Is The SPX Ready For Liftoff?

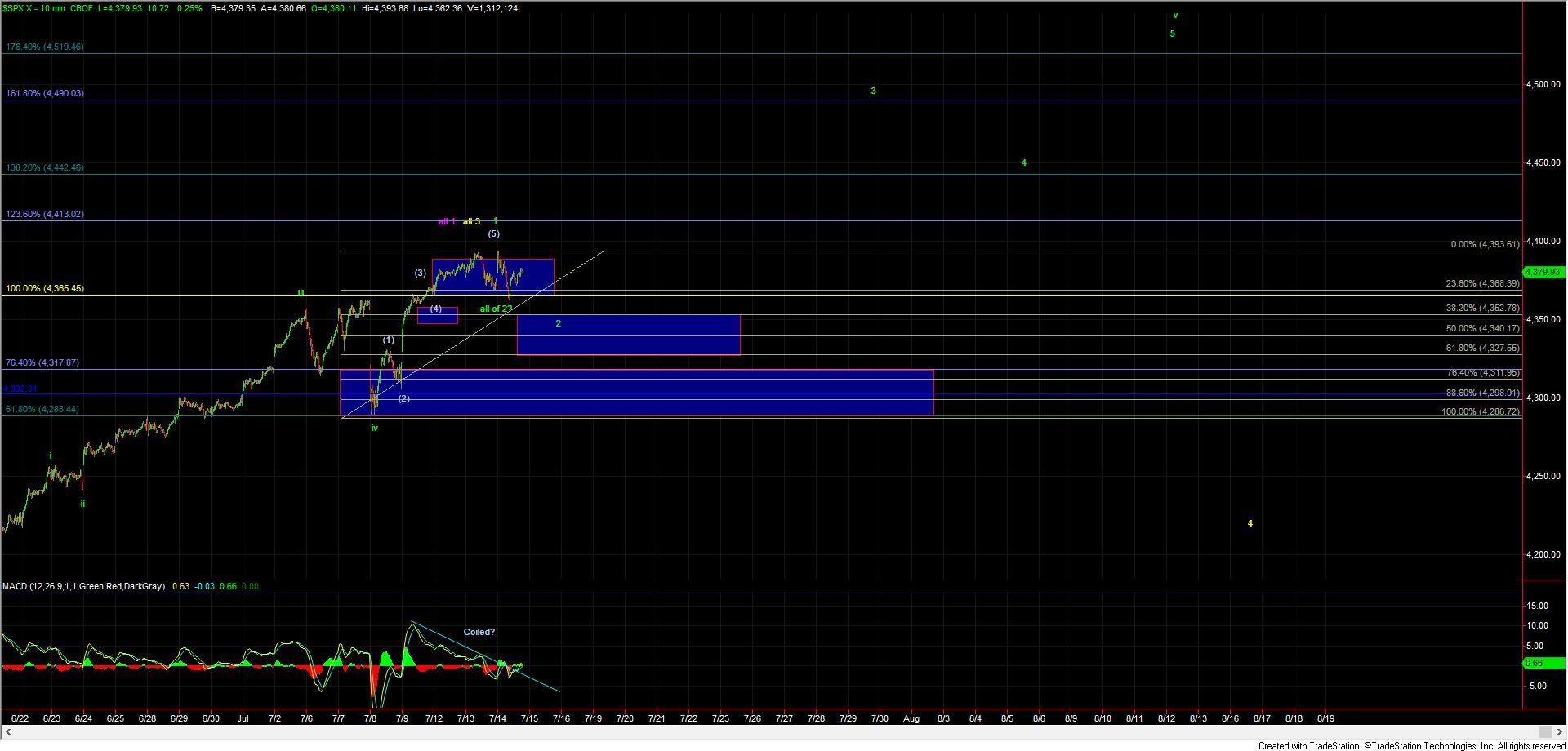

Overnight we saw the ES pullback again only to get bough in the early pre-open hours. That buying continued at the open and into the early morning regular trading session. This pushed both the ES and SPX to slight new highs but we were unable to sustain a break out higher before turning back lower again in the mid-morning. The market then found a bottom just as the lunch hour began after which point we saw both the SPX and ES give us a smaller degree five-wave move up off of the lows which was followed by a smaller degree corrective move that was then also bought as pushed higher into the EOD. We are however still sitting under the highs that were struck this morning which is leaving it unclear as to whether we have struck bottom in the smaller degree wave 2 as shown on the SPX 10m chart.

