Is The Top In Place?

Yesterday, I outlined that a downside follow-through below 5056SPX would get me to adjust my wave count and view the top as being in place as my primary count. And, when you look at the 60-minute chart, you will see that is exactly where I now stand.

Clearly, I am still going to want to see a break down below 4946SPX to make that a much higher probability, but I have seen enough thus far to view it as more likely than not that the top is now in place, and my wave structure is being presented accordingly.

Now, there are a few issues I addressed in alerts today, which I want to repost in my afternoon report.

“I know many are attempting to count a 5-wave decline off the recent highs. I personally view that as an exercise in futility. You see, if this is an initial a-wave decline in SPX, it will most likely be a 3-wave event, as most a-waves are only 3 waves. So, I am simply going to allow the market to prove us a clear bottom, followed by a week+ long corrective bounce, and we will then view that as the initial a-b structure off the low. A 5 wave decline from that point will signal the wave 1 of the c-wave down, and that will put us on high alert for a major decline to potentially begun.

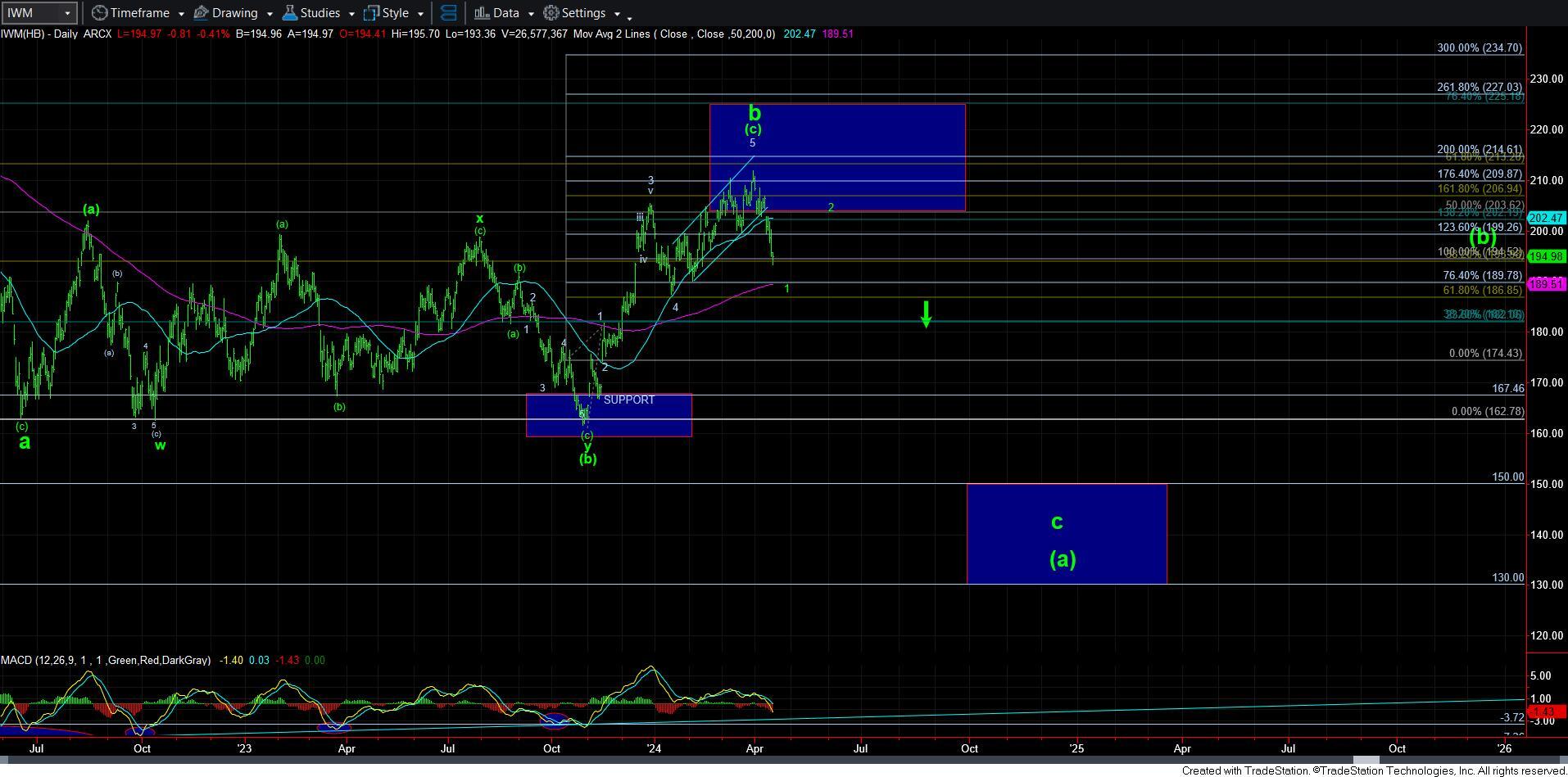

So, ultimately, I think following the IWM over the coming weeks may be more enlightening.”

“I want to make a point to everyone right now that you may not like, but may be able to appreciate: I am not going to do any micro 5-minute wave counts on SPX until we get at least a week long corrective bounce.

You see, the decline we are seeing can be counted in many ways. And, I do not want to mislead anyone into thinking that a count I put on a 5-minute chart is high probability when it really is not. This is likely an a-wave decline in SPX, and as such, they are most often 3-wave corrective structures and are not always clearly known when they complete until we see a corrective bounce that can be classified as a b-wave bounce.

Therefore, until I see a bounce large enough to be considered such a b-wave bounce, I am simply going to put the a-wave placeholder on the 60-minute chart, and will let you know when I think the a-wave is likely done because the bounce has become large enough to consider as a b-wave.”

“Folks, while I also have Mike's count on the Russell as one I am watching, there are two others I am contemplating as well. In fact, we could be completing a leading diagonal down in IWM, as we have now struck the minimum target for such a count. But, as I said, ideally, I want to see us return to the box below, which is the origination region of the ending diagonal we just completed for the 5th wave of the (c) wave of b.

So, just like with the SPX, should we see a SIZEABLE corrective bounce over the coming weeks, then I am likely going to assume it is as a wave 2, at least from a protective standpoint if nothing else.”

To summarize what I have said in these alerts, I am simply going to allow the market to subdivide lower – ideally closer towards the 4946SPX region before we see a b-wave corrective bounce. And, once we see a large enough corrective bounce to consider it as the b-wave, then I will begin to look down again, and for a break down below 4946SPX.

But, the clearer structure we will be following is in the IWM. Again, ideally, we should we dropping down towards the blue box on the 60-minute IWM chart to complete wave 1 down, as that is the ideal target region after completing an ending diagonal for wave 5 of [c] of b in IWM. Thereafter, I will be looking for a bigger corrective bounce in wave 2 which will likely set up a major market decline, which can still be completed in this calendar year.

So, for now, I would say that I have taken my bear suit out of the closet, I have had it cleaned, and I am preparing to don that suit once we get that 1-2 set up in the IWM. But, I am not expecting a similar 5-wave downside structure to be seen in SPX, as it is not needed.