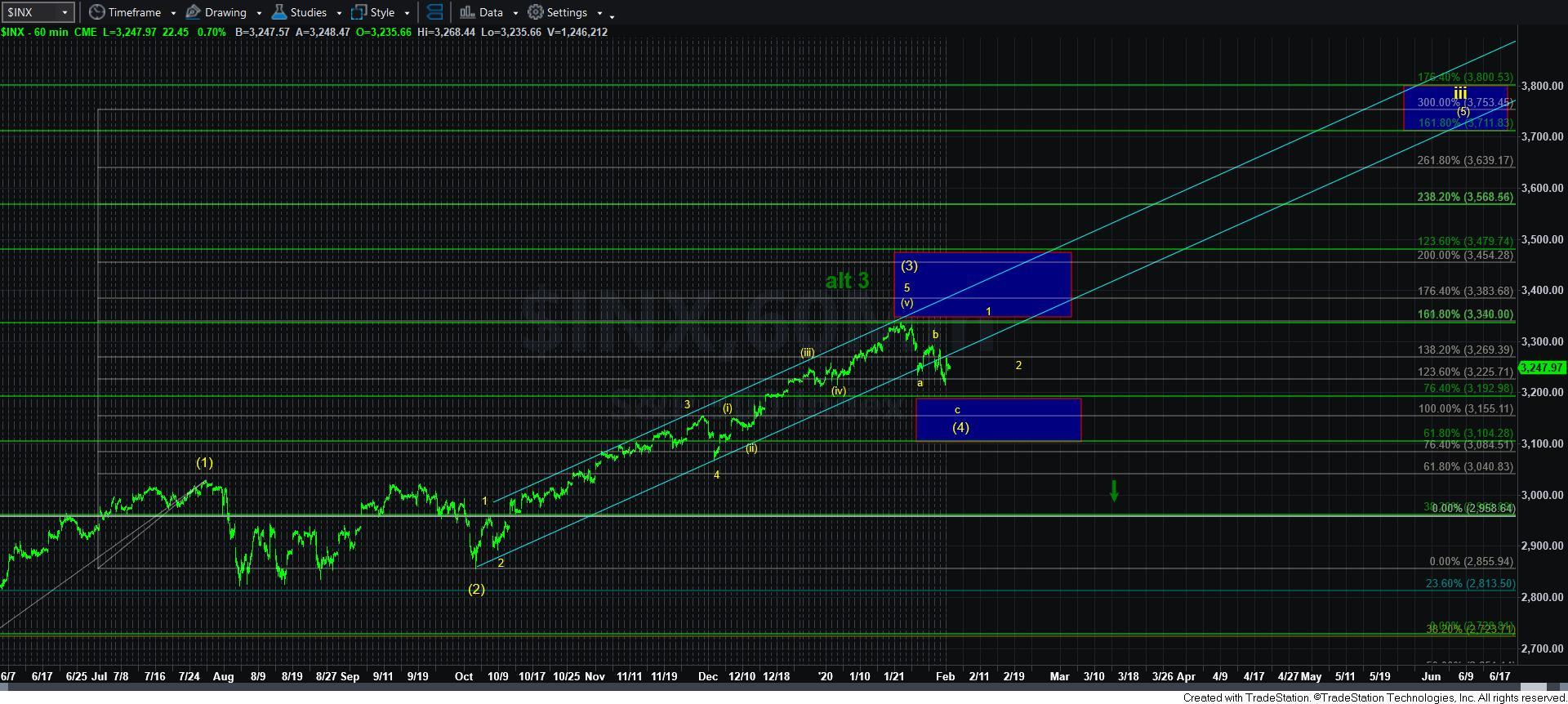

Is There More Downside Left?

With today’s rally, the market has left us with an incomplete downside structure. That has several implications, with the greater likelihood being that we still have to set up for another drop.

First, I do want to note that, over the last year, we have seen several pullbacks provide us with incomplete downside structures. So, that must at least be a consideration to us. However, with the rally, thus far, taking shape as an overlapping corrective structure, I think the market will have to prove that an incomplete structure will complete this wave [4]. That means we will need to see the market break out through the 3311 for me to consider this potential. And, that would suggest that we may be completing wave 1 of [5] as a leading diagonal.

That means that the more likely scenario is that the market is setting us up to test the 3192SPX region. The most direct manner in which we can get there is through the ending diagonal structure outlined in yellow on the 5-minute SPX chart. That means that today’s high must be respected, and that we see downside follow through as early as tomorrow.

However, if the market is able to move through today’s high, then I think we are still working on the b-wave of this wave [4], but with a much more complex structure, as also shown on the 5-minute chart in purple.

In simple terms, as long as today’s high is respected, then the ending diagonal taking us to the 3192SPX region sooner rather than later is going to be my primary count. If we are able to break out over today’s high, then the larger degree b-wave will be my primary count, with the alternative only at that time being the potential that wave [4] has already completed. For now, I expect us to see lower levels before this pullback is completed.