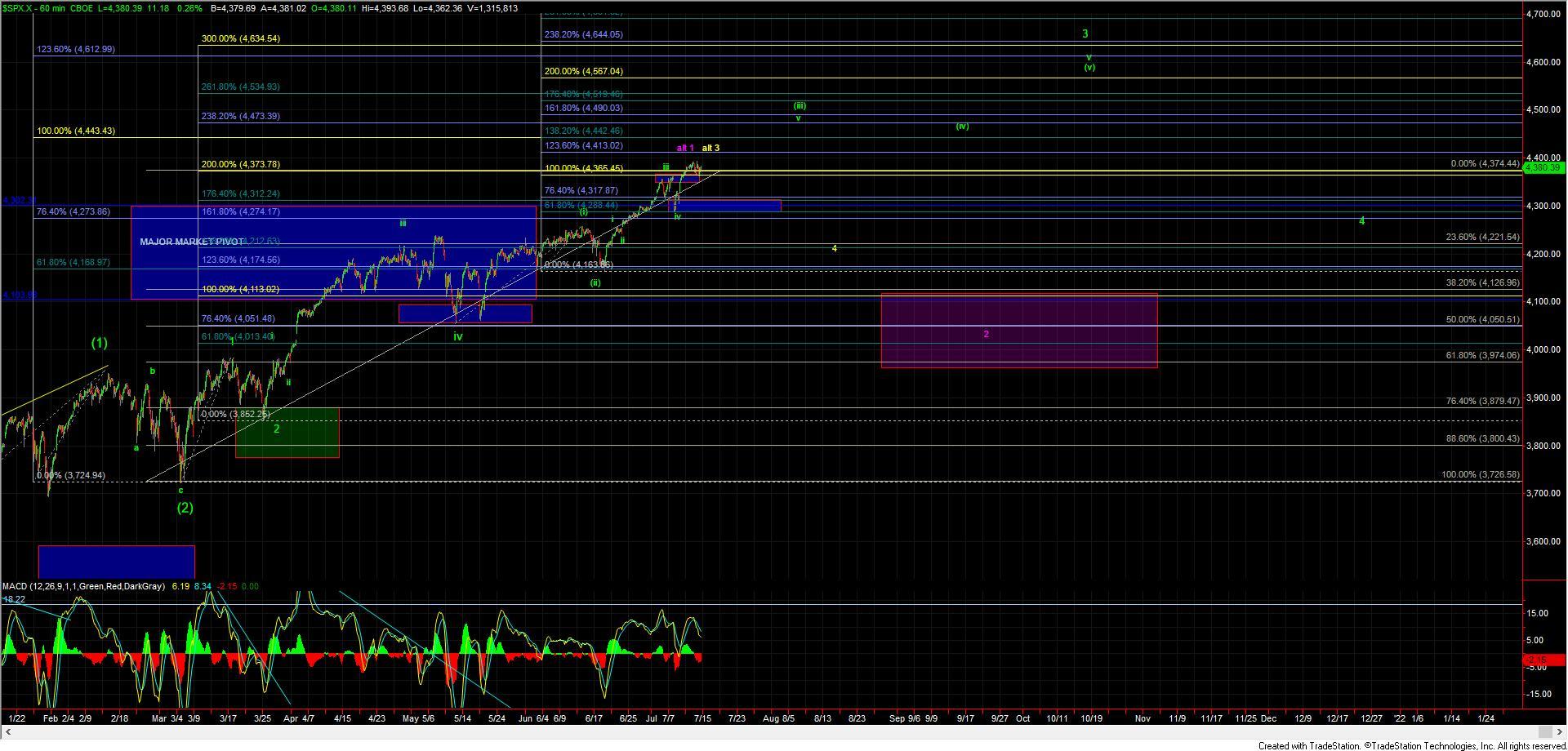

What I will note is that the action to the downside is clearly corrective which is supportive of the green primary count which should still resolve higher vs. seeing this make a larger degree top per the yellow count. Furthermore, I wanted to add that the pattern on the VXX is also supportive of seeing higher levels on the SPX count per the green count vs. topping in the alternate yellow count. This is due to the fact that the VXX has a fairly clear five wave move down off of the highs AND that it has not exceeded the previous low. This pattern makes it much less likely that the VXX has a full pattern in place this making it more likely to need lower lows which again is supportive of the ES following the green vs. yellow paths.

So from here we still are looking for a sustained break over the 4393 level to give us an initial signal that we have indeed put in a bottom of that wave 2. If we can manage to break over that level then we will look for a break of the 61.8-76.4 pivot from the move up off of the 7/8 low and into today's high to give us further confirmation that we have bottomed. Currently, that pivot zone comes in at the 4428-4444 zone on the SPX. That pivot zone would however change if we push deeper into the support zone on the SPX for the wave 2. If we do break lower and then move under the 4327 level followed by a break of the 4311 and then under the 7/8 low then it opens the door to this having already topped in the yellow wave 3.

Finally, I do want to note that while still less than ideal I have not fully ruled out the possibility of the larger degree wave 1 which I am showing in purple on my 60min SPX chart. While the overall large degree pattern would be different under those two scenarios should they occur in the near term they would actually look very similar as they both would be larger degree corrective patterns that have similar support regions.