Is The Breakout Underway?

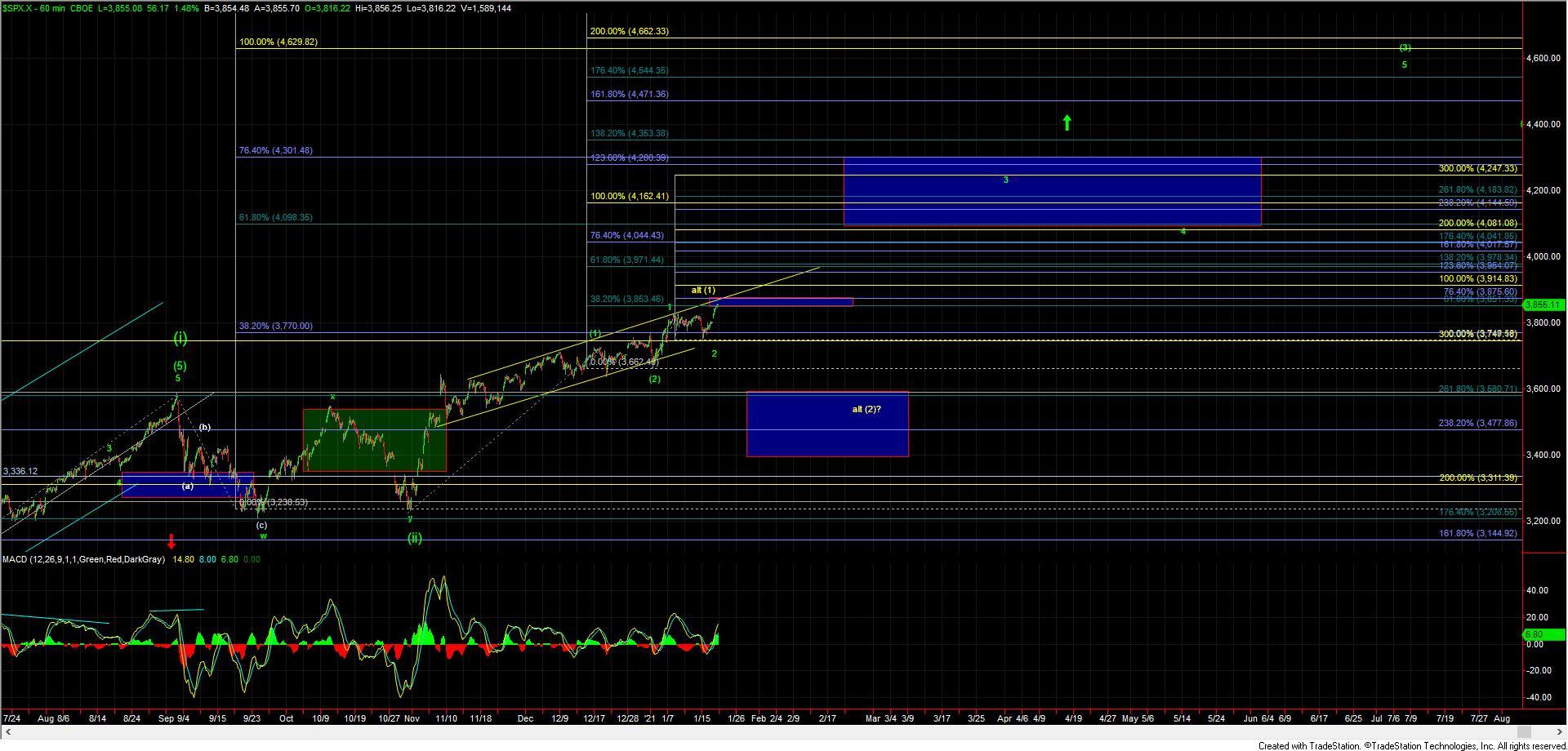

Today we saw the market break out to new highs with the SPX up nearly 1.5% and over 50 points at the time of this writing. Furthermore, we broke out over the key micro resistance levels that I had noted yesterday that should have held if we were indeed going to see an immediate pullback for the wave C down back below the 3739 low. So with this move higher through the resistance levels noted it is now looking more probable that we have indeed bottomed in all of the green wave 2 and headed higher for the wave iii of 3.

This is putting our micro support at the 3814-3806 zone and as long as we can manage to hold over this zone the near-term pressure will remain up on the SPX per the green most immediately bullish count. The next key overhead pivot comes in at the 3851-3875 zone which represents the 61.8-76.4 ext of the wave 1 that began at the 3662 low. Further confirmation that wave 3 is indeed underway would then come with a break of the 3914 level at which point we should have a fairly clear path up towards the low to mid 4000s into the spring/summer of this year.

So while the market still needs to give us a confirmation with a breakthrough the next overhead pivot the structure that is developing off of the lows is certainly shifting the odds to the wave 3 being underway. So as long as we can manage to hold the support levels noted it is looking like the breakout is indeed underway.