Is The Market Ready To Launch Or WIll It's Liftoff Be Put On Hold

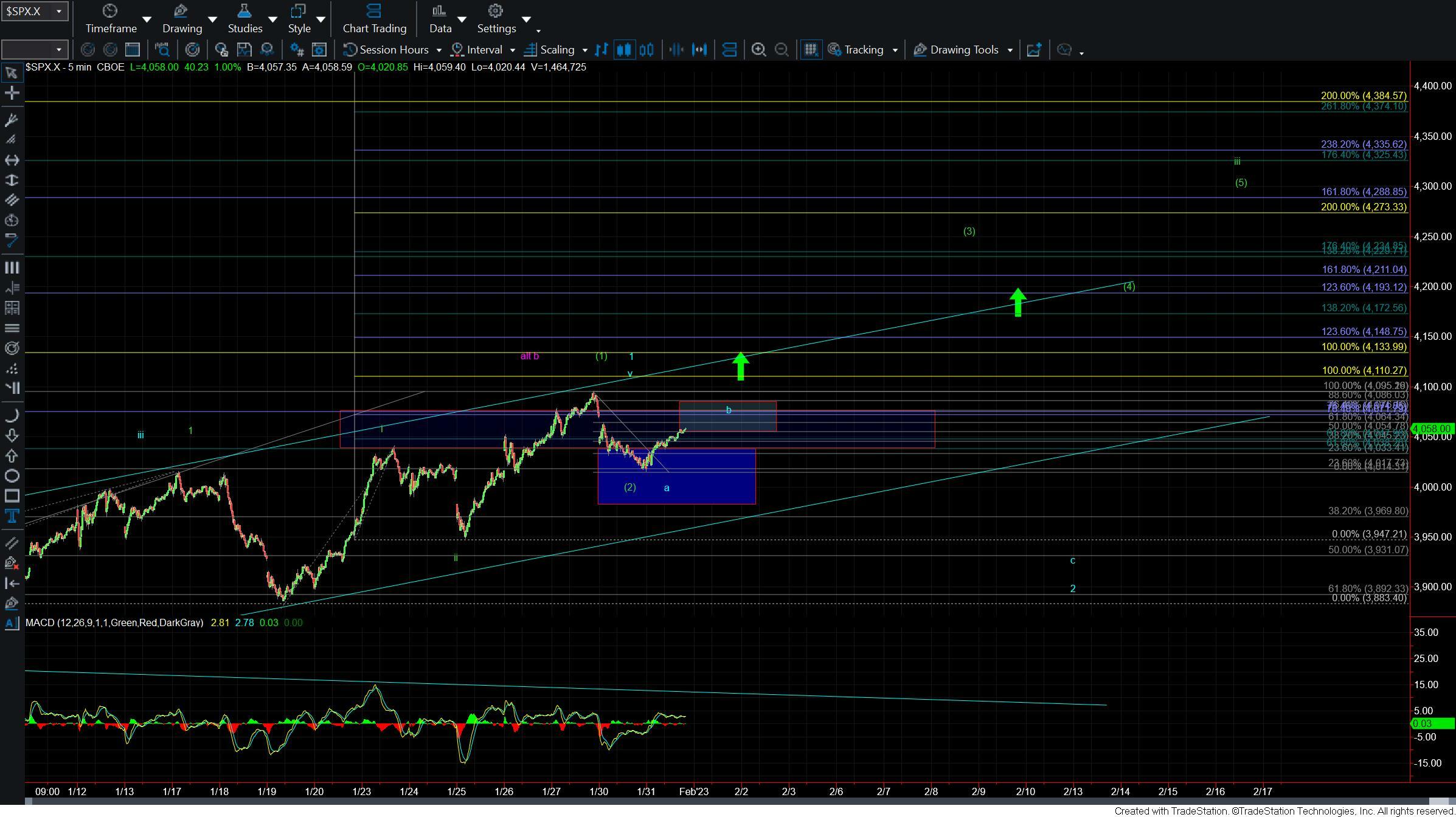

Overnight we saw the SPX futures move lower before finding support at the 61.8 retrace level of the move up off of the 1/25 low. Since holding that level we have moved higher throughout the day and into the time of this writing. This action is still keeping the more immediate bullish count as shown in green in play for the time being and allowing for this to see a more immediate push to new highs. We do however still have some work to do before we can confirm that we have indeed put a bottom in and are simply not moving higher in a wave b retracement higher as laid out per the blue count. The pattern that I am watching on both the RTY and NQ is more supportive of the green count which is one of the reasons why I have opted to leave this as my primary count for the time being. With that being said the green count is not without it's issues and has some work to do before we can confirm a breakout.

