It Must Fit - Market Analysis for Nov 3rd, 2021

Consider this an early peek at the weekend update, as I will likely just repeat most of what I am about to say.

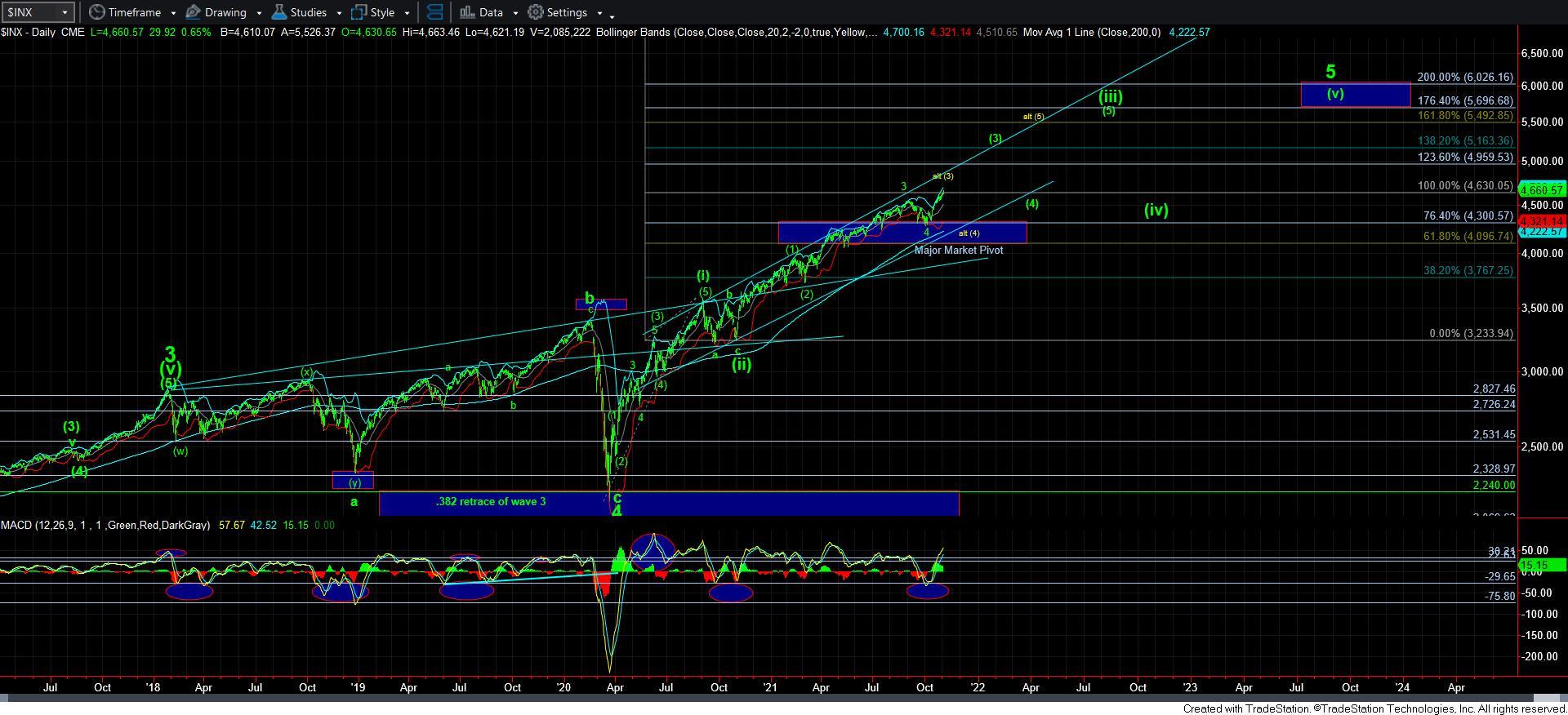

First, I want to start by saying that nothing I am about to say changes the fact that I view this as a bull market with much higher levels to likely be seen in 2022. Second, I want to note that my target for 2022 now seems to be a minimum of 5163SPX region.

The issues with which I am struggling up here is trying to discern the path that takes us to those levels. But, even though I am struggling with the path to those higher levels I expect in 2022, long term investors should continue to hold all their long positions, and if we break a support, then you can choose to hedge if you want. But, the bigger picture still likely points to at least 5163SPX in 2022, so long term investors should act accordingly.

As far as the specific pattern, I always say that due to the market being fractal in nature (meaning it is variably self-similar at all degrees of trend), this rally has to fit in the big picture in a reasonable manner. Therefore, we really have come up quite high for a wave i of 5 of [3]. That means we really need to see an imminent turn down to keep this as the higher probability at this time.

However, if the market is able to continue to push higher in the coming days, then I have to more strongly consider that this is actually completing wave [3] of [iii] off the March 2020 lows. The main reason I am more willing to accept that is due to the break out in the IWM. You see, if the strength in the IWM continues in the coming week or two, then it means we are targeting its wave 5 of [3] target box sooner rather than later.

But, if this is the path the market should take, it would mean that the SPX will likely pullback to the 4300SPX region into early 2022. Therefore, it would push back the rally I want to see in 2022 a few months. It would also mean we are completing the larger structure off the March 2020 lows in a more accelerated fashion, as it means the next rally would be wave [5] of [iii] off the March 2020 low, rather than wave 5 of [3] of [iii]. In other words, it means we would move one wave degree higher sooner than I had originally expected.

But, if we are really moving up on degree in wave structure, it would also suggest that the next rally into 2022 may not even stop at the 5163SPX region, and may even extend up to the 1.618 extension of waves [i][ii], as seen on the daily chart, which is the 5500SPX region. And, yes, it is possible we can complete that within 2022.

For now, my preference would be to see a corrective pullback begin imminently, and take us back down to the 4400-4500SPX region for wave ii. As long as that pullback is corrective, I can maintain the current green count as shown, with our target for 2022 being the wave [3] of [iii] in the 5163SPX region.

However, if we continue higher in the coming week or two, then I am going to have to more strongly consider the yellow alternative presented on the attached daily chart, especially if IWM continues to our next target box. But, consider that even if this does take precedence, then it would suggest our target for 2022 will be 5163-5500, and it will be based upon the size of waves 1-2 within wave [5] of [iii], and where it projects. But, this also would mean we will not likely see our annual Santa rally, as the wave (4) pullback can take us into the end of the year or early 2022.