Is Everyone Enjoying Their Jello?

If you have been reading my analysis for at least a few months, you would know that I view trying to prognosticate the exact path of a corrective structure as akin to trying to throw Jello for distance. And, the main reason is that it is quite variable and, at times, almost unpredictable.

Yet, when you understand the bigger market context, you know when to expect this type of whipsaw market, so you can adjust your trading before it occurs. Therefore, there is a lot of benefit in understanding the context of the market within which you are currently navigating, even if there are times the exact path is not always going to be predictable or clearly evident in the smaller degree.

Thus far, the market is providing us some evidence that it wants to continue to rally a bit more, as presented by the yellow count on our charts. And, as long as we hold the uptrend channel on the 5-minute Emini S&P 500 (ES) chart, then I am going to continue tracking that potential quite closely.

But, if you ask me if it is my “primary” analysis, I would have to tell you that it is really not beneficial to present something in this micro structure as a “primary expectation” since the only real expectation I can maintain with a high degree of confidence is that whipsaw will likely continue until we head down to our expected targets well below where we currently reside.

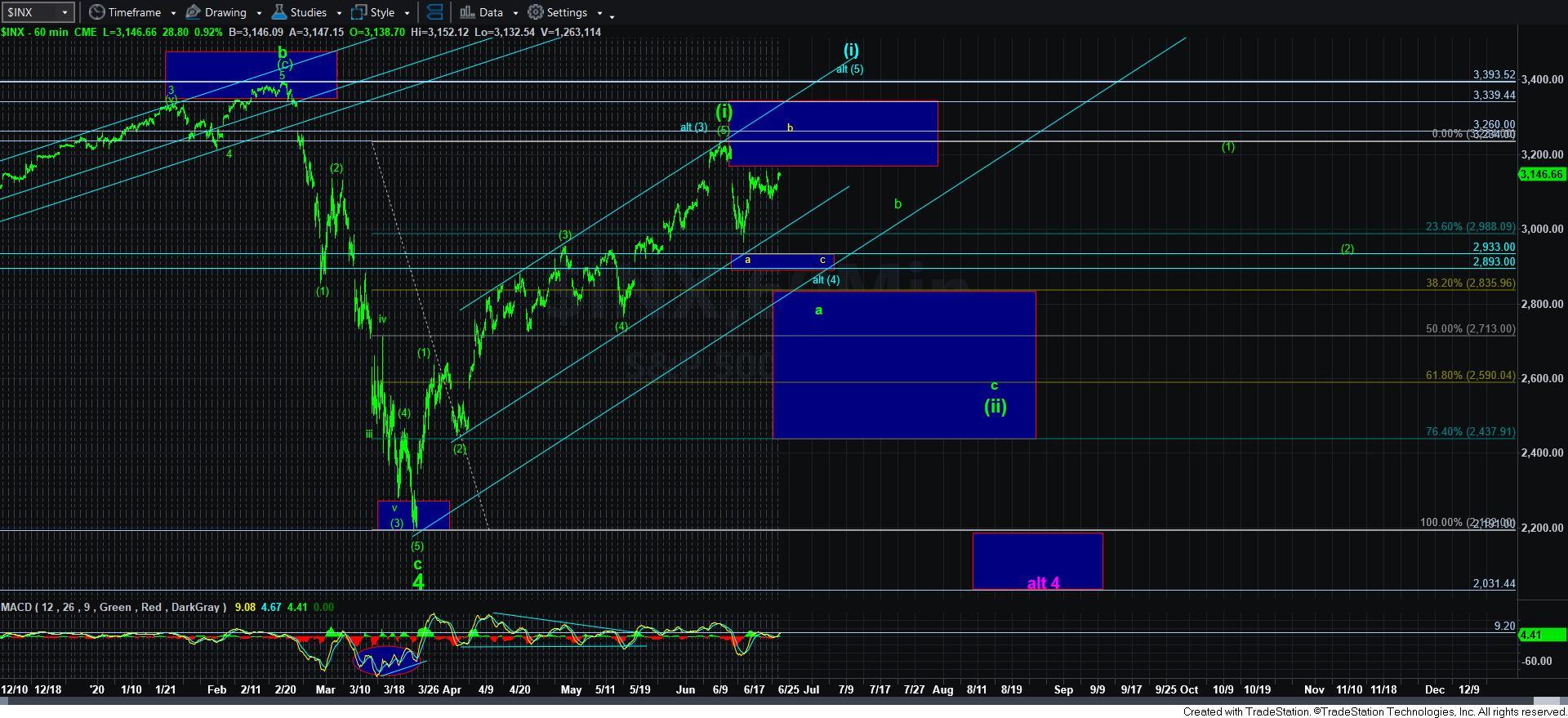

If the market is able to continue along the yellow path in the coming days, then it would likely set up a sizable decline towards the 2900 region support again on the S&P 500 (SPX). And, if we break the uptrend channel on the ES sooner rather than later, that would open the door to that decline to the 2900 SPX region sooner rather than later.

At the end of the day, my larger degree expectation still remains in place and that is we will likely see much lower levels in the coming weeks. Moreover, the potential for us to be in blue wave [5] at this time is somewhat diminished since we did not drop deep enough to substantiate that count for me, as explained in my weekend analysis. So, for now, I am viewing us within a b-wave rally. The only question for me is whether it will push higher one more time for a more expanded b-wave as outlined in yellow.

Lastly, for those that did not see her post last week, Dr. Cari provided the following warning to members of Elliottwavetrader for the coming weeks:

"This has been some year so far-- a global pandemic, protests calling for freedom from restrictions, and protests calling for sweeping reforms to long-standing injustices. There has been economic upheaval and job losses at a record rate. Crisis of some type is almost a background new normal, it would seem. Yet, somehow, over the next few weeks, something is likely to break above our new threshold of "normal crises."

Looking at the mood pattern for the next two weeks, the telltale signature for global or governmental crisis has reappeared. Once again the Manic and Controlled lines on the chart below can be seen moving together instead of in opposition which is the norm. It would not be concerning with Manic on top, except that an inversion condition is currently in play making what would be a "government intervention in a crisis" pattern into a two to three week long "global or governmental crisis" pattern.

While this crisis period could be about anything or several things, if a crisis develops in the week ending June 26 it's more likely to be geopolitical or global (due to Expansive being low in this inverted condition). For the week ending July 3, it would more likely be domestic or economic (due to Vulnerable being low in this inverted condition). Geospatial analysis for the U.S. for June 28 - July 6 was inconclusive. However, it did show a higher risk for the Southwestern U.S., IF there is a specific destructive event within the U.S.

The roller coaster of 2020 has been resetting, slowly climbing to the top of the next peak. We're about to experience the next intense drop. It will likely leave us somewhat shocked and surprised once again. Get ready... here we go!"