As I noted yesterday the 4017- 3980 zone was acting as key support today and the market managed to hold that zone and press higher. The action up off of that low however does not quite have a full five wave structure just yet so we need to see further upside follow-through to keep the green count in play as the primary path forward. From a pure price perspective, I would want to see this breakout over the 4086 level which is the 88.6 retrace of the move down off of the highs to give us initial confirmation that we are indeed going to see a break over the 4095 high. From there the next key overhead pivot remains at the 4110 level and moving through that level would open the door to seeing a more sustained and direct grind higher toward the 4200-4350 zone overhead.

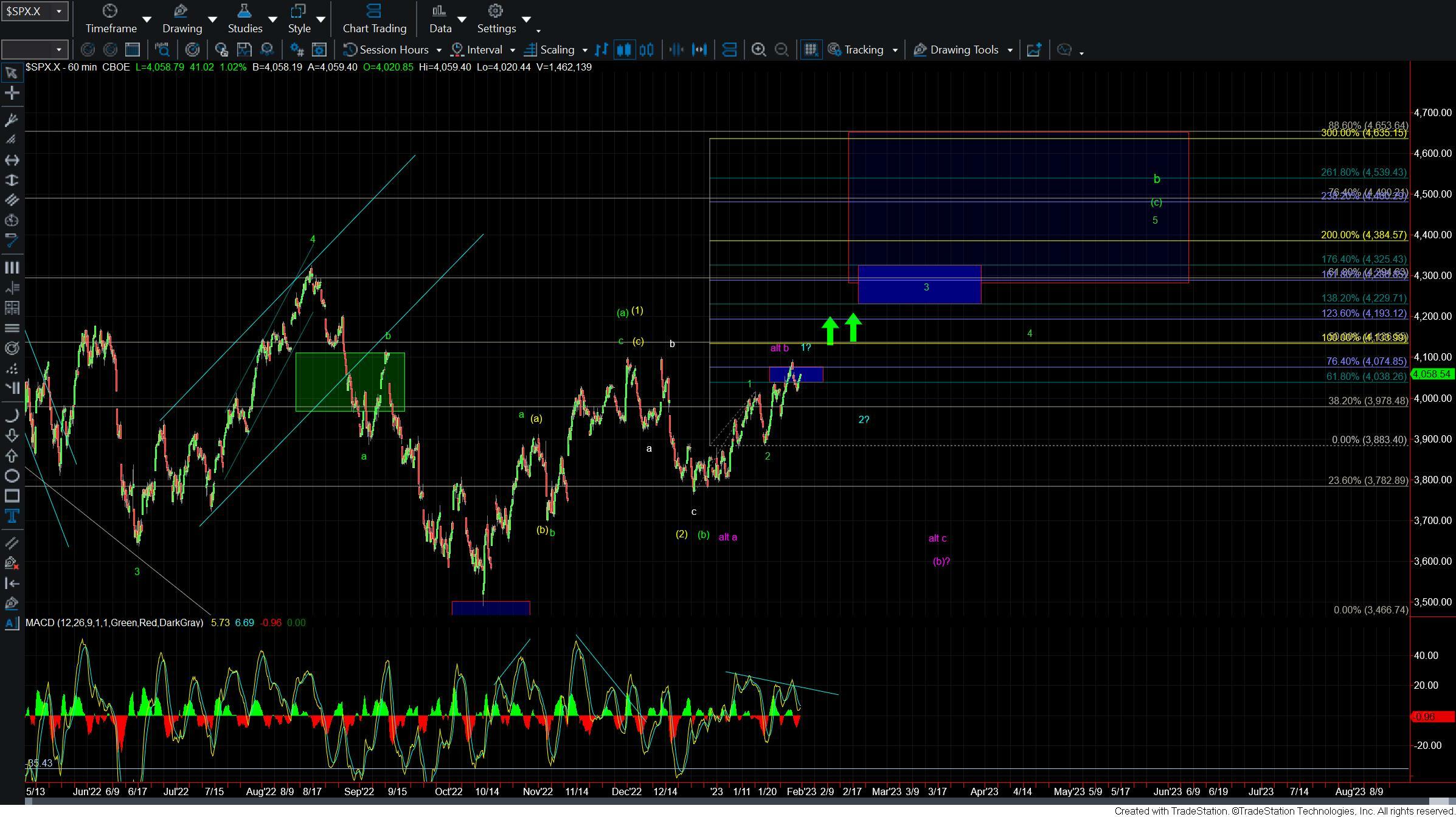

If we begin to break below today's LOD at the 4020 level then it would make it much more likely that we have indeed topped in the blue wave b and are heading lower in the larger wave c of 2. Under that case support for the larger wave 2 would come in at the 3966-3844 zone below. As long as that zone holds then I would still be looking for this to see a larger move higher for the wave 3 up into the early part of this year.

So while there are still some issues with the green count on the SPX I will continue to view this path as my primary count as long as we can hold over today's LOD at the 4020 level. If that level breaks then I will firmly move to the blue count but for now I am going to give the green count the benefit of the doubt.