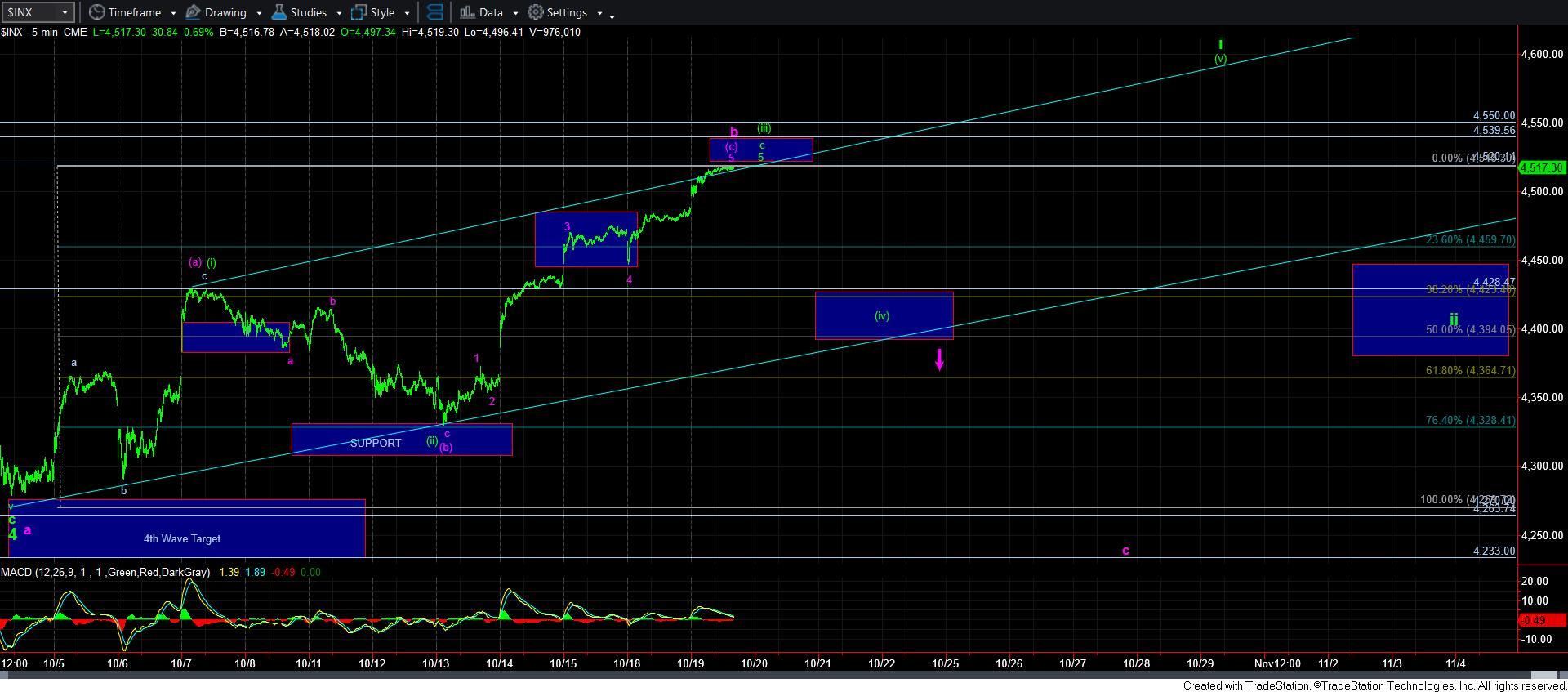

First, my ideal target region for the wave [iv] of the leading diagonal is in the 4394-4423SPX region, as you can see from the attached 5-minute chart. The main reason it is that deep is because we normally see overlap between waves [i] and [iv] within a diagonal.

Second, the manner in which the market drops towards that support will tell us all that we need to know. If the pullback is clearly corrective, then it could be a buying opportunity for a rally towards the 4600SPX region and the completion of wave [v] of i.

However, if the decline is clearly IMPULSIVE, then we are likely targeting the 4230-4270SPX region again in the purple c-wave down.

So, at this point, it has become relatively simple. We need to break below 4486ES to even begin assuming that the next pullback is in progress. And, once we are below 4470ES, then we can begin to discern the nature of the pullback as to whether it is corrective or impulsive.